- The correction on Wall Street is prolonged, but not violent today. US100 and US500 are losing 0.3%

- Hewlett Packard Enterprises (HPE.US) shares lose 8% on news of Juniper acquisition

- Euphoria on Juniper (JNPR.US) and Accolade (ACDD.US), whose report beat analysts' forecasts

- 10-year bond yields stay above 4%, dollar index gains 0.1%

- PIMCO analysts expect stabilization in the bond market, after the recent rally

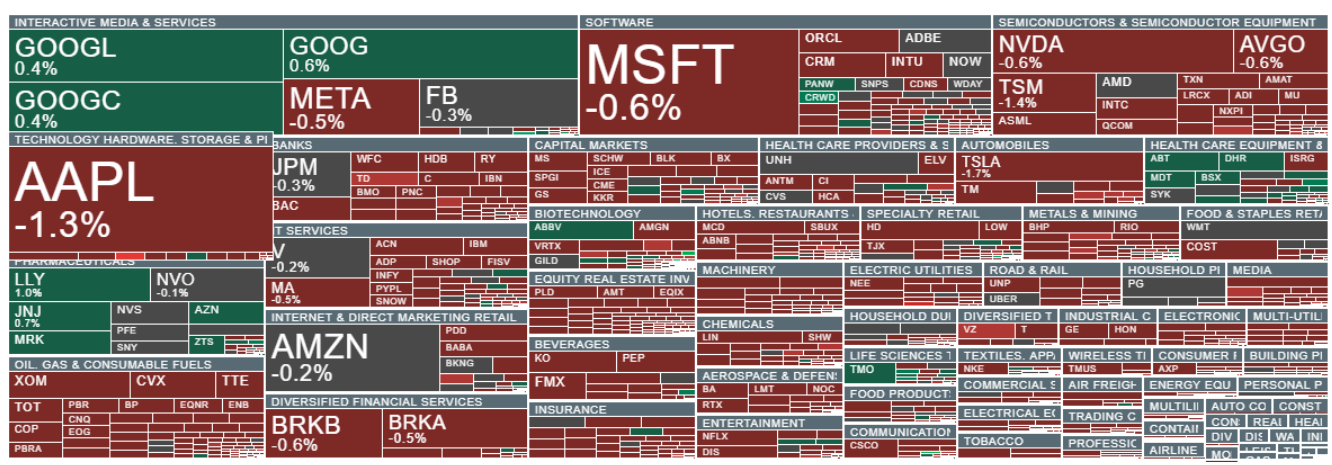

Today we see a further drop in sentiment on Wall Street, and PIMCO indicated that the fixed-income asset market could still give investors equity-level returns, with lower risk, if the strength of the economy continues at current levels. Such a scenario would imply a rather hawkish Fed position. Today, the World Bank confirmed that the global growth forecast for 2024 is unchanged from June 2023. Growth is still expected to be 0.5% higher than the June forecast due to the strength of the US economy. The bank forecasts U.S. economic growth of 1.6% in 2024, up 0.8% percent from June 2023, after stronger-than-expected growth of 2.5% in 2023. Major U.S. indexes are trading down 0.5% today, with market attention shifting to Hewlett Packard and Juniper Networks, which may soon be a single company.

The U.S. stock sector is seeing declines today. The gains are seen again in the medical/pharmaceutical sector, where sentiment for 2023 was very pessimistic. Gains are being made by Merck (MRK.US), Johnson&Johnson (JNJ.US) and Eli Lilly (LLY.US) Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appUS100 chart (H4)

Source: xStation5

News from companies

Juniper Networks (JNPR.US), whose biggest rivals in the industry are Arista (ANET.US) and Cisco (CSCO.US), is gaining more than 20% after WSJ reports that suggest the company has held advanced talks to sell its business to Hewlett Packard Enterprise (HPE.US). In response to the news, HP shares are trading down more than 8% after the market opened.

The correction on Hewlett Packard stopped at the SMA200 level (red line), near $16.2 per share. A drop below $16 could indicate a test of the 38.2 Fibonacci retracement, at $14 per share. Source: xStation5

- CrowdStrike (CRWD.US) shares are trading up 2% after Morgan Stanley, pointed to expected higher demand for the company's software services

- GoDaddy (GDDY.US) is trading up nearly 3% on comments from Piper Sandler, whose analysts raised the online platform company's business outlook, highlighting an acceleration of 30% EBITDA margin growth. They now expect a reversal of the 5-year trend of margin compression

- Match Group (MTCH.US) is trading at a euphoric 10% gain after reports from the Wall Street Journal that activist fund Elliott Investment has built positions worth about $1 billion on the stock, betting on further growth for the dating app provider

- MaxCyte (MXCT.US) rises 5% after releasing preliminary Q4 revenues that are higher than a year earlier.

- Microchip Technology (MCHP.US) erases an initially downward reaction to a report that the chipmaker reported Q4 2023 revenues down 22% y/y vs. earlier estimates of a 15 to max. 20% y/y

- Nvidia (NVDA.US) is down nearly 1% today from historic highs reached yesterday, despite further 'optimistic' signals from the AI industry. The CEO of Korean semiconductor maker SK Hynix expects the AI memory boom to double the company's value

Analyst recommendations

- CrowdStrike (CRWD.US) received a rating upgrade at Morgan Stanley due to an improved demand outlook

- Interactive Brokers (IBKR US) Interactive Brokers upgraded to "buy" at Goldman Sachs. Target price is now $102

- PayPal (PYPL.US) downgraded to 'balance' by Morgan Stanley. Report highlighted slower-than-expected business growth, stock loses 1.2% today

- Netflix (NFLX.US) loses after Citi analysts reduced the streaming company's rating to neutral, citing overly high market expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.