-

US indices finished yesterday's trading lower. S&P 500 dropped 0.30%, Dow Jones moved 0.46% lower and Russell 2000 dropped 1.07%. Nasdaq was outperformer with 0.03% gain

-

Stocks traded mixed during the Asian session. Nikkei gained 0.6%, Kospi added 0.2%, S&P/ASX 200 moved 0.8% lower and indices from China dropped

-

DAX futures point to a higher opening of the European cash session

-

Fed's Waller said that markets got ahead of themselves with pricing a 100 basis point rate hike for next FOMC meeting. Fed's Bullard also said he opts for 75 basis point move rather than 100

-

Mario Draghi's government won a confidence vote but coalition ally Five Star Movement refused to back it. As a result Mario Draghi offered his resignation to President Matarella. Resignation was rejected

-

Japan will bring back online 9 nuclear reactors ahead of winter to reduce dependence on energy imports

-

Chinese GDP dropped 2.6% QoQ in Q2 2022 (exp. -1.5% QoQ). On an annual basis growth reached 0.4% YoY (exp. 1.0% YoY). Statistics office said that Chinese economy is facing structural and cyclical issue, and is still impacted by Covid-19

-

Chinese retail sales increased 3.1% YoY in June (exp. 0.1% YoY) while industrial production was 3.9% YoY higher (exp. 4.0% YoY). Urban investments increased 6.1% YoY (exp. 6.0% YoY)

-

Cryptocurrencies trade slightly higher. Bitcoin gains 0.7% while Ethereum trades 1.5% higher. Kusama outperforms with 5% gain

-

Oil trades little changed this morning after a volatile session yesterday. Brent tests $100 area

-

Precious metals trade mixed - gold and platinum trade flat, silver drops 0.3% and palladium gains 1%

-

EUR and NZD are the best performing major currencies while AUD and USD lag the most. However, ranges on the FX market were quite narrow during the Asian session

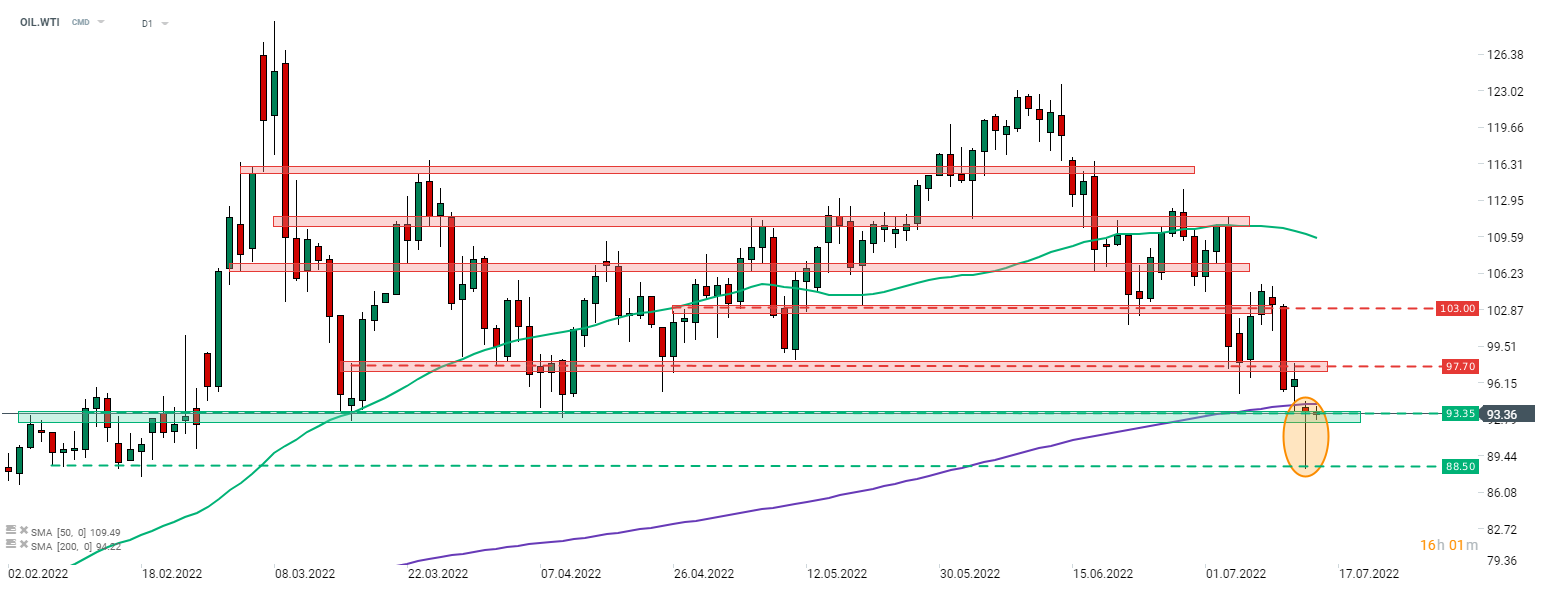

WTI (OIL.WTI) plunged yesterday and reached the lowest level since mid-February. However, price started to recover in the afternoon and regained more than half of a drop. As a result, a bullish candlestick pattern surfaced near an important support zone. Source: xStation5

WTI (OIL.WTI) plunged yesterday and reached the lowest level since mid-February. However, price started to recover in the afternoon and regained more than half of a drop. As a result, a bullish candlestick pattern surfaced near an important support zone. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.