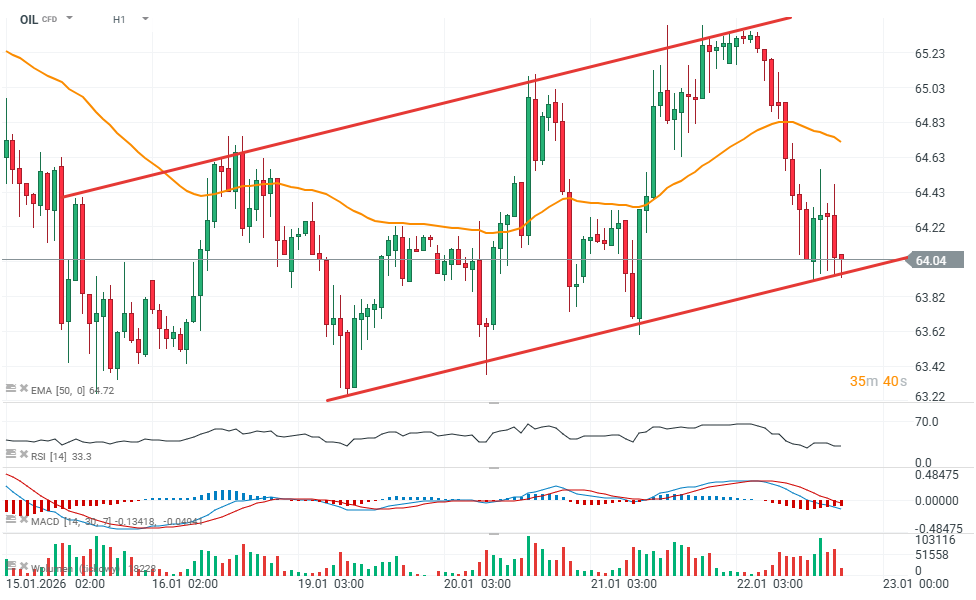

US energy market data released today pointed to a solid build in crude oil inventories and a larger-than-expected draw in natural gas stocks. As a result, oil prices slipped slightly toward the $64 per barrel area. Meanwhile, the “supportive” natural gas report triggered some profit-taking, although the base case remains a continuation of the strong uptrend.

-

Crude Oil Inventories (EIA): +3.602M bbl (forecast: -0.108M, previous: +3.391M)

-

Gasoline Inventories (EIA): +5.977M bbl (forecast: +1.466M, previous: +8.977M)

-

Distillate Inventories (EIA): +3.348M bbl (forecast: 0M, previous: -0.029M)

-

Cushing Crude Inventories (EIA): +1.478M bbl (previous: +0.745M)

-

Natural Gas Storage (EIA): -120 bcf (forecast: -98 bcf, previous: -71 bcf)

Source: xStation5

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.