Minutes from the FOMC meeting that took place in March has just been released. The publication did not trigger any major moves on the markets, however stock indexes attempt to erase some of the recent losses. During the last meeting, Fed raised the target for the fed funds rate by a quarter-point to 0.25%-0.5%, in line with market expectations. It wass the first increase in borrowing costs since 2018. Today markets were primarily focused on details regarding balance sheet reduction. The release showed Fed officials consider it would be appropriate to move the stance of monetary policy toward a neutral posture expeditiously and that a move to tighter policy could be warranted, depending on economic and financial developments. On the balance sheet reduction, officials agreed that monthly caps of about $60 billion for Treasury securities and $35 billion for MBS would likely be appropriate. The minutes also showed that many participants would have preferred a 50bps increase in the feds funds rate in March.

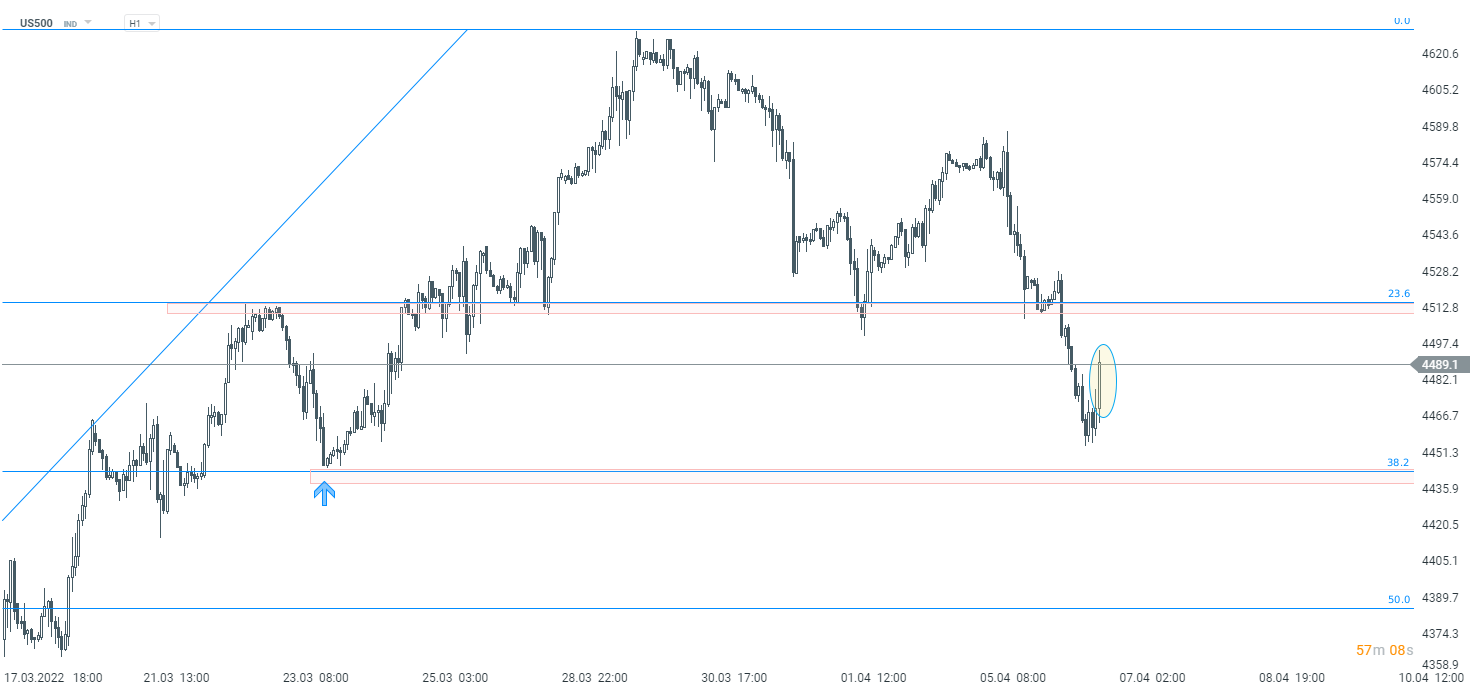

US500 rose slighlty following the release of FOMC minutes. Source: xStation5

US500 rose slighlty following the release of FOMC minutes. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.