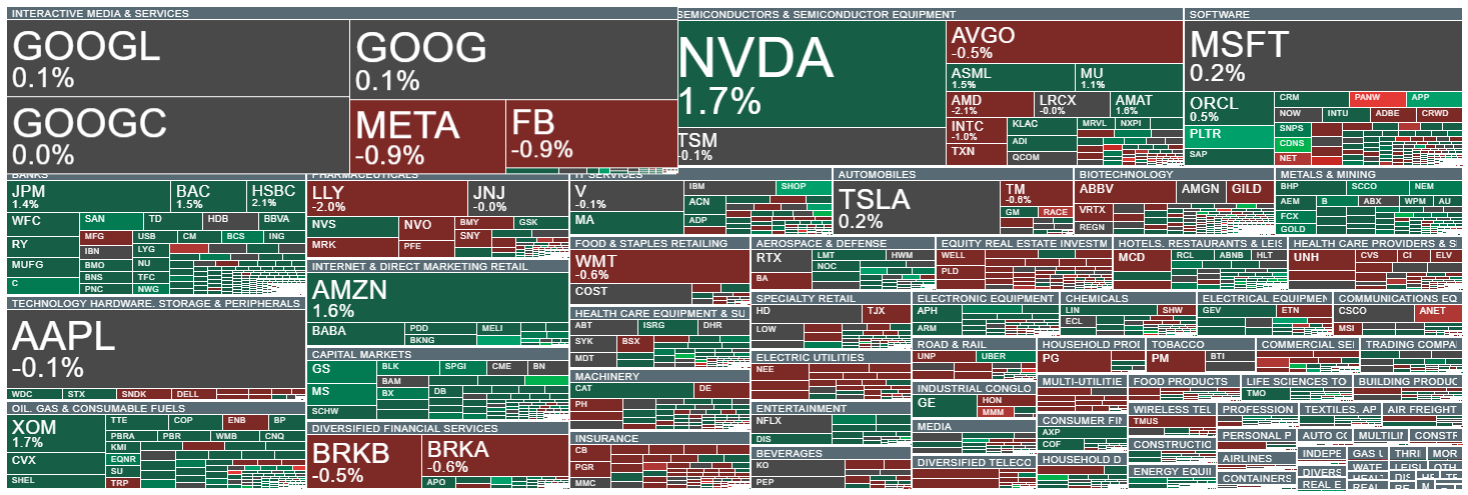

US index futures are higher after the cash open, pointing to a return of buying interest following the recent pullback. Sentiment is also supported by a constructive tone in equities outside the US. Nasdaq 100 futures are up more than 1%. The strongest risk-on signals are visible in financials, banks and the oil market, while within Big Tech the standout gainers are Nvidia and Amazon.

Source: xStation5

US100 has reacted twice to support at the 200-session exponential moving average (EMA200, red line) and is resuming its advance today. A move back above 25,500 points could indicate a more durable shift in sentiment toward a bullish bias.

Source: xStation5

Magnificent Seven - Nvidia clearly the strongest

-

Nvidia (NVDA.US): +1.7% – up after reports that Meta plans to deploy “millions” of Nvidia processors over the coming years, highlighting the accelerating scale of AI investment and strengthening ties between key players in the sector.

-

Amazon (AMZN.US): +1.6%

-

Microsoft (MSFT.US): +0.5%

-

Tesla (TSLA.US): +0.4%

-

Alphabet (GOOGL.US): +0.3%

-

Apple (AAPL.US): +0.2%

-

Meta Platforms (META.US): -0.5%

Top gainers

-

Global-e Online (GLBE.US): +24% – Q4 results beat expectations and guidance came in strong.

-

Rush Street (RSI.US): +20% – Q4 revenue and adjusted EBITDA topped consensus.

-

Mister Car Wash (MCW.US): +17% – Leonard Green & Partners to take the company private at $7 per share.

-

Wingstop (WING.US): +13% – solid results and US same-store sales growth above forecasts.

-

BioAge Labs (BIOA.US): +13% – upgraded to “buy”; investors are pricing in the potential of the company’s key therapy.

-

Verisk Analytics (VRSK.US): +11% – Q4 results exceeded expectations.

-

Madison Square Garden Sports (MSGS.US): +9% – the board approved a plan to evaluate a potential separation of the Knicks and Rangers businesses into two separately listed companies.

-

Moderna (MRNA.US): +8.1% – the FDA accepted for review an application related to a candidate seasonal flu vaccine.

-

Goosehead Insurance (GSHD.US): +7.8% – Q4 adjusted profit above consensus.

-

Constellium (CSTM.US): +6.8% – Q4 revenue up 28% YoY on strong demand in packaging and automotive.

-

Caesars Entertainment (CZR.US): +6% – better-than-expected “same-store” adjusted EBITDA.

-

Palantir (PLTR.US): +5% – upgraded following strong gains and improving margins.

-

Pitney Bowes (PBI.US): +5% – results beat forecasts and the 2026 outlook was strong.

-

Upwork (UPWK.US): +5% – announced a $300m share buyback program.

-

New York Times (NYT.US): +1.7% – shares rose after Berkshire Hathaway disclosed a position.

Top decliners

- Northern Dynasty Minerals (NAK.US): -34% – negative reaction after reports of US Department of Justice activity related to a federal case concerning the Pebble Project veto (Alaska).

-

SimilarWeb (SMWB.US): -21% – Q4 results missed expectations and guidance disappointed.

-

Axcelis Technologies (ACLS.US): -13% – weaker-than-expected Q1 guidance.

-

Palo Alto Networks (PANW.US): -7% – weaker guidance for Q3 and full-year adjusted profit.

-

MKS Instruments (MKSI.US): -6.7% – the market reacted negatively to results and the outlook.

-

ICL Group (ICL.US): -4.3% – Q4 profit and revenue below consensus.

-

Crocs (CROX.US): -1% – downgrade cited weakening domestic demand.

-

Workday (WDAY.US): -0.8% – downgraded to neutral.

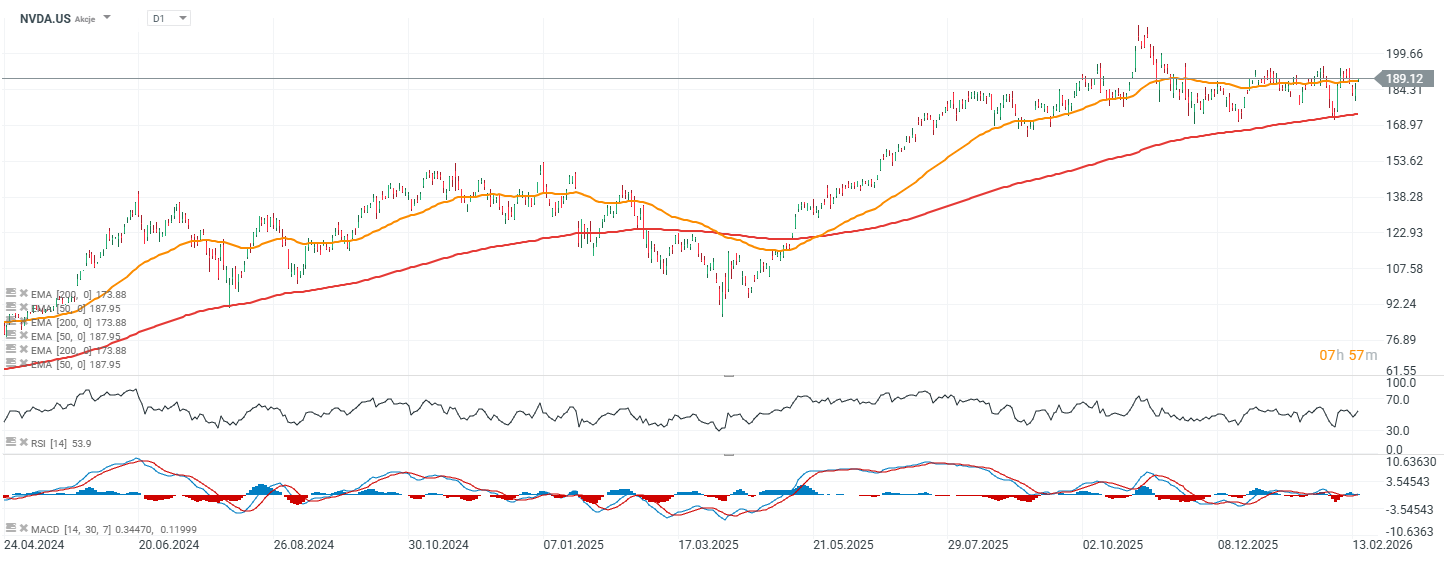

Nvidia shares are up nearly 2% and have moved above the 50-session exponential moving average (EMA50), which suggests a return of bullish momentum.

Source: xStation5

Palantir gains 5% amid Mizuho upgrade

-

Upgrade from Mizuho: The bank raised its rating to Outperform from Neutral and maintained a $195 price target. The rationale: following a valuation “reset,” the risk/reward profile appears more attractive, with analysts describing the company as being in a category of its own.

-

Valuation backdrop: Despite last year’s AI-driven rally, the stock is still down roughly 25% in 2026, a move the market largely attributes to multiple compression.

-

Demand signal: Mizuho points to growing interest in the US commercial segment for Palantir’s AIP platform, alongside easing concerns about further multiple contraction after the earlier pullback.

-

Headquarters relocation: Palantir announced it has moved its headquarters to Miami from Denver, without providing additional details.

-

What investors are watching: Whether premarket gains will hold after the open — signaling fresh buying interest — or whether the move is driven primarily by short covering.

-

Risks: The company remains priced as a high-growth name; a slowdown in commercial wins or weaker government demand could renew pressure on the stock.

Source: xStation5

Strong Quarter for Analog Devices and Record Outlook

WTI crude rises more than 3% 📈🔥

Palo Alto earnings: Is security cheap now?

Cocoa plunges 45% this year 🚩The sell-off accelerates

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.