-

Asian shares experienced a significant selloff due to concerns about rising Treasury yields and increasing Middle East tensions.

-

10-year US government bond yields rose for the fourth consecutive day, reaching new high at 4.96%

-

Major Asian stock indices, including Sydney, Hong Kong, mainland China, and Tokyo, declined by over 1%.

-

Gold prices remained stable, having risen about 7% since the Hamas attack on Israel on October 7.

-

Oil prices surged due to Iran's intensified criticism of Israel after a Gaza hospital explosion.

-

United Airlines' shares dropped around 10% due to concerns about the Israel-Hamas conflict and rising aircraft fuel prices.

-

UK Prime Minister Rishi Sunak is set to visit Israel on Thursday.

-

Japan's Top Currency Diplomat Kanda highlighted global economic risks, attributed China's economic slowdown to policy failures, and predicted India's potential to surpass the US economy.

-

Russian Foreign Minister Lavrov expressed concerns about the Gaza conflict becoming a regional issue.

-

Biden clarified that the US has not offered troops in case Hezbollah initiates a war on Israel.

-

Barclays anticipates a Fed interest rate hike by 25 bps in December, shifting from their initial November prediction.

-

Japan's Chief Cabinet Sec. Matsuno expressed hopes for oil-producing countries to maintain global market stability.

- Australia macro data pack:

- Australian Unemployment Rate: 3.6% (Forecasted: 3.7%, Previous: 3.7%)

- Australian Full Time Employment Change: -39.9k (Previous: 2.8k)

- Australian Participation Rate: 66.7% (Forecasted: 67%, Previous: 67%)

- Australian Employment Change: 6.7k (Forecasted: 20k, Previous: 64.9k)

-

Japan macro data pack:

- Japanese Imports YoY: -16.3% (Forecasted: -12.7%, Previous: -17.8%)

- Japanese Total Trade Balance: 62.4B (Forecasted: -451.45B, Previous: -930.5B)

- Japanese Exports YoY: 4.3% (Forecasted: 3%, Previous: -0.8%)

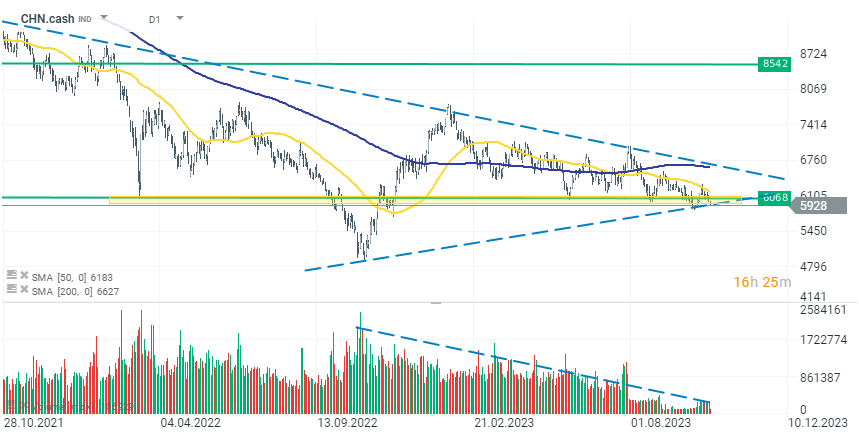

China's HSCEI Index is losing more than 2.0% today, while CHN.cash CFDs on the index are trading more than 1.0% lower. The price of the index is dangerously approaching the level of the lower limit of the descending triangle. If this resistance is broken with increasing volume, we can expect deeper declines to new lows.

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.