-

US indices dropped yesterday and erased all of the post-FOMC jump. S&P 500 dropped 0.87%, Nasdaq slumped 2.47%, Russell declined 1.95% while Dow Jones finished 0.08% lower

-

Major indices from Japan and China dropped over 1% today, following into footsteps of their US peers. S&P/ASX 200 gained 0.1% while Kospi added almost 0.4%

-

DAX futures point to a lower opening of today's European cash session

-

The Bank of Japan decided to leave interest rates and yield targets unchanged. BoJ may start slowing purchases under its pandemic relief programmes early next year

-

China revised 2020 GDP growth data down from 2.3 to 2.2%

-

According to Politico report, White House acknowledged that 'Build Back Better' infrastructure bill is not going to get through the Congress this year

-

United Kingdom and Australia signed post-Brexit trade deal. Deal includes removal of most of the tariffs on goods

-

According to Goldman Sachs, impact of Omicron on oil demand and mobility has been small so far

-

Turkish lira dropped to a fresh record lows with USDTRY jumping past 16.00 and EURTRY moving above 18.00

-

CHF and JPY are the best performing major currencies while commodity currencies (AUD, CAD, NZD) lag the most

-

Precious metals gain, oil drops and industrial metals trade mixed

-

Cryptocurrencies are trading slightly lower. Bitcoin trades near $47,500 while Ethereum tests $3,950 area

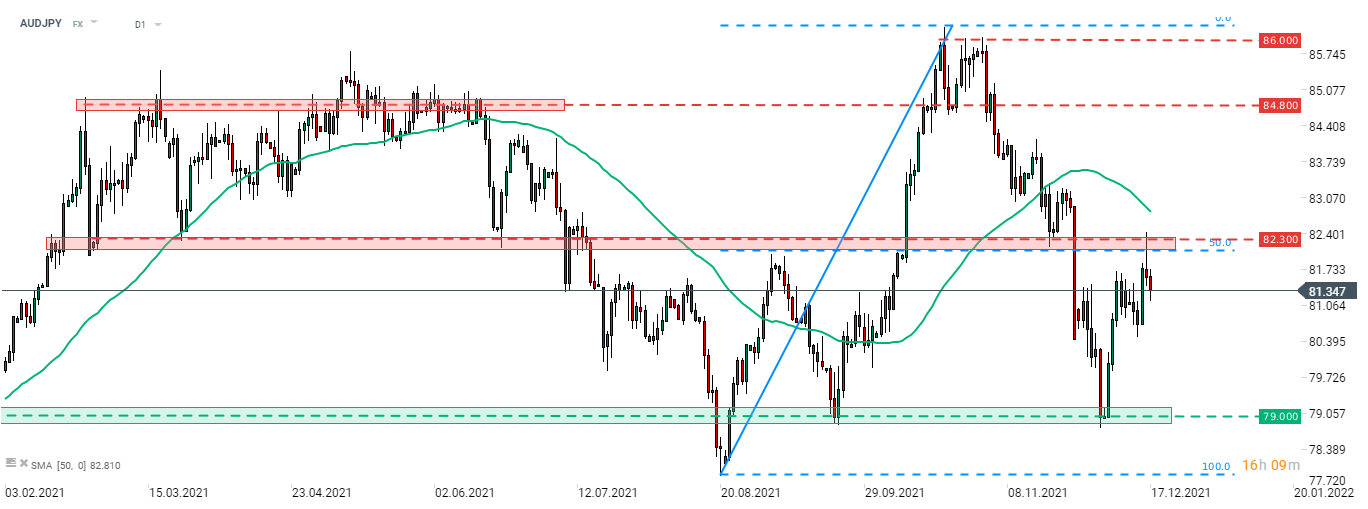

AUDJPY experienced a big reversal yesterday and halted upward correction at the resistance zone marked with 50% retracement of the upward move started in August 2021. Pullback is deepening today, thanks to the strength of the Japanese currency. Near-term support zone can be found in the 79.00 area. Source: xStation5

AUDJPY experienced a big reversal yesterday and halted upward correction at the resistance zone marked with 50% retracement of the upward move started in August 2021. Pullback is deepening today, thanks to the strength of the Japanese currency. Near-term support zone can be found in the 79.00 area. Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.