- Wall Street indices finished yesterday's trading higher after weaker-than-expected retail sales and industrial production data from the United States boosted hopes for quicker Fed rate cuts

- S&P 500 gained 0.58%, Dow Jones jumps 0.91%, Nasdaq added 0.30% and small-cap Russell 2000 rallied almost 2.50%

- Indices from Asia-Pacific traded higher today - Nikkei gained almost 1.0%, S&P/ASX 200 traded 0.7% higher, Kospi jumped 1.3% and Nifty 50 moved 0.6% higher. Hang Seng rallied over 2%

- European index futures point to a higher opening of the cash session today

- Fed Bostic said that US central bank is likely to consider rate cuts soon but there is no urgency to deliver them

- BoJ Governor Ueda said that the bank will consider policy moves once inflation target is achieved sustainably

- Ueda also said that based on the economic and inflation outlook, accomodative monetary conditions will continue even after ending negative interest rates

- New Zealand's manufacturing PMI improved from 43.4 to 47.3 in January. Employment subindex climbed to 51.3 - the first reading in expansion territory (above 50 pts) since February 2023

- Cryptocurrencies extend gains, with Bitcoin holding above $52,000 mark

- Energy commodities trade little changed - US natural gas prices gain 0.2% while oil trades flat

- Precious metals pull back - gold and silver trade flat, while platinum drops 0.6% and palladium declines 0.8%

- USD and AUD are the best performing major currencies while JPY and NZD lag the most

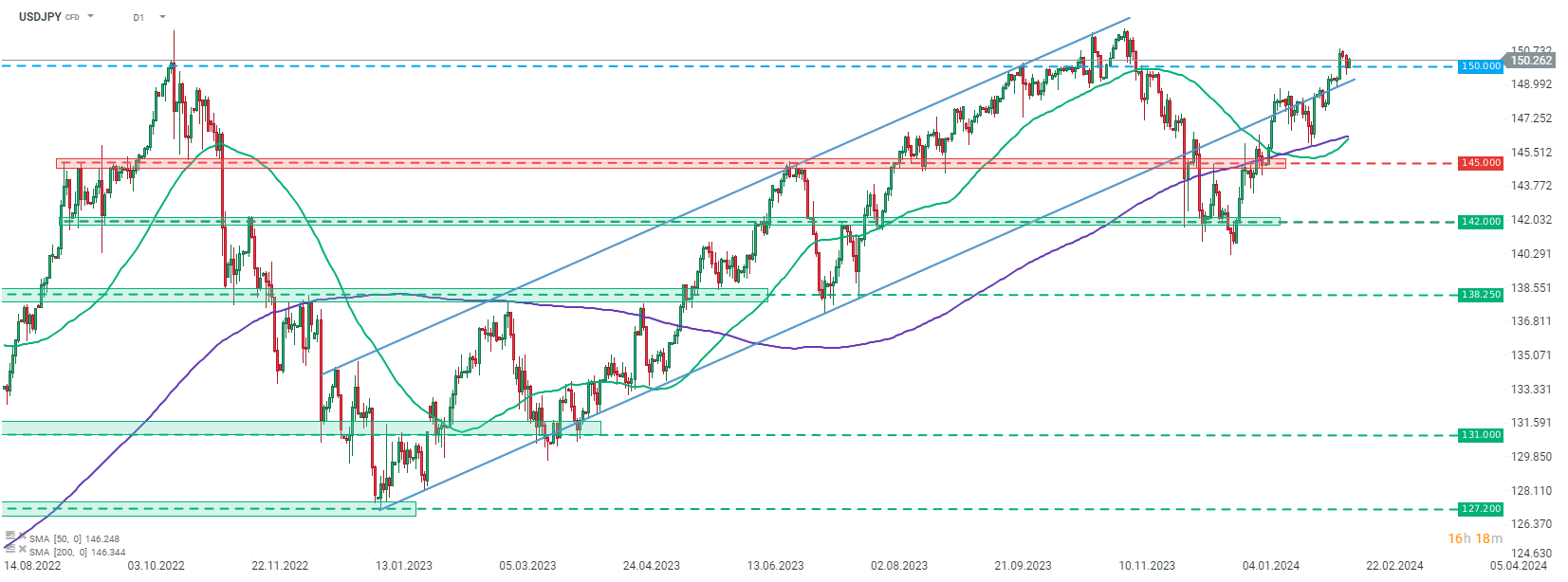

USDJPY resumes climb after a brief two-day correction. Pair continues to trade above 150.00 level associated with BoJ interventions. BoJ, however, limited itself to verbal interventions so far. Source: xStation5

USDJPY resumes climb after a brief two-day correction. Pair continues to trade above 150.00 level associated with BoJ interventions. BoJ, however, limited itself to verbal interventions so far. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.