- Tech companies leading the gains

- Dollar index shows little change

- US bond yields decline

The end of the week on Wall Street brings an improvement in sentiment. Gains are especially noticeable in tech companies, with the US100 index gaining nearly 1.50% at the time of publication.

Key catalysts contributing to the improved market sentiment on Friday include positive quarterly earnings reports, notably from Tesla, and a tapering of recent hawkish speculation around a more restrictive Fed approach. Currently, the market appears to be cooling hawkish tendencies and gradually returning to normalization. Strong US economic data also supports sentiment. Orders for durable goods came in better than expected, and the final UoM report for October showed improved consumer sentiment and a drop in inflation expectations.

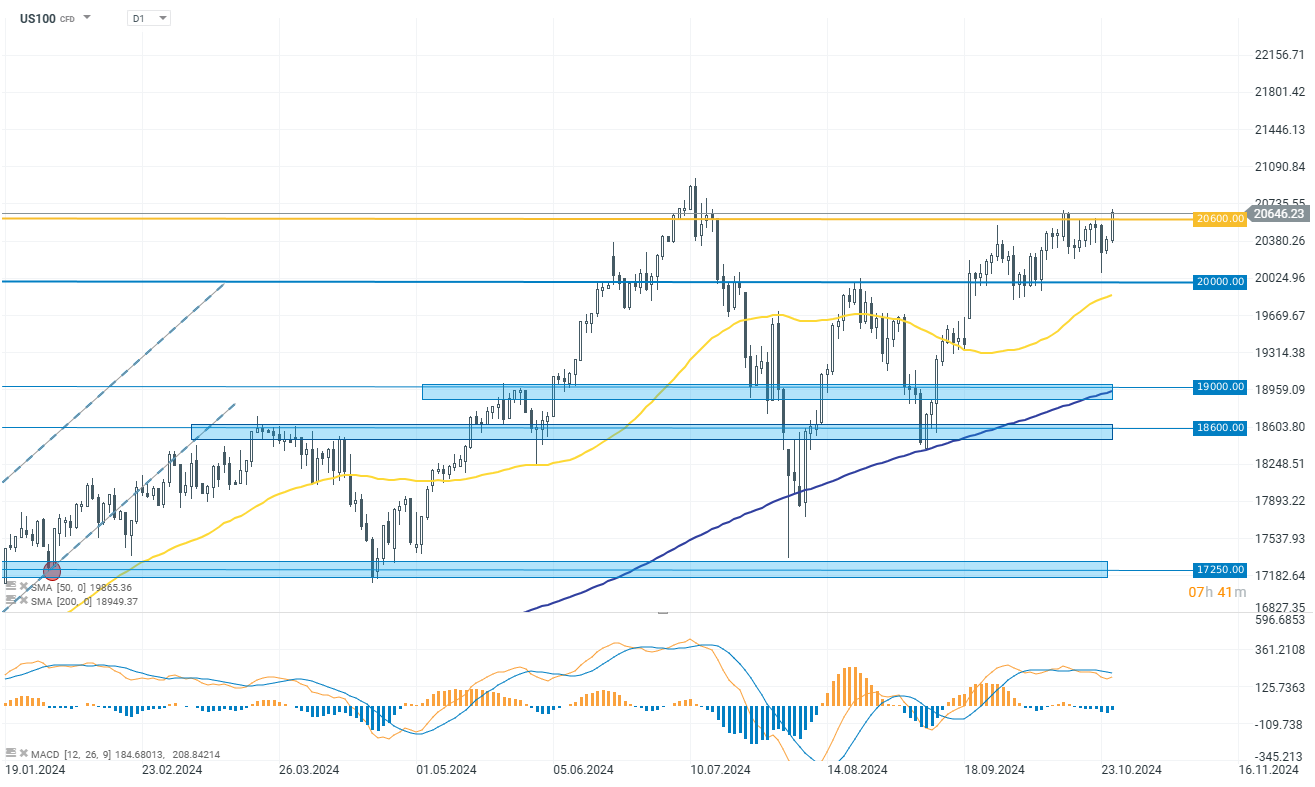

US100

The technology companies' index is decisively breaking through the barrier at 20,600 points. At the time of publication, the US100 is already up by 1.50%. Leading gainers include companies in the semiconductor and advanced technology sectors, such as AMD, Tesla, Intel, Lululemon, and ON Semiconductor. If gains are sustained, the next stop for bulls will be the historic ATH above 20,900 points and below 21,000 points.

Source: xStation 5

Company News

-

L3Harris Technologies (LHX.US) stock gains 4.50% following strong Q3 results and an upward revision to the lower end of its FY2024 guidance. Revenue is now expected between $21.1B and $21.3B, and adjusted EPS was raised to $12.95–$13.15.

-

Skechers (SKX.US) reduces all gains from the initial higher opening and now is losing 0.25%. The company reported Q3 results, with sales up 15.9% year-over-year (Y/Y). The wholesale segment led with a 20% increase to $241.4M, and direct-to-consumer (DTC) sales grew 9.6% to $81.3M. Q4 guidance forecasts $0.70–$0.75 EPS on $2.165B–$2.215B in sales, slightly below consensus. FY2024 outlook was raised to $4.20–$4.25 EPS and $8.925B–$8.975B in sales, surpassing expectations.

-

Western Digital (WDC.US) gains 7.80% despite posting mixed FQ1 results. The company reported a profit of $1.71 per share (a reversal from last year’s loss of $1.76), with revenue up 49% Y/Y. Cloud revenue, making up 54% of total sales, grew by 153% Y/Y and 17% quarter-over-quarter (Q/Q).

-

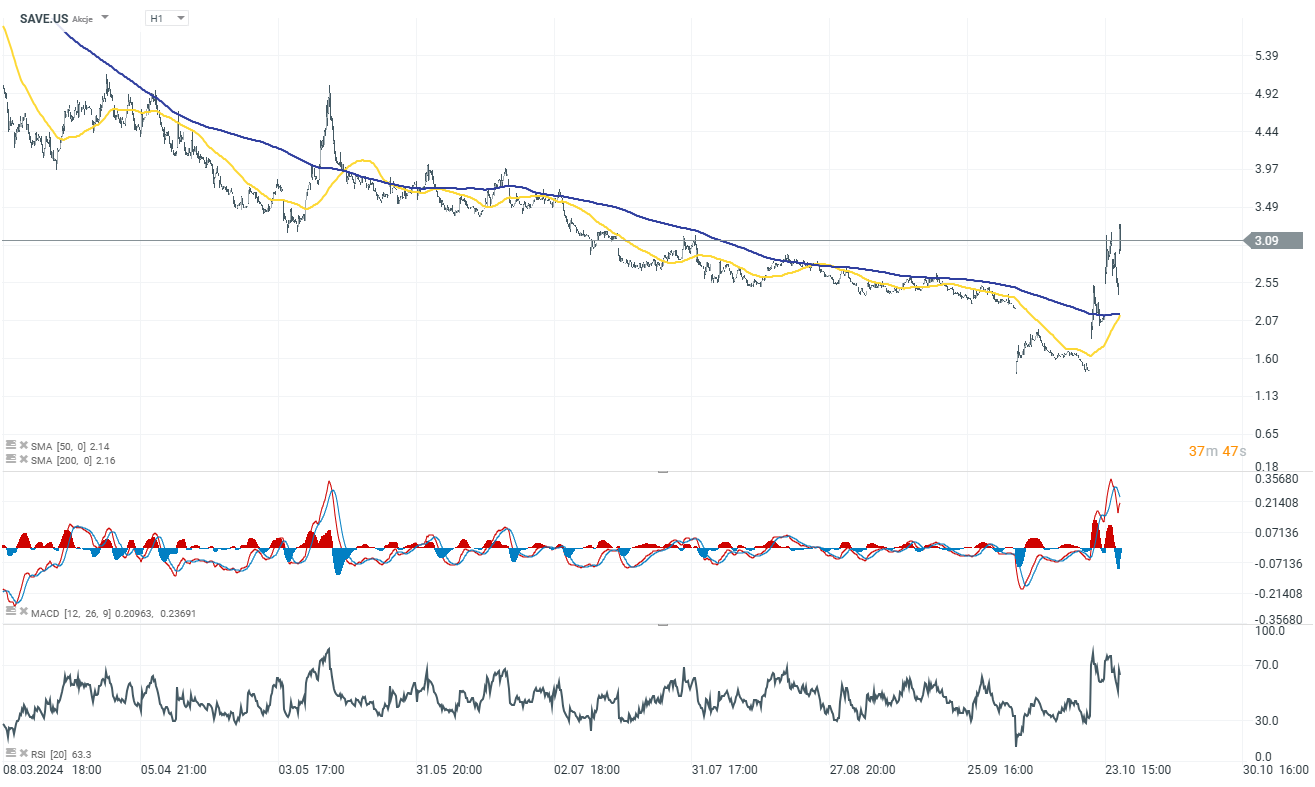

Spirit Airlines (SAVE.US) surged another 28% after announcing liquidity-boosting measures, including selling 23 Airbus planes to GA Telesis for about $519M, expected to improve liquidity by $225M by the end of 2025. Spirit also plans capacity reductions and job cuts, aiming to end the year with over $1 billion in liquidity.

-

Capri Holdings (CPRI.US) stock plunged 49% after a judge blocked its $8.5B merger with Tapestry (TPR.US) over antitrust concerns. Tapestry, whose shares rose 14.40%, plans to appeal.

-

HCA Healthcare (HCA.US) fell over 8% due to Q3 results missing expectations and lowering its full-year forecast to the lower end of prior ranges, citing hurricane impacts. HCA reaffirmed its 2024 guidance with EPS between $21.60–$22.80 and revenue of $69.75B–$71.75B, near the consensus estimate.

-

Dexcom (DXCM.US) dips 4.50% despite reporting a 2% Y/Y revenue increase; U.S. revenue dropped 2%. The company upheld its reduced full-year revenue guidance of $4.0B–$4.05B, aligning with the consensus estimate.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.