- In spite of a higher opening, US indices finished yesterday's trading lower. S&P 500 dropped 0.39%, Dow Jones moved 0.19% lower and Nasdaq slumped 0.58%. Small-cap Russell 2000 traded around 0.2% down

- Indices from Asia-Pacific traded lower, following a downbeat session on Wall Street. Nikkei slumps 1.8%, Nifty 50 and S&P/ASX 200 drop 0.1% each and Kospi trades 0.2% lower. Indices from China trade little changed

- DAX futures point to a lower opening of the European cash session today

- According to unconfirmed media reports, SpaceX is considering offering shares at around $95 per share, valuing the company at $175 billion

- According to China Securities Journal, there is space for interest rate and reserve requirement ratio cuts in China

- Bank of America expects Bank of Canada to deliver the first rate cut in June 2024

- BoJ Governor Ueda warned that Japan's situation will become more challenging in 2024 and that it is important for wages to keep rising and support consumption

- Chinese exports increased 0.5% YoY in November (exp. -1.1% YoY) while import were 0.6% YoY lower (exp. 3.3% YoY). Trade balance for November came in at $68.39 billion (exp. $58 billion)

- Australian trade balance for October came in at A$7.13 billion, slightly below expected A$7.48 surplus

- Cryptocurrencies resumed climb after a brief pause yesterday. Bitcoin trades 0.4% higher, Ethereum gains 1.4% and Dogecoin adds 1%

- Energy commodities trade mixed - oil gains 0.6% while US natural gas prices drop 1%

- Precious metals gain in spite of USD strengthening - gold and platinum trade 0.1% higher while palladium rallies 0.7%. Silver is a laggard with 0.2% drop at press time

- JPY and USD are the best performing major currencies, while NZD and AUD lag the most

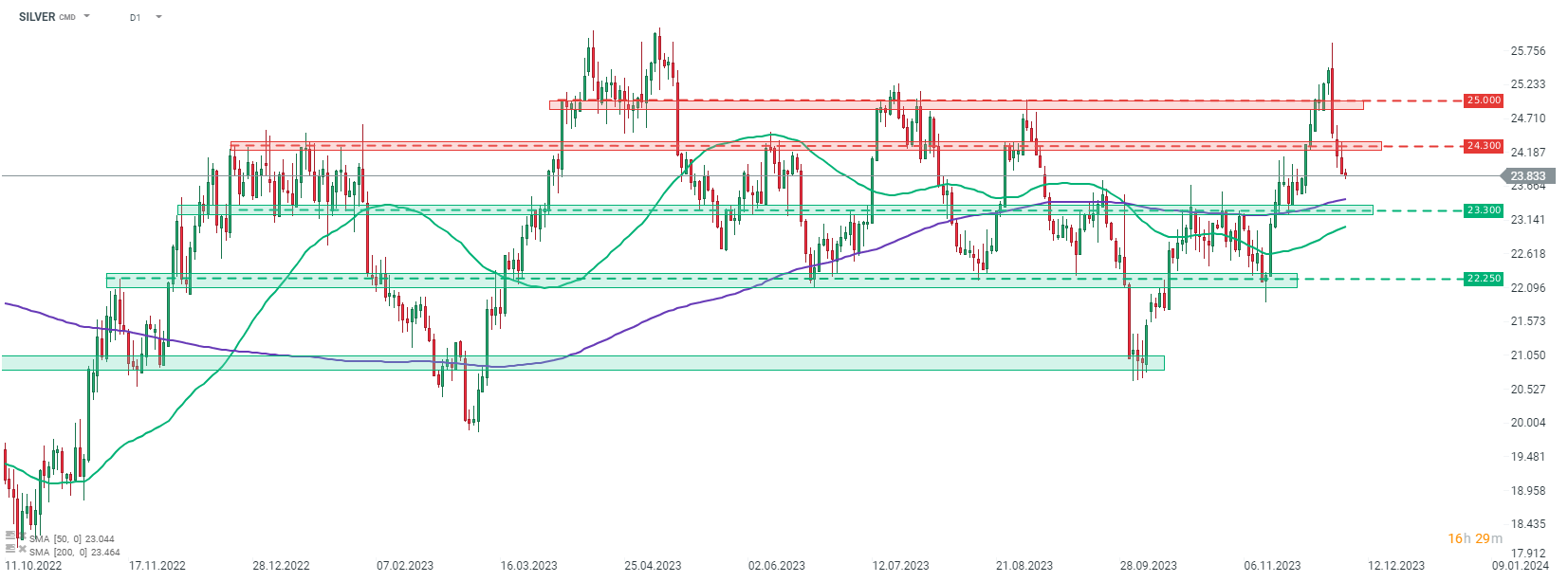

Silver continues to pull back. Price has already dropped 8% from an intraday-high reached near $25.90 per ounce on Monday. Source: xStation5

Silver continues to pull back. Price has already dropped 8% from an intraday-high reached near $25.90 per ounce on Monday. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Brent tops $90 per barrel

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.