- Asia-Pacific market indices are trading lower, reflecting the negative sentiment seen on Wall Street yesterday.

- Shares of Meta Platforms (META.US) fell 3.4% in the market after the close of the U.S. session, although initial reaction to better quarterly results lifted the stock as much as 5% higher.

- Mark Zuckerberg's company reported better-than-expected third-quarter results, with revenue rising 23%, the fastest pace of growth since 2021.

- European futures pointed to a sharply lower opening of the cash session on the Old Continent. Contracts based on the German Dax are losing 0.37%, while those based on the US Nasdaq index are down more than 1.1%.

- WSJ reports that the US Auto Workers union and Ford are expected to announce an agreement.

- The strongest currencies in the FX market today are the US dollar and the Canadian dollar. The Australian dollar and the New Zealand dollar are the weakest performers.

- The USDJPY pair broke above the psychological barrier of 150.00 yesterday evening and is currently trading in the 150.44 zone (the highest level since October 2022.

- Japanese Finance Minister Suzuki says he is sticking to the previous monetary policy, thus keeping a close eye on JPY exchange rate movements.

- The Australian dollar lost on an intraday basis against the strength of the US dollar and comments by Bullock, who somewhat softened her narrative regarding future interest rate hikes. On the other hand, however, the governor admonished that the fight against inflation may not be over yet. Investment banks are forecasting further interest rate hikes for Australia.

- Key macro events today include: the U.S. GDP report, the PCE ratio, and interest rate decisions by the ECB and CBRT.

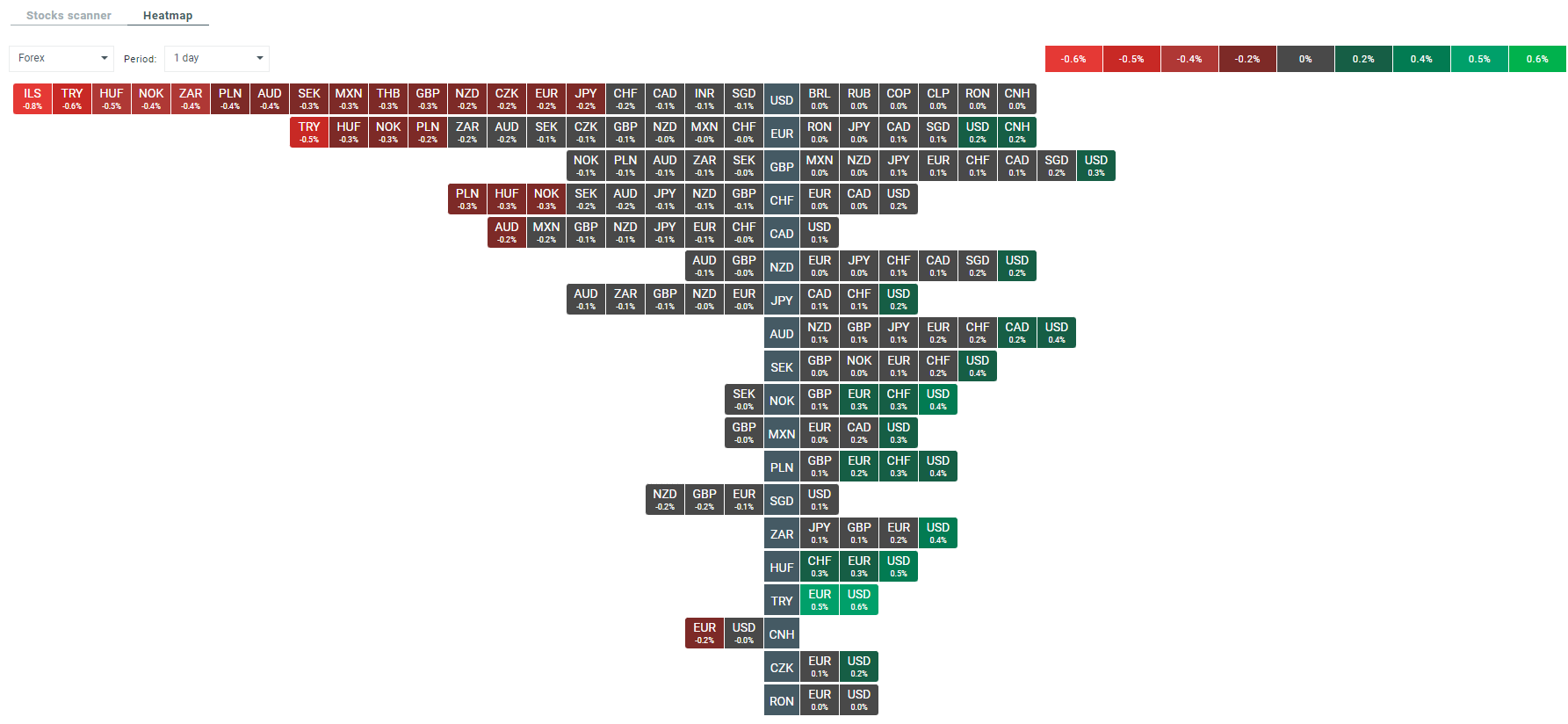

Heatmap of the FX market, which illustrates the volatility on individual currency pairs at the moment. Source: xStation 5

Heatmap of the FX market, which illustrates the volatility on individual currency pairs at the moment. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.