At the start of a new week, the focus is on the US, and whether the world’s largest economy can avoid a government shutdown on Tuesday at midnight. The Republicans and Democrats are locked in a fierce battle to avoid a funding deadline at the end of this month, and at this late stage it appears that both sides are far from an agreement to extend government funding, which increases the chance of a shutdown.

Although stock markets have absorbed this risk well, and futures point to a higher open for both European and US indices later today, concern about a government shut down is being expressed via the gold price, which has surged above $3,800 per ounce this morning, and is higher by more than $40 at the start of the week.

President Trump is scheduled to meet with four top Congressional leaders on Monday in a last-ditch attempt to avoid a shutdown, which may be fueling the positive tone to equities at the start of this week. However, this meeting will come before a crucial Senate vote later on Monday that will determine whether or not the government will shut down. The Republicans were able to agree on a funding bill earlier this month, however, this was blocked by Senate Democrats who sought more generous healthcare funding.

Trump threatens mass firings if funding deal not made

During press interviews this weekend, the President warned that there would be mass federal job cuts if the Senate does not agree to a funding bill. Trump also suggested that these layoffs would be permanent. This would be unusual, in the past, government workers were usually furloughed rather than laid off permanently, which could have negative repercussions for the US labour market. This is likely a tactic from President Trump to try and force Democrats into backing down on healthcare spending demands. If the shutdown does happen, then it could add to labour market pressure and force a faster pace of job cuts from the Federal Reserve, especially next year. Right now, there are just over two rate cuts priced in for 2026 by the Fed Fund Futures market, this could be recalibrated higher later this week if the US government does shut down.

If a shutdown does take place, then it could lead to more than 850,000 job losses, this was the number of government workers who were furloughed when the government last shut down in 2013. A shutdown this week would also mean that Friday’s September jobs report would not be released, which could lead to confusion and uncertainty about the current health of the US jobs market, which may trigger excess volatility in the middle of this week.

US stocks snap 3-week winning streak

Global stocks managed to end Friday higher, after US core PCE was in line with expectations for August. However, US indices snapped a 3-week winning streak and the S&P 500 closed down 0.3% on the week. European indices managed to outperform their US counterparts last week, the Eurostoxx 50 and the FTSE 100 both closed higher by 0.7% last week as European banks and UK mining companies did well last week. As we start a new week, both US and European futures are pointing to a higher open later today. UK futures are expected to edge lower, after a 0.5% drop in the oil price so far this morning, this comes after Opec + suggested that it could increase production in November. Thus, we could see further losses later today, and Brent crude has backed away from $70 per barrel.

Bullish momentum could sustain stock market gains into Q4

US stocks have defied fears about seasonal weakness in September, the S&P 500 is higher by 2.8% month to date, the Nasdaq is higher by 4.7%. Asian stocks are the top performers, the Nikkei is higher by more than 6% so far in September, the Hang Seng by more than 4.1%. The weakness across US markets last week combined with fears about elevated price levels and the sustainability of the AI trade, should mean that the set up for October is looking shaky. However, when stocks perform well in September, this typically leads to a strong performance for Q4, and no one can deny that momentum is bullish.

Inflows into ETFs this month were at their highest level of the year so far, and the US attracted the bulk of flows, followed by Asia. Inflows into European ETFs has been dwindling in recent months, and this continued in September, which may suggest a preference for US equities as we move into the final three months of the year. Interestingly, gold outperformed global equities, and is higher by more than 10% in September, as a mixture of strong US economic growth, inflation concerns and now US government shutdown risk triggers another leg higher in the yellow metal.

At the same time as gold is rising, US yields also look like they have made a bottom, the 10-year yield is at its highest level since early September, and the 2-year yield is at its highest level since late August. The question, as we move into October, is whether gold, and equities can rise at the same time as yields?

Looking forward to this week, there are some key risk events that could determine how well financial markets welcome the start of the fourth quarter.

1, US payrolls data

As mentioned above, there is a chance that the US non-farm payrolls report could be delayed if there is a US government shutdown later this week. If the data is delayed, this could have major ramifications for financial markets. Although there is a near 90% chance of a rate cut in October, the September jobs data will be watched closely to ratify the view that the US labour market is cooling down, and interest rate cuts are justified.

Diverging views at the Federal Reserve leads to scaled back rate cut hopes

Traders have scaled back their expectations of Fed rate cuts in recent weeks, after diverging views on the future path of policy have been expressed by FOMC members. Just last week, the newest member of the committee, Stephen Miran, voiced extreme dovish hopes for rate cuts, while other members including Raphael Bostic and Mary Daly sounded much more cautious about cutting rates at this juncture. After the strong upward revision to Q2 GDP, a soft September jobs report is what may be needed to drive the stock market rally from here. This is a crucial part of the puzzle for the Fed, as weak jobs data justifies further rate cuts.

Fed needs to manage a two-speed economy

If the labour market data is released on Friday, as scheduled, then analysts are expecting a reading of 50k. Although this is an increase on the 20k reading for August, it is still very weak, and could lead to upward pressure on the unemployment rate, which is expected to remain steady at 4.3% this month. Average hourly earnings are also expected to remain steady at 3.7% for September. If the data is hotter than expected, this could make it harder for the Fed to justify an October rate cut, especially after the stronger than expected GDP report. The difficulty for the Fed is that there is a two-speed economy right now, on the one hand tech and the AI trend is hot, but on the other hand, autos, home builders and retailers are suffering.

When bad data is good for financial markets

Since the Fed remains data dependent, stocks may take a weaker than expected number in their stride, as bad news is good news for financial markets. However, risk sentiment will also be sensitive to a stronger number, as this could reduce the chance of further Fed rate cuts this year, which may weigh on stocks and other risky assets. As you can see below, elevated price to earnings ratios can lead to US stock market underperformance. The S&P 500 is trading at a 27 times earnings, which is historically high, thus investors may be even more sensitive to upcoming economic data than usual.

Chart 1: S&P 500 and the S&P 500 P/E ratio

Source: XTB and Bloomberg

2, Rachel Reeves speech

At 12pm today, the Chancellor Rachel Reeves will deliver her much anticipated speech at the Labour Party conference. This is seen as laying the groundwork for November’s budget, and it may have big implications for the UK Gilt market and the pound later today.

Sentiment towards the UK has been jittery in recent weeks, as speculation mounts about how Rachel Reeves will plug an expected £30bn hole in the UK’s public finances in the upcoming budget. In recent weeks, the focus has been on tax increases, which has led to fears about UK economic growth. However, as the Labour Party conference begins and we wait for Rachel Reeves’ speech on Monday, the narrative is starting to shift.

Fears of a move to the left and a leadership challenge to Keir Starmer from Andy Burnham, caused a spike in UK yields last week, especially after Burnham said that he would not be in ‘hock’ to the bond markets. The bond market did not take kindly to Burnham’s dismissive attitude, as yields rose, Keir Starmer was able to launch an attack, linking Burnham’s rhetoric to Liz Truss.

This appears to have silenced Burnham for now, so the focus may shift to Rachel Reeves’ speech. As mentioned, in recent days the focus has shifted from relentless tax speculation to the prospect of spending cuts. The UK’s welfare bill is a massive albatross around the UK’s neck. Funding this beast is problematic, especially when more than 50% of households take more out of the system than they put in. Rachel Reeves is expected to make a pledge that fiscal restraint is a path to victory in 2029.

Measures she is expected to announce include a ‘youth guarantee’ scheme that will force young people who have been on universal credit for 18 months back into work. There has also been speculation that she could break the Labour manifesto and hint at changing one of the big taxes in the November budget, and speculation is growing that VAT could rise in November. This could lead to a one-off increase to inflation, which is already elevated, but this may be the easiest and fairest tax to increase.

We expect Reeves to use this speech to push back on calls from the left for a wealth tax, and to maintain her fiscal rules. Any hint of unfunded spending pledges could have big ramifications for the Gilt market and may weigh on the pound, which is rising vs. the USD on Monday morning, as the dollar gives up some of last week’s gains.

While Rachel Reeves very much needs to be in ‘hock’ to the bond market, there is only a small degree of fiscal restraint that she can sell both to her own party and to the bond market. If she does announce some cost saving measures during her speech on Monday, she will still most likely need to find £30bn in the Budget.

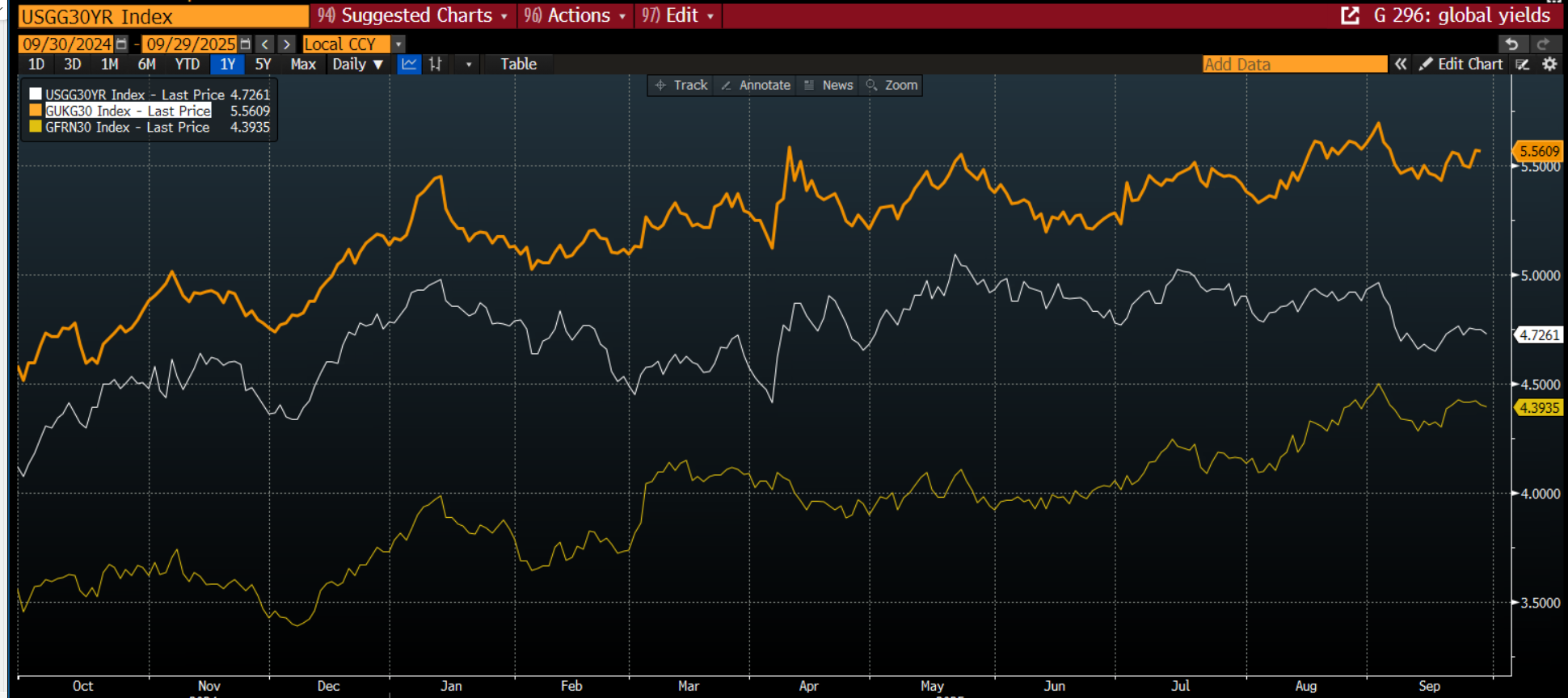

However, a more prudent approach to government spending could be welcomed by the bond market. If Reeves can strike a careful note, then bond yields could fall, and this may boost the pound even further at the start of this week. As you can see below, the UK 30-year yield is significantly higher than the US and French yield, even though France and the US have their own fiscal issues. This means there is no room for error for the Chancellor later today.

Chart 2: UK, US and French 30-year sovereign bond yields

Source: XTB and Bloomberg

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.