- Glencore shares: Up nearly 8 per cent.

- Rio Tinto shares: Falling by 1.7 per cent. Shareholders fear that the Glencore takeover will be expensive and difficult.

- Copper price: Reaches the highest prices in history – over 13,000 dollars per tonne.

- Important date: 5 February 2026. By this date, Rio must publicly announce whether it will actually make an offer to acquire Glencore. If it withdraws, it must wait six months before it can compete with another rival.

- Coal: This is the biggest problem. Rio does not want coal, but Glencore is one of the world's leading producers of thermal coal. Negotiators will be grappling with this issue for weeks to come.

- Competition: BHP is waiting in the wings. This company also wants to expand its copper operations. If the talks between Rio and Glencore go badly, BHP may step in.

- Mining sector: The entire European mining industry is growing thanks to this news. The European commodities index is rallying, and investors are returning to mining stocks.

- Glencore shares: Up nearly 8 per cent.

- Rio Tinto shares: Falling by 1.7 per cent. Shareholders fear that the Glencore takeover will be expensive and difficult.

- Copper price: Reaches the highest prices in history – over 13,000 dollars per tonne.

- Important date: 5 February 2026. By this date, Rio must publicly announce whether it will actually make an offer to acquire Glencore. If it withdraws, it must wait six months before it can compete with another rival.

- Coal: This is the biggest problem. Rio does not want coal, but Glencore is one of the world's leading producers of thermal coal. Negotiators will be grappling with this issue for weeks to come.

- Competition: BHP is waiting in the wings. This company also wants to expand its copper operations. If the talks between Rio and Glencore go badly, BHP may step in.

- Mining sector: The entire European mining industry is growing thanks to this news. The European commodities index is rallying, and investors are returning to mining stocks.

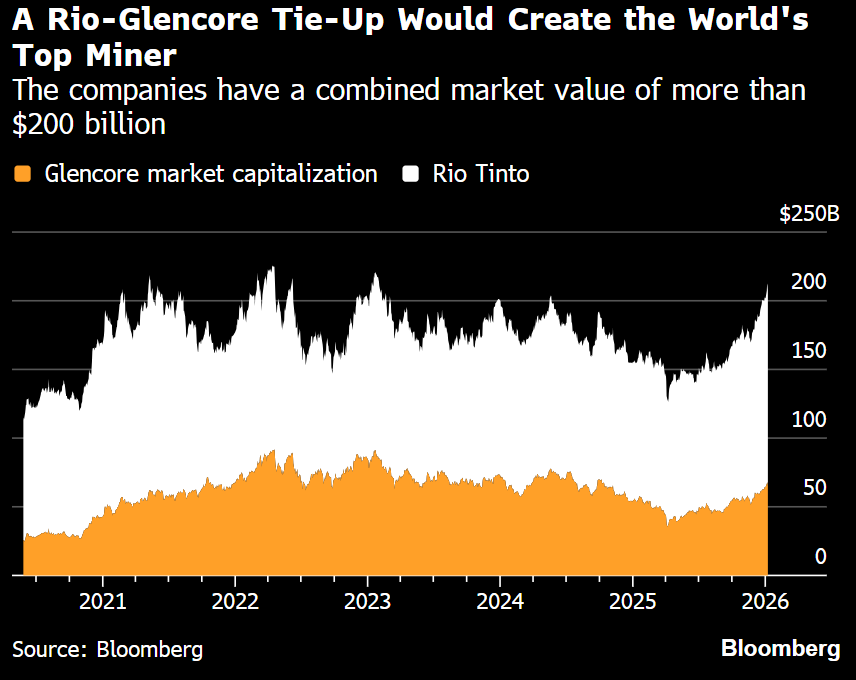

European stock markets are buzzing with rumours of a mega-merger. Rio Tinto (RIO.UK) and Glencore (GLEN.UK) have resumed merger talks that would create the world's largest mining entity, worth over $200 billion. This is the second attempt – the first in 2024 fell through due to valuation disputes. Now, however, conditions are better: copper is breaking records (over $13,000 per tonne) and the entire sector is experiencing a raw materials frenzy. The key deadline for the entire transaction is 5 February. By that date, Rio must confirm the offer or withdraw for six months.

The market reacts emotionally, but asymmetrically. Glencore shares are soaring by as much as 7.8% in London, their highest level since July 2024. Investors know that Glencore is a bargain: it has the best copper assets, wants to double production within a decade, and without copper itself, there is no energy future. Rio Tinto, on the other hand, is losing 1.7-6.3% depending on the stock exchange, reflecting fears of share dilution and integration costs. The mining sector across Europe is benefiting from flows driven by hopes of an agreement between the two sides.

The combined market capitalisation of both companies currently exceeds USD 260 billion. Source: Bloomberg Financial LP

Market experts are divided on whether the merger is a good idea. Analysts at Morgan Stanley see great potential here and recommend buying shares in both companies. According to them, the merger would highlight Glencore's true value, which the market underestimates. In addition, the combined company would be much more focused on copper – this metal would account for 35 per cent of revenues, compared to only 25 per cent at present. However, Oddo BHF bank criticises this idea. Analysts there argue that merging Rio and Glencore would be very complicated. They fear that the cultures of the two companies are completely different and may not get along. They are also concerned about coal – Glencore is one of the world's largest coal producers, while Rio withdrew from this business several years ago.

Secondly, the merger would have to be approved in at least eight countries, which would take time and money. Thirdly, Rio Tinto's structure as a dual-listed company complicates the share transaction. Some experts believe that the deal will ultimately be smaller than everyone expects. Glencore has a huge trading division that buys and sells raw materials around the world. This division would be a very strange addition to Rio Tinto and may prove difficult to absorb.

There is also a competitor lurking in the background – the large company BHP (BHP.UK), which would like to have more exposure to copper itself. If Rio and Glencore haggle for too long, BHP may enter the game and try to buy Glencore or parts of it itself. Rio Tinto's new boss, Simon Trott, is just taking the helm. For him, this merger will be his first big decision, so investors are watching to see how he ultimately handles such a serious issue. Glencore CEO Gary Nagle, on the other hand, has been saying behind the scenes for years that a merger with Rio is the most logical deal in the entire mining industry.

Glencore shares opened today's session with an upward gap, while on a weekly basis we can see that the scale of recent increases, counting the RSI dynamics from the last 14 weeks, has raised the entity's value to its highest levels since 2022. This shows that investors are currently willing to pay more for the company's shares in view of the incoming corporate news and future prospects. On the other hand, however, it is worth bearing in mind that with such rapid appreciation, failure to meet expectations could theoretically cause a symmetrically faster downward correction in the company's valuation. Source: xStation

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.