• Mixed moods prevail in the Asian markets today. Nikkei lost 0.42%, Kospi rose 0.07% and Hang Seng gained 0.38%. S&P/ASX 200 dropped 0.12%. Dax futures point to a lower opening of the European session

• US reported a record daily high of 185,000 new COVID-19 cases on Thursday

• US Senate Democratic Minority Leader Chuck Schumer said Republican Majority Leader Mitch McConnell had agreed to revive stimulus talks as COVID-19 cases continue to rise.

• US Treasury Secretary Steven Mnuchin said on Thursday he will not extend several emergency loan programs set up with the Federal Reserve to support the economy ravaged by the COVID-19 crisis (these programs will expire on December, 31st). Mnuchin added that he is requesting that the Fed return to the Treasury the unused CARES funds appropriated by Congress for the operation of the programs.

• People's Bank of China left its key interest rates steady for the seventh straight month at its November fixing. The one-year loan prime rate (LPR) was left unchanged at 3.85% after two cuts this year, while the five-year remained at 4.65%.

• Pfizer is expected to file FDA application for COVID-19 vaccine today

• Japan Prime Minister Yoshihide Suga said Thursday that Japan is on maximum alert while metropolitan Tokyo raised its alert level to the highest of four.

• Australia retail sales rose by 1.6 % month-over-month in October, well above market consensus of a 0.3 % rise and after a 1.1 % fall a month earlier, a preliminary reading showed.

• AUD and NZD are leaders among major currencies while USD and JPY lag the most

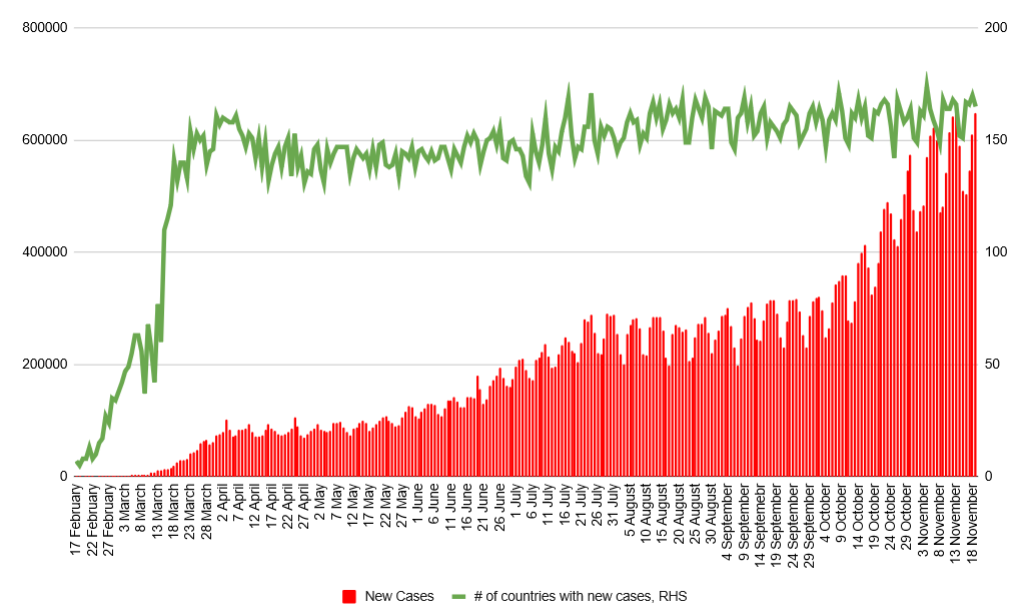

Yesterday 647 719 new coronavirus cases were reported which is the second highest number since the pandemic began. Source: worldometers, XTB

Yesterday 647 719 new coronavirus cases were reported which is the second highest number since the pandemic began. Source: worldometers, XTB

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.