Gains in the natural gas market remain strong ahead of today’s scheduled contract rollover. US Henry Hub natural gas (NATGAS) is up nearly 11%, climbing toward $5.6 per MMBtu. In just three sessions, US natural gas futures have surged by roughly 75%, reaching their highest levels since 2022.

- The main driver is an Arctic cold wave and the largest winter storm of the season. Over the weekend, more than 175 million people across the US are expected to face snowfall, freezing rain, and icy conditions, boosting heating demand.

- The move has also been amplified by a classic weather-driven short squeeze. A sharp shift in forecasts forced traders to cover bearish positions, especially after hedge funds had turned increasingly negative on gas late last week.

- The cold snap also poses supply-side risks. Extremely low temperatures can freeze moisture within infrastructure, potentially disrupting production and LNG export flows.

- Spot prices have exploded as well. Henry Hub cash prices for end-of-January delivery jumped toward $13 per MMBtu (from around $7 on Tuesday and below $4 late last week). In the pipeline-constrained US Northeast, spot deals were reported near $30 per MMBtu.

- Inventory data in the US may look historically “bearish” at first glance. Estimates point to a storage withdrawal of around 98 bcf, compared with the five-year average draw of 191 bcf, suggesting stockpiles remain above seasonal norms and still provide a cushion.

- However, Bloomberg notes the next weekly report could bring one of the largest withdrawals on record if this weekend’s freeze triggers a sharp spike in consumption.

- The cold-driven rally is not limited to the US. Gas prices have also been supported in Europe and Asia. Europe is bracing for another deep freeze and remains heavily dependent on US LNG imports after losing most Russian supply during the 2022 energy crisis.

- The US is the world’s largest LNG exporter, and flows to export terminals now account for roughly 17% of total US gas production—further tying US prices to global dynamics.

- In Asia, the regional gas benchmark has risen to its highest level since late November. While Asia holds stronger inventories than Europe, a prolonged cold spell could intensify global competition for LNG.

- Although markets had been expecting a future supply glut as new LNG projects come online from 2026 onward, the current spike is largely weather-driven rather than the result of a structural shift in long-term fundamentals.

- Bottom line: natural gas has become a far more global and “flexible” commodity, meaning price reactions to weather and LNG flows can now be faster and sharper than in the past.

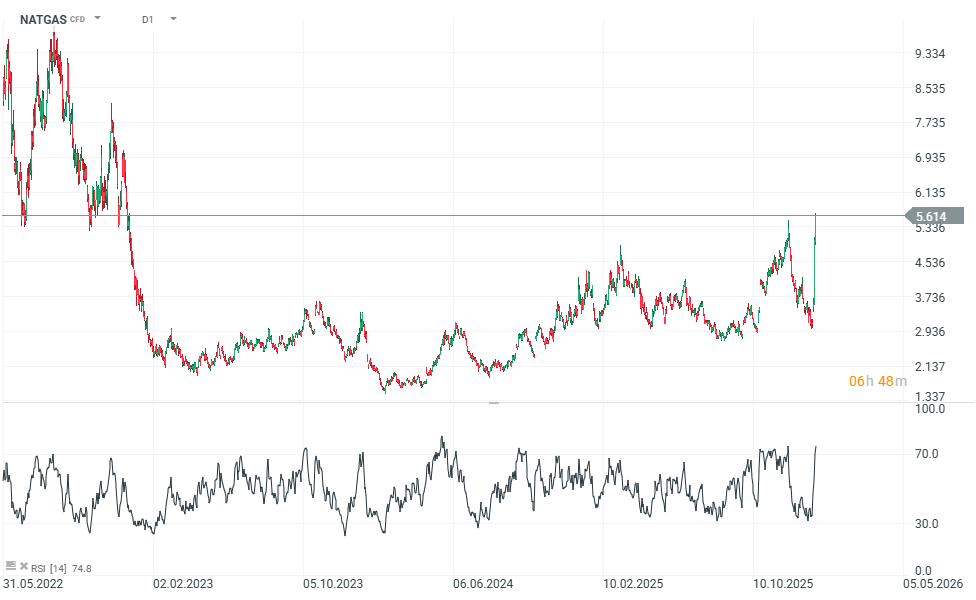

NATGAS (D1 timeframe)

The RSI has moved above 70, typically signaling overbought conditions and increasing the risk of a pullback. However, a meaningful correction would likely require an improvement in weather forecasts. NATGAS is currently trading at its highest levels since December 2022.

Source: xStation5

Since the last contract roll, NATGAS has gained nearly 50%.

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.