At the start of a new week — and the first trading day of September — U.S. index futures remain calm, with moves limited to around ±0.05%. U.S. cash markets will stay closed today for the Labor Day holiday.

Investors are also weighing the impact of a recent U.S. Court of Appeals ruling on Trump-era tariffs. On Friday, the court voted 7–4 that most tariffs imposed by former President Donald Trump were not fully consistent with the law. Experts argue this could weaken the U.S. negotiating position in trade. The decision is suspended until October 14 to allow for further appeals. The case is expected to reach the Supreme Court, but for now, odds favor overturning the bulk of the tariffs while keeping only those targeted at specific sectors. That could potentially bring relief for many companies and improve economic growth prospects.

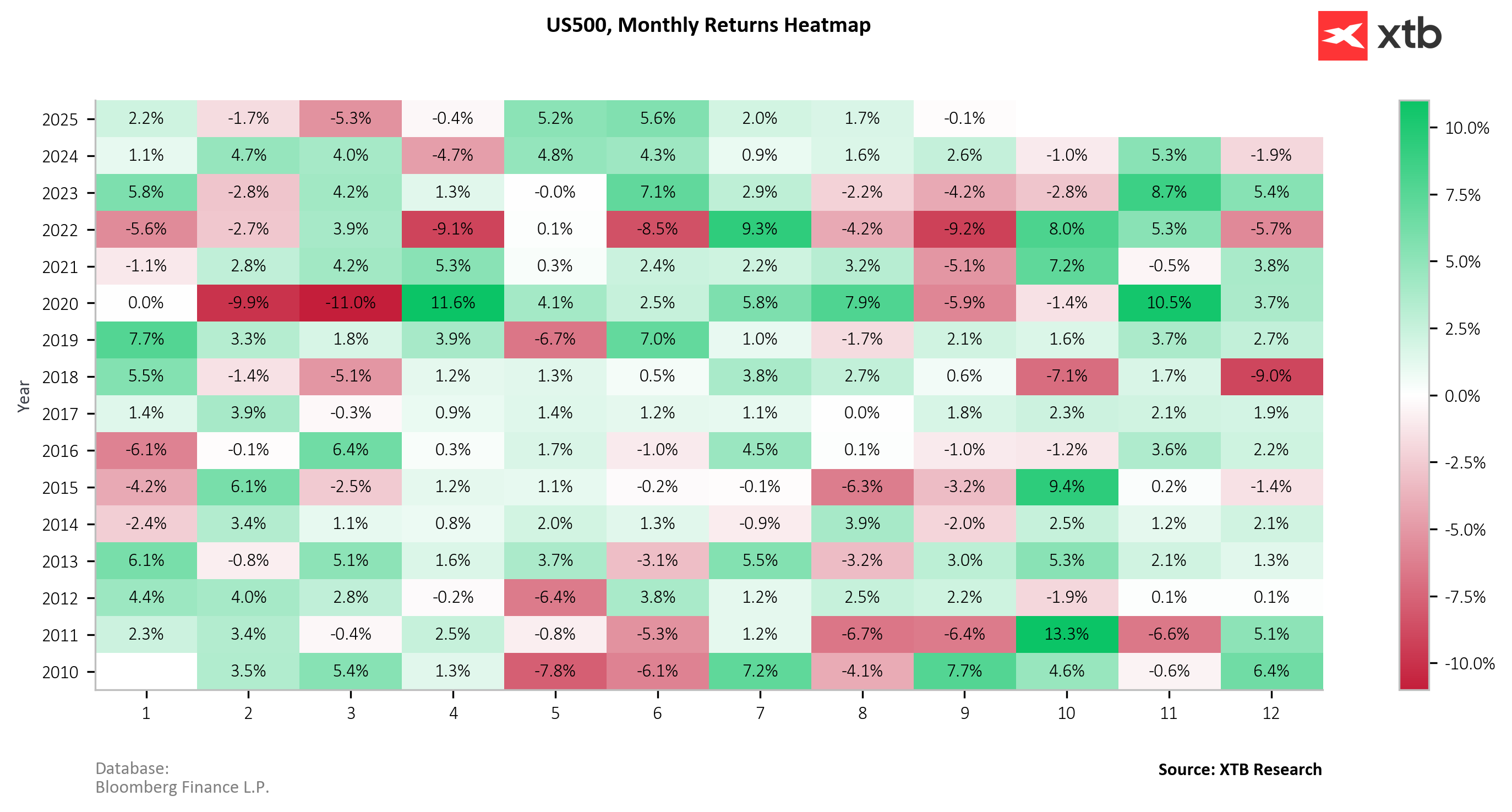

Seasonally, September is often the weakest month for U.S. equities, historically carrying the heaviest selling pressure of the year.

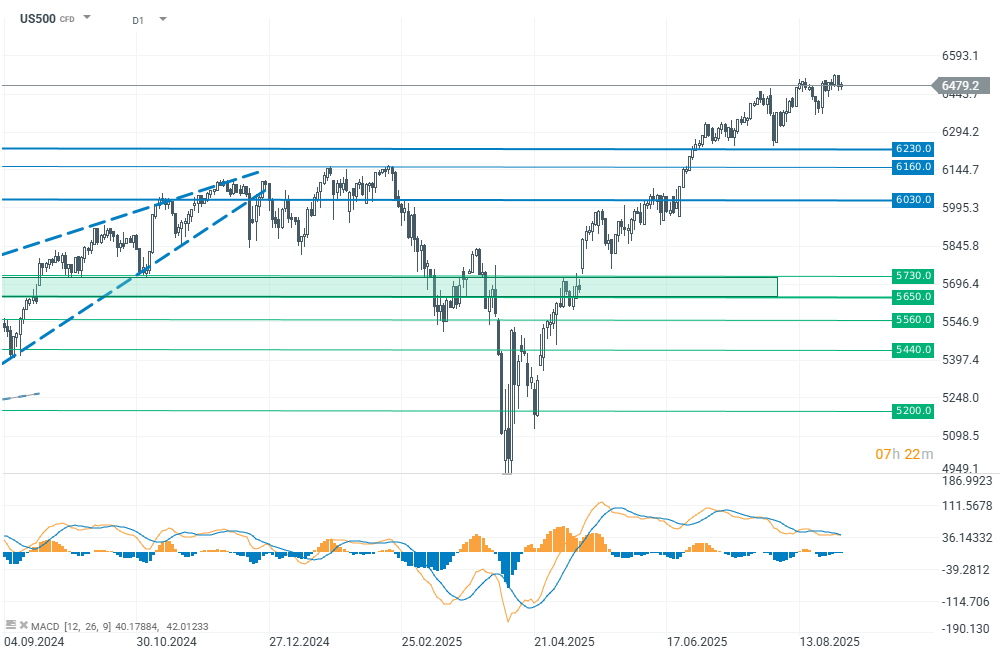

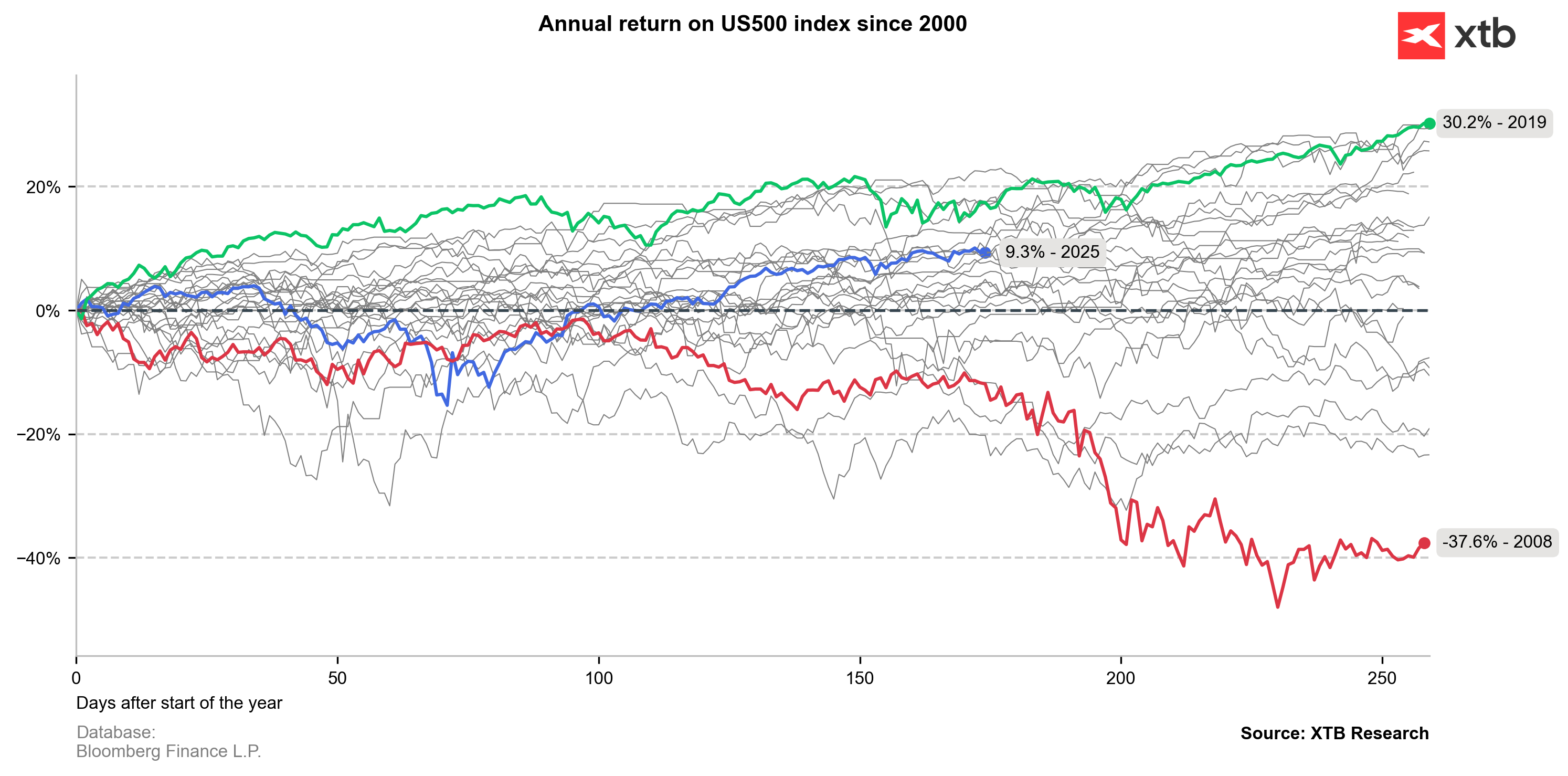

So far, however, the US500 has held up relatively well — gaining 9.3% year-to-date, on top of a strong 2024 performance.

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.