Price of oil continues an upward move started by the end of October 2020. In spite of the deteriorating pandemic situation around the world, crude trades over 50% higher compared to a low reached in November. What are the reasons behind this rally? Is there more fuel for gains? We will try to find answers to these questions.

Positive factors for oil:

-

USD weakening - US dollar has depreciated significantly since the US presidential elections

-

Weakening of the USD and bullish trend on the oil market heralds massive US stimulus incoming - Joe Biden plans to provide trillions of dollars to support economy, including direct payments to citizens

-

Demand in Asia - China has been buying big amount of commodities, including oil, since coronavirus pandemic arrived in the Western World

-

Vaccines - coronavirus vaccines arrived much sooner than expected, hinting that "return to normal" may also occur sooner

-

OPEC+ output limits - oil producers decided not to lift production quotas while Saudi Arabia pledged to limit its output further amid demand uncertainty

-

Inflation hedge - 2021 is expected to bring return of inflation and rising commodity prices are expected to be one of the factors contributing

Negative factors for oil:

-

Pandemic uncertainty - despite massive stimulus and beginning of vaccination, pandemic-related uncertainty remains

-

Mobility - coronavirus restrictions continue to limit mobility around the world, what has a negative impact on demand

-

Potential sell-off on Wall Street - valuations of US stocks are highly inflated what creates a risk of correction. In such a scenario, USD gains could have a negative impact on oil price

-

Changes in the automotive industry - further development and adoption of electric vehicles may limit demand for combustion engine vehicles due to environmental regulations

Is there fuel for more gains?

Oil prices have increased over 10% so far this year. More and more institutions project that prices may recover towards $65-70 per barrel. On one hand, OPEC is worried about the demand in the short-term. On the other, EIA forecasts that demand will begin to rise starting from mid-2021 and throughout 2022. However, 2022 is expected to be the last year of year-over-year increase in oil demand.

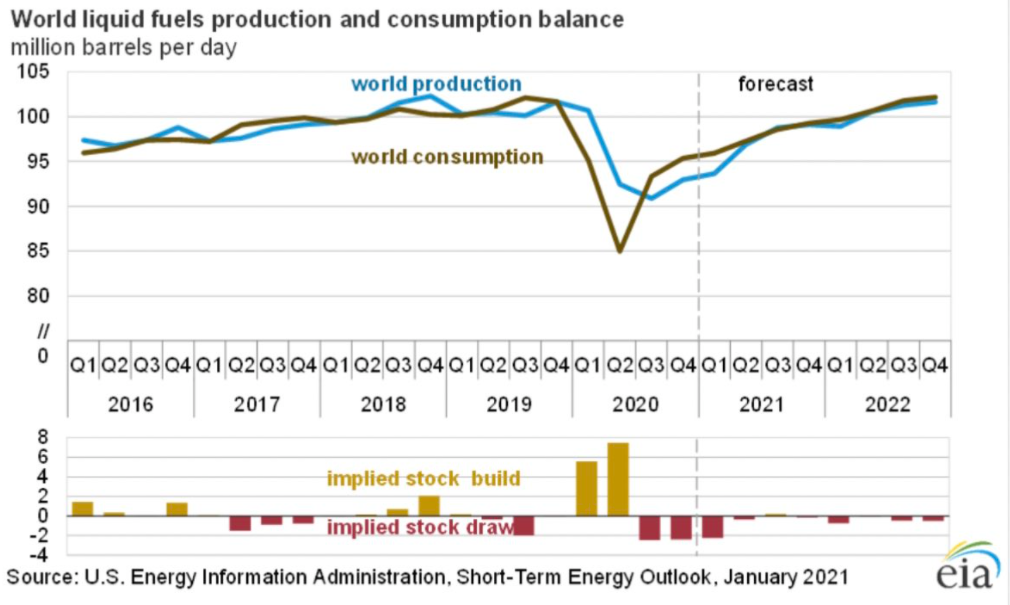

EIA forecasts a huge deficit on the oil market in the first half of 2021. Demand and supply is expected to balance each other until the end of 2022. Source: EIA

EIA forecasts a huge deficit on the oil market in the first half of 2021. Demand and supply is expected to balance each other until the end of 2022. Source: EIA

Oil futures curve has changed a lot. Over the course of a month 6- and 12-month spreads have widened significantly. Backwardation is not extreme yet (6- and 12-months) so there is room for prices to increase additional few dollars per barrel. Speculative positioning is moderate and is not flashing any warning signs yet. On the other hand, spread between June and December contracts shows that oil may be starting to be overvalued.

January-June spread (white line), January-December spread (yellow line), June-December spread (green line). Source: Bloomberg

January-June spread (white line), January-December spread (yellow line), June-December spread (green line). Source: Bloomberg

Technical Analysis

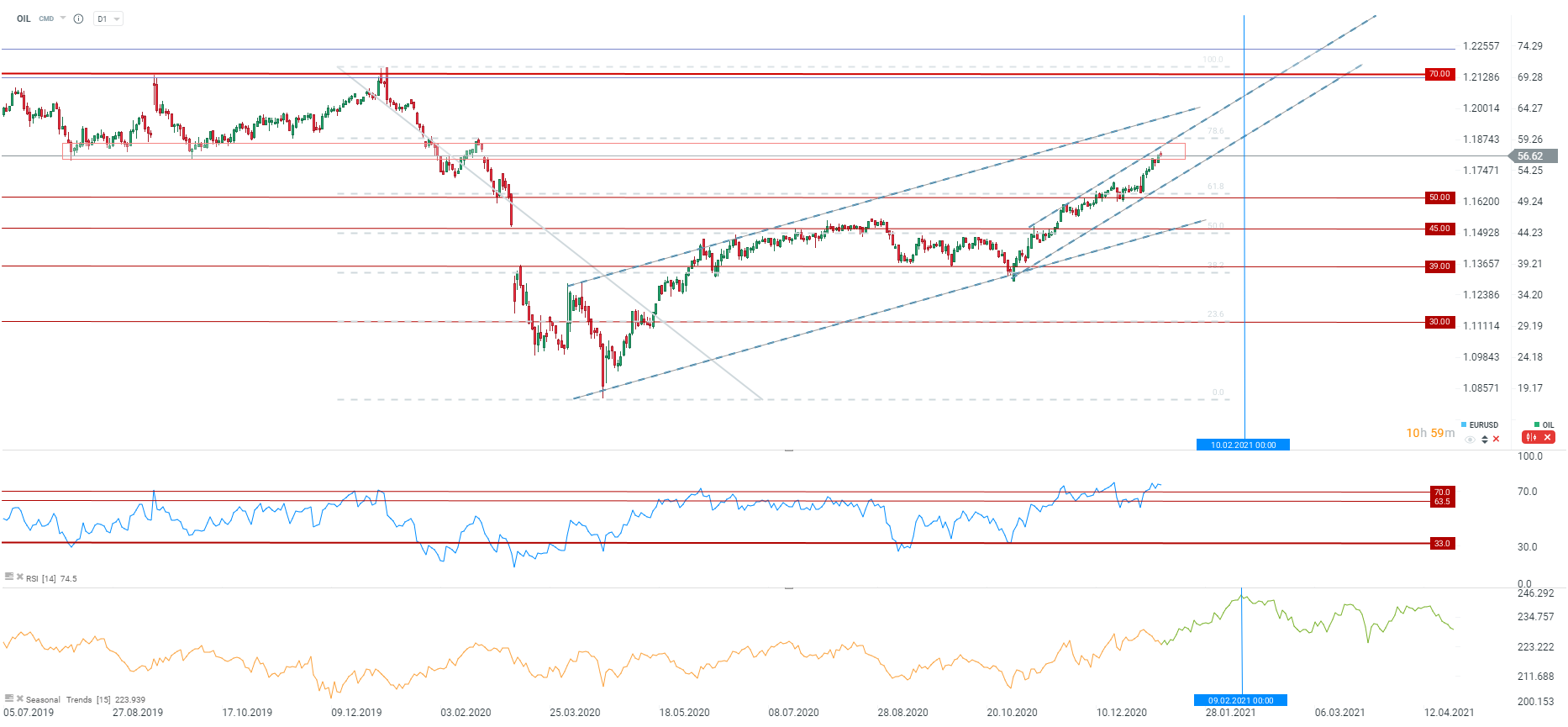

Brent oil has climbed towards an important supply area. Nevertheless, there is still some room for gains until key short-term resistance in the $60 area is reached (78.6% retracement and upper limit of the channel). RSI shows that commodity is overbought but seasonal patterns signal that we are near seasonal low and peak should be reached around February 10. Source: xStation5

Brent oil has climbed towards an important supply area. Nevertheless, there is still some room for gains until key short-term resistance in the $60 area is reached (78.6% retracement and upper limit of the channel). RSI shows that commodity is overbought but seasonal patterns signal that we are near seasonal low and peak should be reached around February 10. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.