Today we can see that futures on silver are rising more than 3.5% and we can see the reason of that in some 'dovish' data and market climate. Yesterday Bank of Canada, today European Central Bank and Danmarks National bank eased policy by slightly cutting rates. Those decisions were awaited, but the situation is looking more dovish, as also the US Federal Reserve may see some dovish pressure amid weaker US job market data.

- Today US jobless claims came in higher than expected (229k vs 220k exp. and 219 k. previously), while US job costs were also revised lower to 4% vs 4.9% in first reading and 4.7% previously. This week, also ADP report came in weaker than expected and JOLTS data came in the lowest level since 2021 signalling dropping free vacancies in US economy.

- According to IMF, Federal Reserve should be very a cautious and data-dependent approach to cutting rates, as US labour market is slowing. Tomorrow, market will know the most important job market data (Non-Farm Payrolls), which will probably increase volatility in both, silver and US dollar at 1:30 PM BST. To sum up, US labour market shows some weakness and oil prices are dropping, which may be a signal for the Fed to think about a small rates cut; maybe in the beginning of autumn.

More pressure on the dovish 'Fed pivot' may help speculative rally of US dollar negative correlated assets such as gold, silver or Bitcoin. Bitcoin also gains today, climbing to $71.500 level.

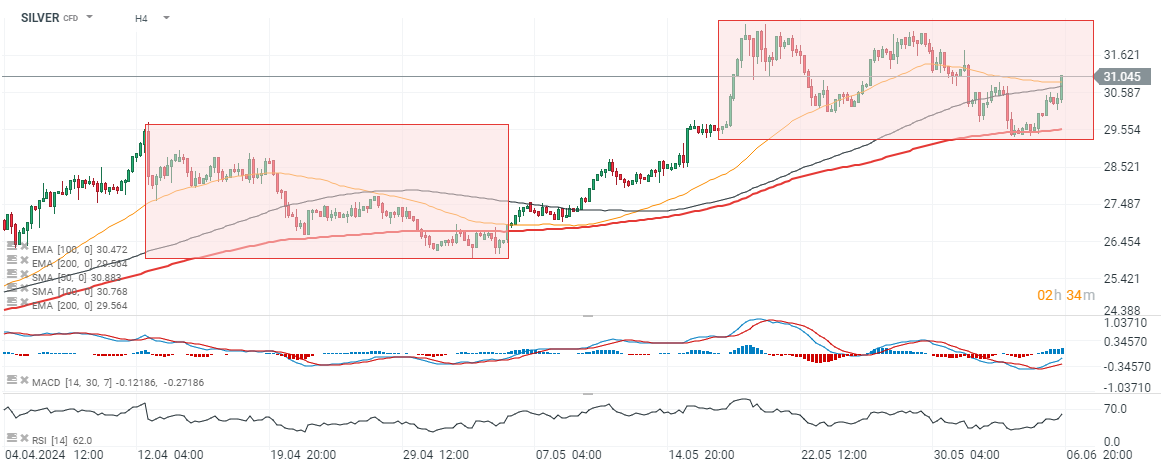

SILVER (H4 interval)

USDIDX vs SILVER (golden chart)

USDIDX vs SILVER (golden chart)

Source: xStation5

Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.