- Hopes for a de-escalation drive the recovery trade

- Gold hits another high as Asian shares sell off

- Political risks mount for stocks

- AI stock sell off takes some froth off the top of a stretched market

- Tech stocks: hopes that Q3 earnings season can assuage political considerations

- French assets weighed down by political pressures

- UK’s households pay down debt as the state accumulates it

- Hopes for a de-escalation drive the recovery trade

- Gold hits another high as Asian shares sell off

- Political risks mount for stocks

- AI stock sell off takes some froth off the top of a stretched market

- Tech stocks: hopes that Q3 earnings season can assuage political considerations

- French assets weighed down by political pressures

- UK’s households pay down debt as the state accumulates it

US equity market futures are pointing to a sharp jump higher after Friday’s sell off. Stocks in Europe are also pointing to a modest move to the upside later, as Donald Trump deescalates the latest trade war with China.

Hopes for a de-escalation drive the recovery trade

Late on Sunday afternoon, Donald Trump seemed to backtrack on his threat to impose a further 100% tariff rate on China after it applied controls to rare earth mineral exports. The President posted on his Truth Social account, saying ‘Don’t worry about China, it will all be fine!’, he said that President Xi ‘had a bad moment’ He said that the US wants to ‘help China, not hurt it !!!’ This seems fairly conciliatory, even if Trump will not take responsibility for escalating this latest trade war.

However, this tweet does not suggest that there has been a solution to the latest trade spat between China and the US, and instead Trump appears to be suggesting that financial markets have overreacted to his threat of 100% tariffs. Thus, even if there is a stock market recovery today, investors could still remain edgy this week and continue the sell off if the situation deteriorates.

The TACO trade, ‘Trump Always Chickens Out’, fueled the recovery rally in April, so if it looks like the same will happen again, then we could see markets absorb Trump’s tariff threats relatively quickly, and volatility could retreat at the start of this week.

Gold hits another high as Asian shares sell off

Gold’s meteoric rise hit the skids on Friday, and at one stage it looked like the metal could close the week below $4,000 per ounce, after rising above this significant level on Wednesday. However, tariff fears threw a lifeline to the yellow metal, it closed above $4,000 on Friday, and has surged to a fresh record high early on Monday, as trade tensions drive more investor demand, even at these lofty levels.

Stocks across Asia opened sharply lower, and the brunt of the selling was focused on the Hang Seng. However, even this has picked up from the lows on optimism that the worst of the latest tariff spat can be avoided.

Political risks mount for stocks

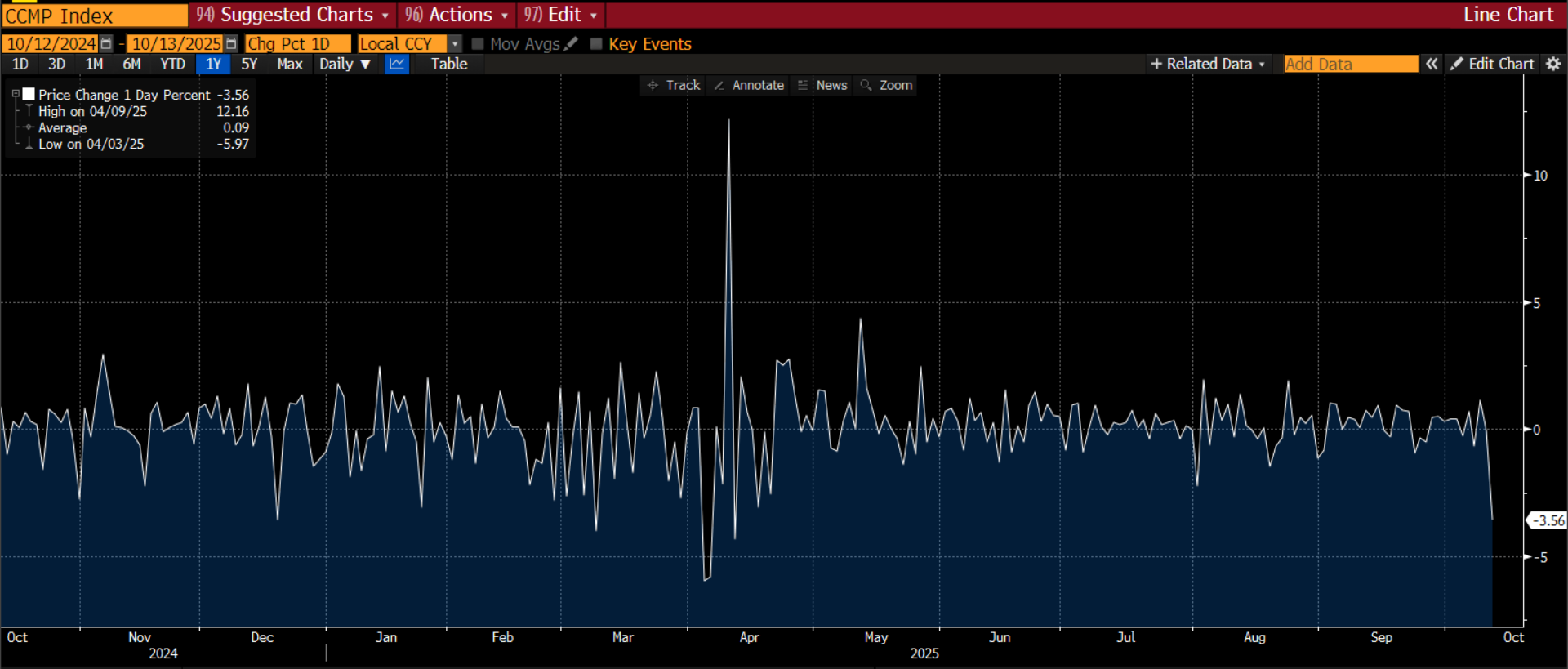

Even though stocks markets are expected to stage a recovery today, the sharp slump in stocks on Friday is a warning for the market. The flare up in trade tensions between the two biggest economies in the world caught traders unawares, volatility spiked, and stocks sold off by the most since ‘Liberation Day’ back in April, with a hefty 3.5% drop for the Nasdaq, and a 2.7% drop for the S&P 500.

AI stock sell off takes some froth off the top of a stretched market

The tech sector was the biggest drag on the S&P 500, which fell nearly 4%. A resumption of the trade war between the world’s two largest economies halted the market binge on AI stocks. In the tech space, the AI trade took the brunt of the selling. The biggest decliners included AMD, Qualcomm and Nvidia, down 7.7%, 7.3% and 4.8% respectively. Friday’s selloff has taken some of the froth off the top of a market that was starting to look a little stretched to the upside. Could this be used as a buying opportunity?

Tech stocks: hopes that Q3 earnings season can assuage political considerations

While we expect tech to lead the bounce back in stocks later today, the selloff could lead to some uncomfortable questions for investors. Firstly, how quickly will the Vix retreat as we still haven’t heard from China about its rare earth minerals exports? The fact that stocks have fallen in Asia suggests that some expect trade tensions to knock market confidence. Secondly, some had assumed that the AI trade would be resilient to geopolitical headwinds, especially after President Trump made concessions to chip makers and the like regarding their exports to China. The risk now is that these concessions could be reversed, especially if tensions boil over between the US and China in the near future.

The size of this pullback suggests that tech remains vulnerable to politics once more, and the Magnificent 7 also had its worst day since April. Traders hope that another strong earnings season for the tech sector later this month will be enough to assuage trade concerns, which can then allow the sector to see its share prices rally into year end.

Chart 1: Nasdaq daily move (%), 1-year chart

Source: XTB and Bloomberg

Bank sell off suggests growth risks remain

There was also a broad sell off in banks, particularly regional banks. This suggests that investors also remain concerned about Trump’s tariff threats impacting the economy and knocking economic growth off course. The regional banking sector is more directly exposed to the fallout from tariffs as they are more closely linked to the real economy, and do not have large trading desks that can benefit from volatility. Interestingly, US banks will report earnings for Q3 this week, and we will detail what is expected below.

French assets weighed down by political pressures

French bond yields are set to rise later this morning, although the euro has regained earlier losses, after the reappointment of Sebastian Lecornu as Prime Minister, less than a week after he resigned. Lecornu is now racing to form a government that will be able to pass a budget before year end. This is no easy task and the latest government may still collapse, as it is already facing a no confidence vote later this week, which could keep pressure on French assets, especially French bond yields. Any budget negotiations will be a delicate dance between the various political factions in the French parliament and the bond market, in the days and weeks ahead. There are some tough choices to be made to get a deal across the line, including some potential deficit-busting policy concessions like scrapping the increase in the national pension age in France.

Pressure to get a Budget passed is imminent. There will likely need to be emergency legislation required early on in Lecornu’s second stint as PM to ensure the government remains funded. The same arguments are likely to dominate in France this week: the centre right will continue to urge the Socialists to maintain fiscal restraint, and they will likely push back on any hint of belt tightening. Thus, we could see more volatility for French bonds in the coming days. It is worth noting that France does not have a huge repayment burden in the coming year, and it is expected to be lower than in 2025, so the real challenge for bonds is political, and the risk that a standoff in the French parliament will cause long term damage to the country’s ability to fund its deficit. Although French stocks have underperformed their US and European counterparts so far this year, the Cac is likely to be driven by global factors on Monday, as investors remain laser focused on the latest developments in the US/ China trade war.

The latest development in France is part of a wider trend where political risk premiums are weighing on bond prices, and pushing up yields across the world, including the UK, which have been elevated since 2022, Japan, and even in the US.

UK’s households pay down debt as the state accumulates it

Elsewhere, there was some good news for the UK this week. When we talk about the UK we often think of a highly indebted nation. Undoubtedly that is true, however, it is the government who is indebted, not the individual. The ONS has reported that debt as a share of household incomes has plunged 40% since 2008, to 117% this year, which is the lowest level since 2002. Healthy household balance sheets and a high savings rate should be an upside risk to UK growth, however, for now, UK consumers are keeping their purse strings closed. UK household spending has risen at a significantly slower rate than in Europe or the US, and this caution is likely to persist until after the Budget. If Chancellor Rachel Reeves avoids rinsing working people and those with savings, then the economy could get a much-needed boost.

There is a lot of political uncertainty that could affect financial markets this week, however, there are some key economic and earnings announcements that we also need to be aware of.

1, UK jobs data: all eyes on wage growth

We could get a goldilocks labour market report for the UK, not too hot and not too cold, for September. Signs that the labour market is stabilizing will be welcome news after months of job losses. Analysts still expect 10k job losses for last month, however, in the 3-months to August, economists estimate that 128k jobs were created. This is lower than a year ago, but it could suggest that this year’s hike in employers’ national insurance is slowly starting to normalize and companies may start hiring once more.

The unemployment rate is also expected to remain steady at 4.7%, and weekly earnings are expected to slow to 4.7% in August, down from 4.8% in July, for the private sector wage growth could moderate to a 4.5% annualized rate down from 4.7%.

With US economic data delayed due to the government shutdown, UK economic data could get more focus than usual. The monthly GDP report is also worth watching. The August data is expected to show a tiny green shoot, which could be welcomed by the market. Analysts expect growth to rise by 0.1% on a monthly basis, and for the 3 month on month rate to rise to a 0.3%, up from 0.2% in July. Right now, the UK, and the government, will take any growth that they can get. Also, any upside surprise could ease concerns about next month’s budget, since it may, slightly, reduce the fiscal hole that needs to be filled on November 26th.

2, Eurozone CPI

The final reading of Eurozone CPI for September is expected to show that inflation rose to 2.2% YoY in September, the highest level since April. This data, if confirmed, could signal that the ECB’s rate-cutting cycle is over for good, which may boost the euro and could add to downward pressure on European stocks later this week. This week’s CPI report will also provide data about what is pushing up inflation in the currency bloc. Service prices remain elevated, so the focus could be on whether inflation could pick up even more, causing a very uncomfortable situation for the ECB.

3, US bank earnings

Goldman Sachs, JP Morgan, Citi, Wells Fargo and Blackrock all report earnings on Tuesday. We expect markets to be fully focused on trade tariffs on Monday, however, the focus could quickly shift, as the Q3 earnings season has been eagerly anticipated by traders. There is optimism that banks could report Q3 revenues that top $9bn for the first time in 3 years, as M&A and dealmaking revenue picks up pace. This will be a key theme for Q3. Markets made multiple record highs, which could keep trading revenues buoyant, however, after doing the heavy lifting for revenue generation in recent quarters, the focus could turn back to traditional investment banking and dealmaking activity, which has thrived under President Trump.

If the main US banks sound positive on the outlook for dealmaking, then this could assuage fears that the US economy is on the brink of a slowdown, especially after some recent soft labour market data.

The market will also want an update on loan loss provisions, if these are stable then it could calm lingering fears about the US economy. It is worth noting that markets remain jittery, and any sign of weakness or disappointment in bank earnings reports will be pounced on. It is not only banks that are at risk, options in the S&P 500 suggest that traders are preparing for large swings in either direction depending on the outcome of this earnings season. Thus, companies that beat expectations could be well rewarded, while companies that miss the target could get punished.

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.