-

US indices plummeted yesterday as risks to the global growth mount. S&P 500 dropped 2.81%, Dow Jones moved 2.38% lower and Nasdaq slumped almost 4%

-

Trading in Asia was mixed today. Nikkei and Kospi dropped around 1.3% while S&P/ASX 200 was down 0.9%. On the other hand, indices from China traded higher

-

DAX futures point to a more or less flat opening of the European cash session

-

Chinese authorities said that restrictions in Shanghai will be eased for districts without virus community spread and some limited movement will be allowed between those districts

-

Russia informed Poland, Lithuania and Bulgaria that it will cut them off natural gas supply today as those countries refused to switch to rouble payments

-

Deutsche Bank expects Fed to hike rates to 5-6% range. Bank expects this to push US economy into a significant recession in late-2023

-

Alphabet (GOOGL.US) reported Q1 revenue at $56.02 billion (exp. $56.1 billion) and EPS at $24.62 (exp. $25.74). Disappointing earnings can be reasoned with poor performance of YouTube - YouTube ad revenue reached $6.87 billion while market expected $7.51 billion. Shares dropped 2.5% in after-hours trading

-

Microsoft (MSFT.US) reported Q1 revenue at $49.36 billion (exp. $49.05 billion) and EPS at $2.22 (exp. $2.19). Company issued an upbeat revenue guidance for the current quarter that also turned out to be higher than expected. Microsoft expects calendar Q2 2022 revenue at $52.4-53.2 billion. Shares gained 4.5% in the after-hours trading

-

Australian CPI inflation jumped 5.1% YoY in Q1 2022 (exp. 4.6% YoY)

-

Chinese industrial profits were 8.5% year-to-date higher after March

-

API report on oil inventories pointed to a 4.78 million barrel build (exp. +2 mb)

-

Cryptocurrencies are trading mostly higher. Bitcoin gains 0.4% while Ethereum advances 0.5%

-

Oil trades more or less flat this morning

-

Precious metals advance slightly. Gold is an exception as it drops 0.3%

-

AUD and NZD are the best performing major currencies while JPY and CHF lag the most

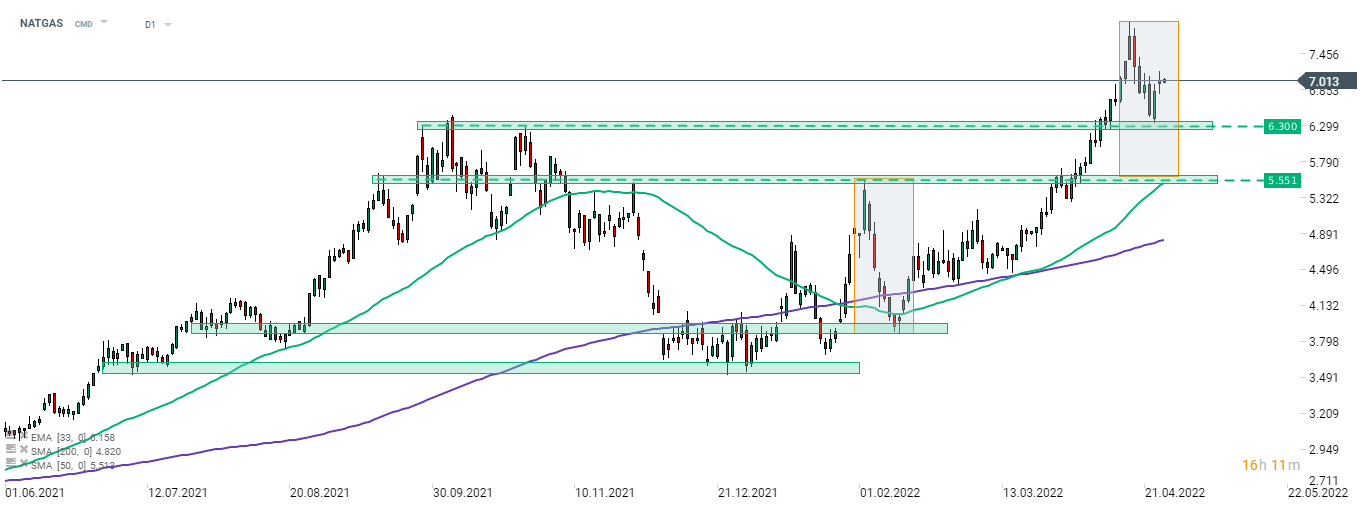

European natural gas prices spiked yesterday on the news that Russia will cut 3 European countries off its natural gas amid failure to settle payments in rubles. However, US prices (NATGAS) have been experiencing rather limited moves. So far there are no indications that Russia has actually stopped natural gas supply. Nevertheless, it could happen later into the day and natural gas is a market to watch in a day ahead. Source: xStation5

European natural gas prices spiked yesterday on the news that Russia will cut 3 European countries off its natural gas amid failure to settle payments in rubles. However, US prices (NATGAS) have been experiencing rather limited moves. So far there are no indications that Russia has actually stopped natural gas supply. Nevertheless, it could happen later into the day and natural gas is a market to watch in a day ahead. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.