Source: BoJ

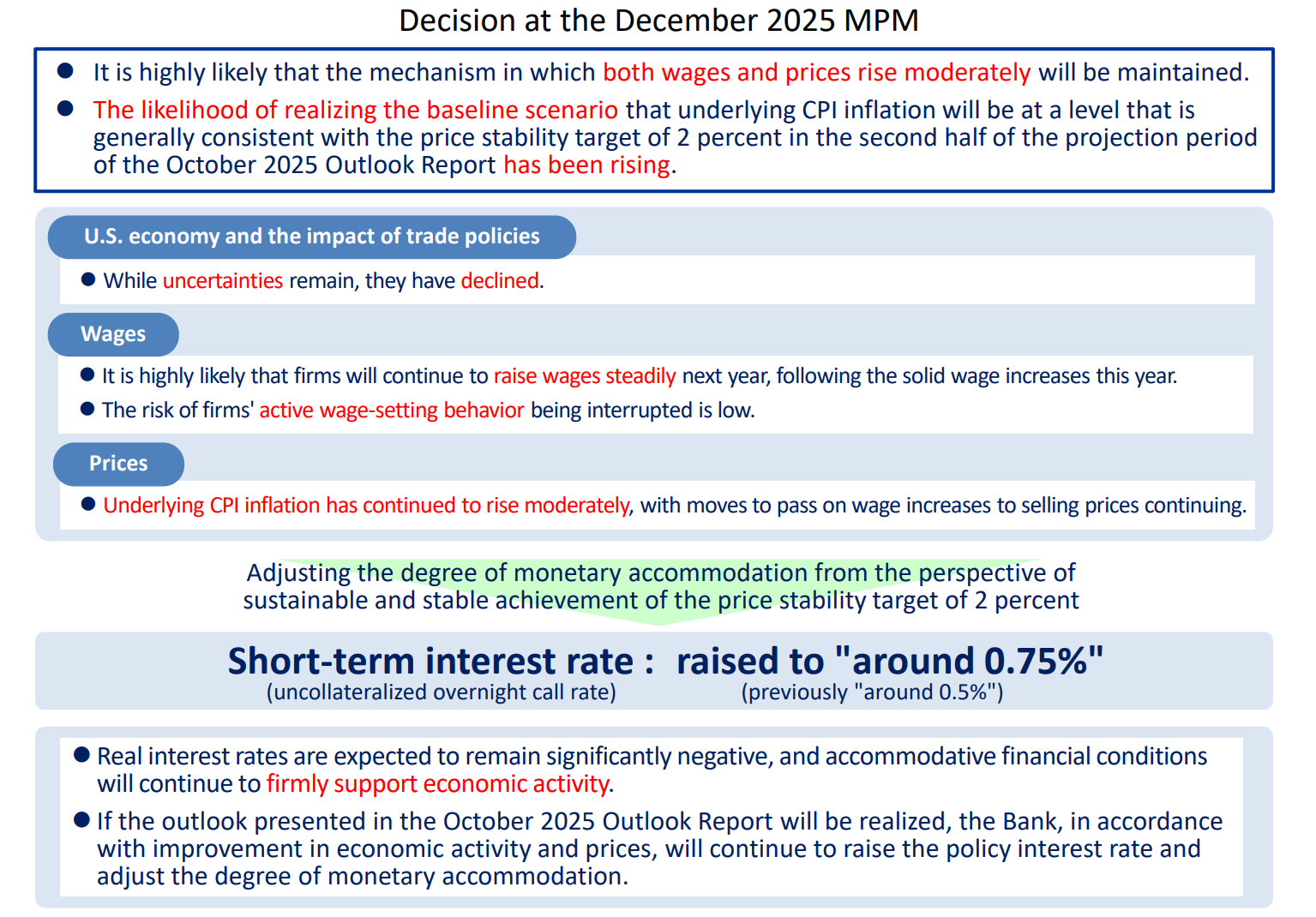

- The Japanese central bank raised its short-term interest rate by 25 basis points to 0.75% (the highest level since 1995). This decision was in line with expectations, hence the relatively limited reaction on the Japanese yen, which, however, lost ground to the dollar immediately after the decision. The USDJPY pair is currently trading in the 156.00 range, its highest level since December 12. At the same time, the JP225 contract is up 0.85%.

-

However, the Bank of Japan stated in its announcement that real interest rates would remain "significantly negative," adding that favorable financial conditions would continue to strongly support economic activity.

-

Japan's nationwide inflation data for November showed persistent price pressures, reinforcing expectations that the Bank of Japan will continue its gradual normalization of monetary policy. November, consumer prices rose 3.0% year-on-year, in line with market expectations and marking another month of inflation well above the Bank of Japan's 2% target. The index excludes fresh food prices but includes energy, making it one of the most closely watched indicators of underlying inflation trends.

-

The decision was unanimous, although the statement revealed divergent views on inflation dynamics. The bank reiterated that it would continue to raise interest rates if the economy and prices developed in line with forecasts.

-

A press conference with BoJ Governor Kazuo Ueda is scheduled to begin at 7:30 a.m., during which he will comment on today's decision. Below are the most important comments from bankers included in the communication following the decision.

- At the same time, the Trump administration is initiating a review to allow the potential sale of advanced Nvidia H200 chips to China, with the US government receiving 25% of the sales revenue to reduce China's incentive to develop the technology independently. The decision marks a significant departure from previous export restrictions and aims to maintain US technological superiority by preventing China's inclination to develop domestic chips.

- Futures contracts indicate positive sentiment during today's session. Contracts on European and US indices are recording significant gains (DE40 +0.6%; US100 +0.28%).

- Precious metals are experiencing mixed sentiment. GOLD is currently losing 0.15% in value, while SILVER is resuming its upward momentum.

- We are also seeing a market rebound in Bitcoin, whose prices are currently rising by 1.66%.

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.