Spanish telecom company Telefonica (TEF1.ES) stock surged 10.0% after the company announced that it will sell its mobile phone masts in Europe and Latin America to US-based telecom infrastructure operator American Towers (AMT.US) for 7.7 billion euros ($9.41 billion).

Telefonica's subsidiary Telxius Telecom will hand over more than 30,000 mobile phone masts in Spain, Germany, Brazil, Peru, Chile and Argentina to American Towers which will then lease the phone masts back to Telefonica. The sale is the biggest ever by Telefonica, which expects to book a capital gain of around 3.5 billion euros and cut its net debt by about 4.6 billion euros. As a result of the transaction, Telefonica will only own tower assets in Britain.

For American Tower the deal gives access to the European market, which has become more attractive thanks to the implementation of 5G, especially in Germany where its competitor Cellnex (CLNX.ES) is still absent.

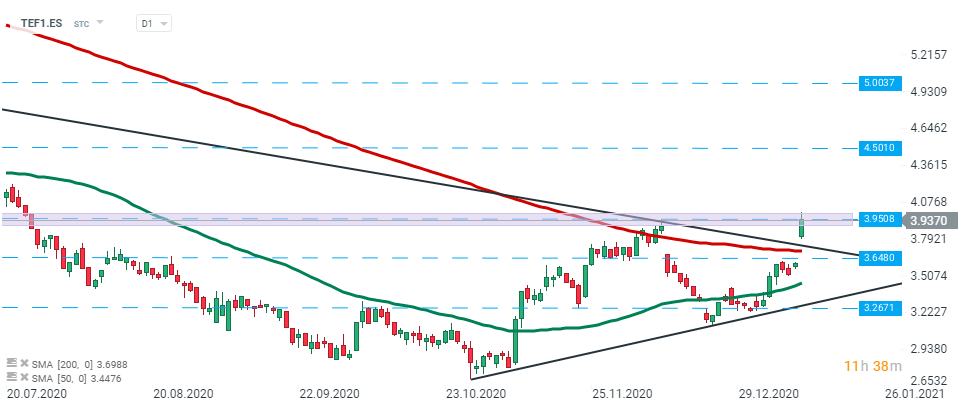

Telefonica (TEF1.ES) stock launched today’s session higher and broke above the downward trendline and 200 SMA (red line). Currently price is testing major resistance at €3.95. Should a break above occur, upward move may accelerate towards next resistance at €4.50. On the other hand, should the sellers halt an upward move here, another downward swing may start. Local support lies at €3.64. Source: xStation5

Telefonica (TEF1.ES) stock launched today’s session higher and broke above the downward trendline and 200 SMA (red line). Currently price is testing major resistance at €3.95. Should a break above occur, upward move may accelerate towards next resistance at €4.50. On the other hand, should the sellers halt an upward move here, another downward swing may start. Local support lies at €3.64. Source: xStation5

American Towers (AMT.US) stock saw a relatively small reaction to today’s news. Yesterday price bounced off the local support at $210.30, however only break above the upper limit of the descending channel and major resistance at $227.39 may pave the way for a bigger upward move. Source: xStation5

American Towers (AMT.US) stock saw a relatively small reaction to today’s news. Yesterday price bounced off the local support at $210.30, however only break above the upper limit of the descending channel and major resistance at $227.39 may pave the way for a bigger upward move. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.