WTI crude is currently up 1.30% at 65.90 USD per barrel. Brent crude is trading above 70 USD. The escalation of tensions between the US and Iran has once again increased the geopolitical risk premium.

Reports of a deadlock in diplomatic talks and rising US military activity in the region have heightened concerns about a potential strike on Iran. Investors are building long positions ahead of the weekend, fearing that any disruption in the Strait of Hormuz could significantly constrain global supply. Although previous episodes of tension did not lead to sustained price increases, analysts warn that underestimating the current risk may be a mistake, especially as Iran signals the possibility of targeting energy infrastructure in the event of further escalation.

The macroeconomic backdrop further complicates the situation. The Fed meeting minutes showed policymakers remain cautious about rate cuts, with some even leaving the door open to renewed tightening if inflation proves persistent — supporting the US dollar and Treasury yields. At the same time, a potential upcoming Supreme Court ruling on tariffs could materially shift expectations for economic growth and oil demand. A positive pro-growth surprise — such as the removal of tariffs — could further support oil prices through improved demand prospects, while weak macro data or hawkish signals from the Fed could cap gains despite geopolitical tensions.

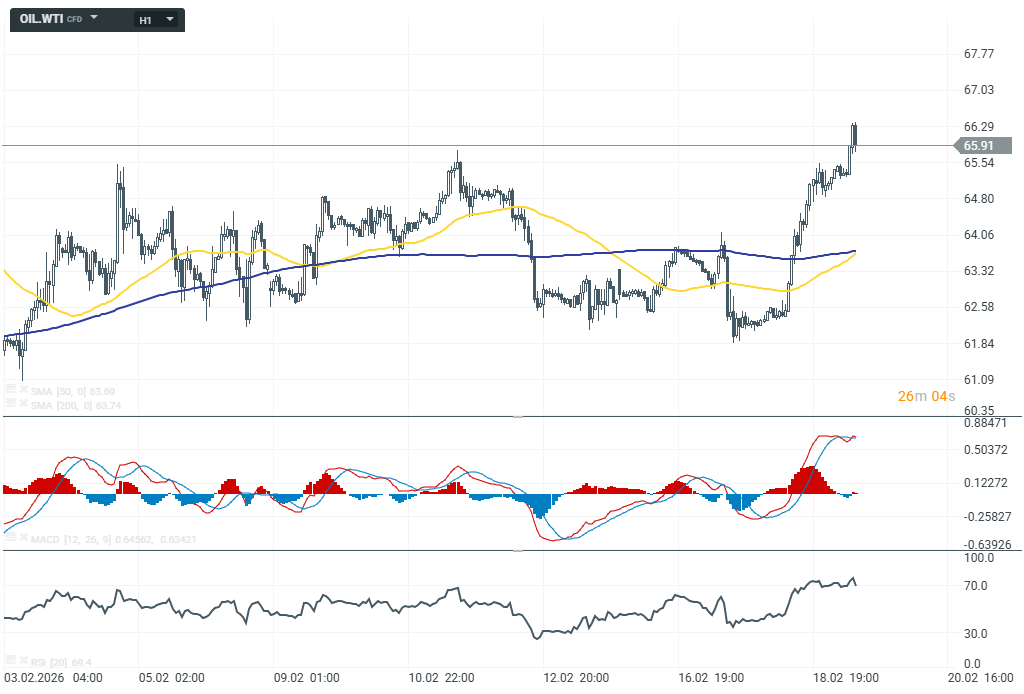

From a technical perspective, oil has rebounded strongly from support in the 62–63 USD area and is now testing key resistance in the 66–67 USD zone. A clear breakout above this level would open the way toward 70.50 USD and could further increase the geopolitical premium in prices. However, in the absence of a clear escalation of the conflict, the market may remain within its existing range, balancing headline risk against macroeconomic fundamentals.

Morning wrap (19.02.2026)

Fed minutes released 🗽Key takeaways

Daily summary: Wall Street and oil gain 📈 EURUSD slides 0.5%

Gold surges 2.5% nearing $5000 per ounce 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.