Qualcomm gains 6.50% after quarterly results that exceeded expectations, reflecting a revival in the smartphone market. The company reported adjusted revenues of $9.39 billion, up 1.3% year-over-year, surpassing the estimate of $9.32 billion. The adjusted earnings per share were $2.44, exceeding the estimate of $2.32.

Revenue:

- Q3 Revenue: $9.39 billion, up 1.3% year-over-year, exceeding the estimate of $9.32 billion.

- Comparison: The increase is a slowdown from the 16% year-over-year increase in the previous quarter.

- Q4 Forecast: Expected to range from $8.8 billion to $9.6 billion, compared to the consensus estimate of $9.08 billion.

Earnings Per Share (EPS):

- Q3 Adjusted EPS: $2.44, surpassing the estimate of $2.32 and marking a 6.1% increase year-over-year.

- Q4 Forecast: Expected to range from $2.15 to $2.35, with a midpoint above analyst estimates.

Qualcomm's board highlighted the company's diversification efforts and positive outlook. CEO Cristiano Amon expressed satisfaction with record QCT Automotive revenues for the third consecutive quarter. He also noted upcoming Snapdragon X launches and progress in AI capabilities across various product categories. The board also pointed out strong demand for premium Android phones in China, attributing Qualcomm's success to its competitive position. Despite challenges in the IoT sector, Qualcomm's strategic moves aim to reduce dependence on phone chips and strengthen growth in other markets, enhancing its resilience in a competitive industry.

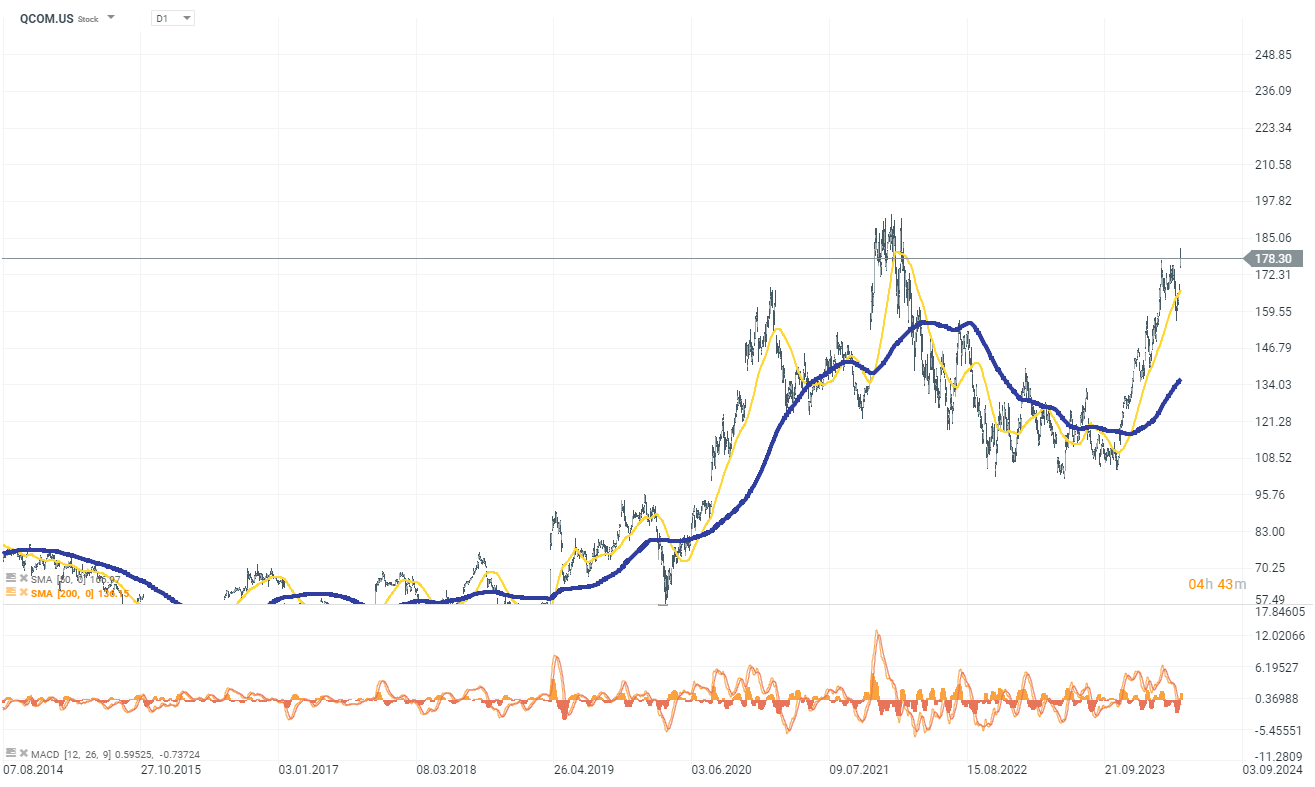

Qualcomm shares (QCOM.US) are gaining 6.50% today to $178, approaching historical highs from 2022 at around $192.

Source: xStation 5

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.