-

US indices finished yesterday's trading higher. S&P 500 added 0.51%, Dow Jones gained 0.20% and Nasdaq moved 0.79% higher. Russell 2000 added 0.43%

-

Indices from Japan, South Korea and China gain. Australian S&P/ASX 200 lags

-

DAX futures point to a flat opening of the European session

-

Fed Chairman Powell said that the Fed will not raise rates preemptively and that he believes inflation will wane over time

-

China said that its army is reading to respond to provocations from other countries

-

Rumours that OPEC+ will decide to boost oil output during a meeting next week intensify

-

Bank of Japan minutes showed that members agreed economy is on the road to recovery and that inflation increase lacks strength

-

Australia may decide to impose coronavirus restrictions on Sydney amid jump in new cases in the city

-

Japanese manufacturing PMI index for June dropped from 53.0 to 51.5 (exp. 53.2)

-

API report on oil inventories point to a 7.2 million barrel draw (exp. -3.5 mb)

-

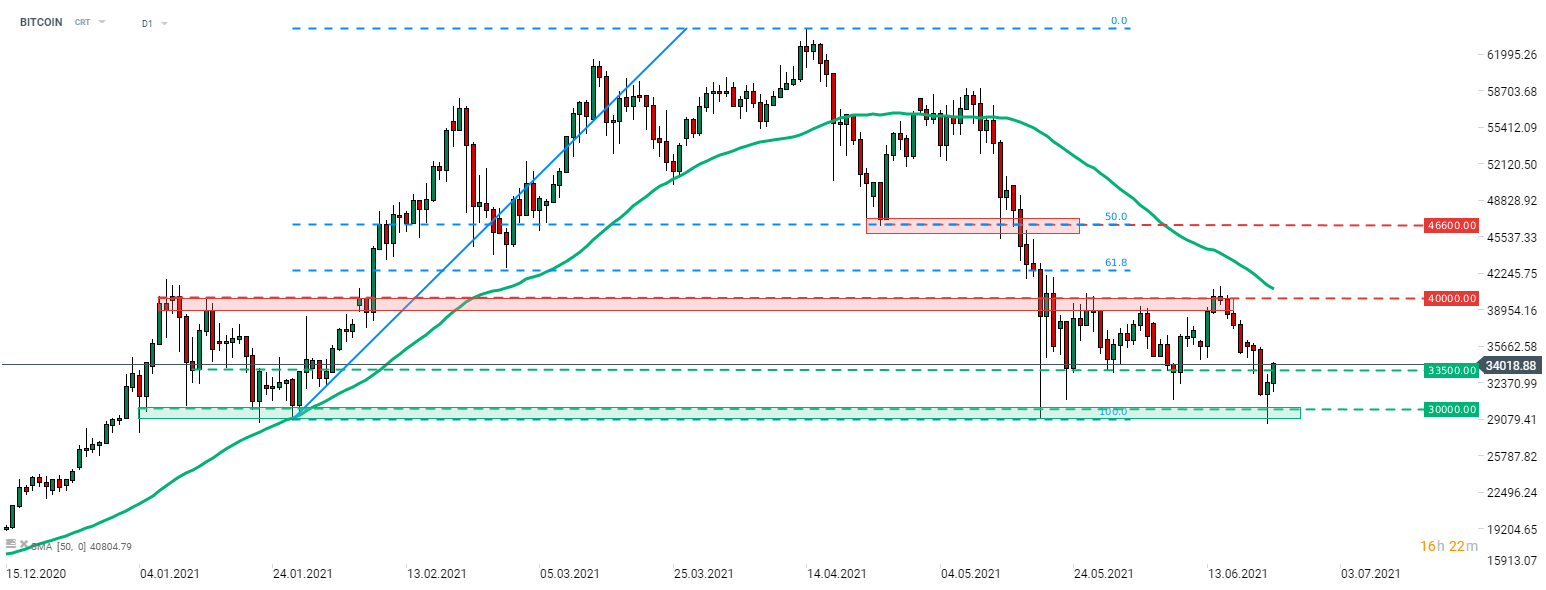

Bitcoin trades slightly below $34,000 mark

-

Precious metals and oil trade higher. Industrial metals trade mixed

-

GBP and USD are the best performing major currencies while NZD and EUR lag the most

Bitcoin continues to recover from a recent massive sell-off. The coin bounced off the $30,000 support area yesterday and climbed above a lower limit of a recent trading range at $33,500. Source: xStation5

Bitcoin continues to recover from a recent massive sell-off. The coin bounced off the $30,000 support area yesterday and climbed above a lower limit of a recent trading range at $33,500. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.