- Wall Street opens higher at the start of a new week

- US bond yields are falling, and the dollar is showing no major changes

On the first day of the new week, US indices opened slightly higher after the US100 and US500 reached historical highs at the end of last week. Investors are waiting for the publication of leading indicators from the Conference Board. The dollar's rise has slowed, and today it is showing no major changes. The yields on US bonds are falling, approaching 4.08%.

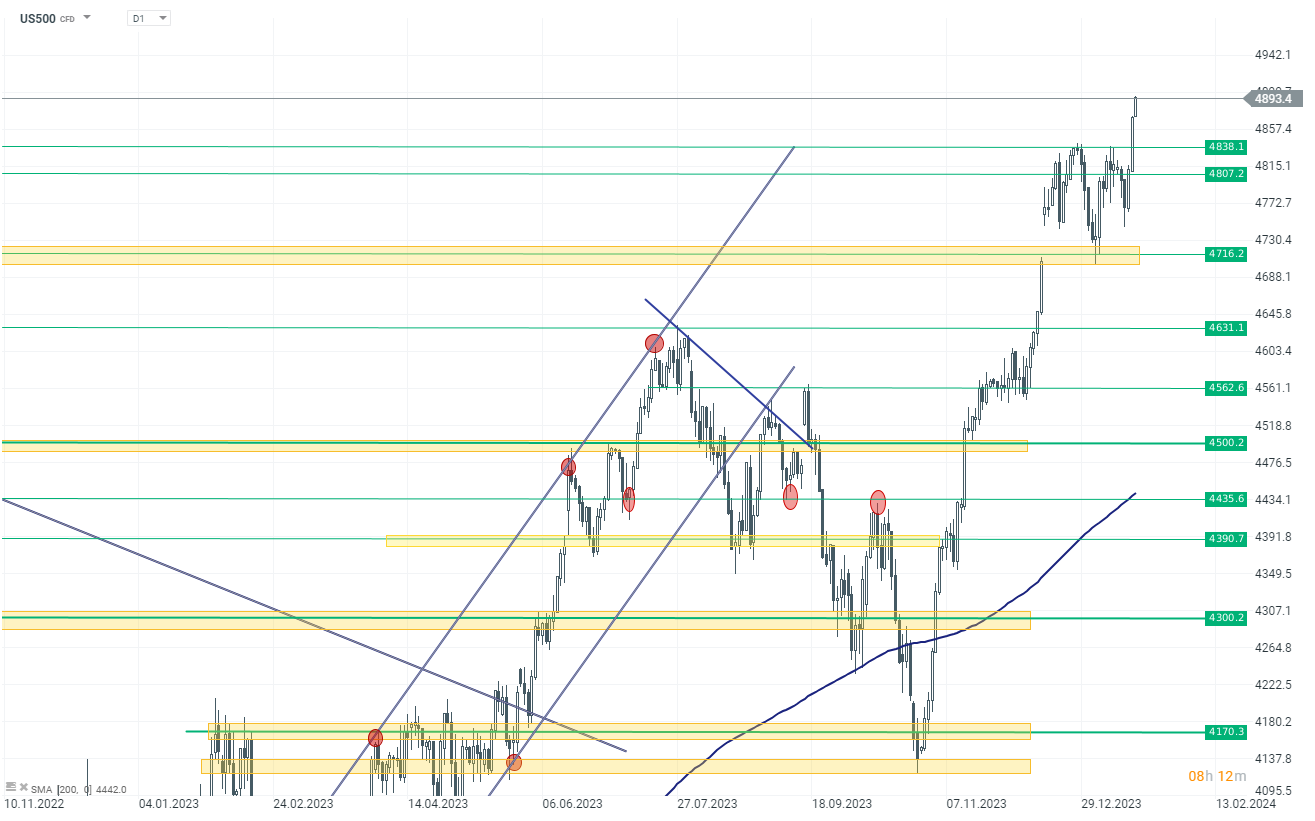

US500

Today, the US500 gained 0.45% after reaching new historical highs at the end of last week. Currently, the US500 is maintaining just below 4900 points. The first level worth observing in case of a correction is the upper level of the last consolidation, i.e., 4830-4840 points.

Source: xStation 5

Company News:

Macy's (M.US) stock gain over 4% before the market opened, following the rejection of a $21 per share takeover bid from Arkhouse Management and Brigade Capital Management. The department store chain's CEO, Jeff Gennette, deemed the offer "not actionable" and lacking in value for shareholders.

SolarEdge Technologies (SEDG.US) rose over 5% following the announcement of a16% reduction in its global workforce, affecting approximately 900 employees, including around 500 from its manufacturing sites. Despite these cuts, CEO Zvi Lando reaffirmed SolarEdge's confidence in the long-term growth of the solar energy market and its leading position in the smart energy sector.

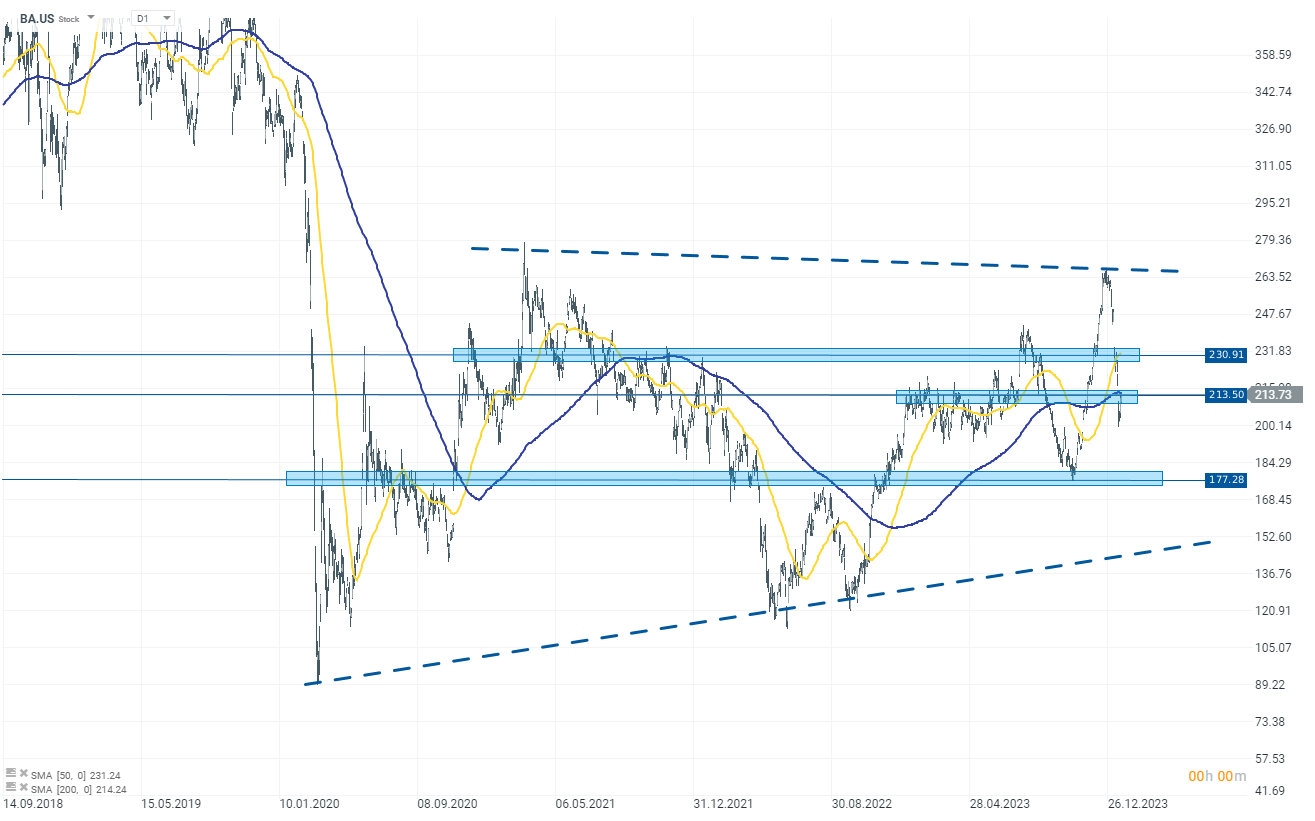

Boeing (BA.US) - the Federal Aviation Administration (FAA) has extended its scrutiny of Boeing (BA.US) by recommending inspections of the door plugs on the 737-900ER model, following similar issues found in the Max 9 used on Alaska Airlines Flight 1282. This comes after a door plug failure at 16,000 feet on a recent flight, leading to the grounding of 171 Max 9 jets. The FAA's recommendation aims to enhance safety, following reports of bolt issues in some 737-900ER planes. Boeing, facing a deep examination of its manufacturing quality, supports the FAA's call for more inspections. Major operators of the 900ER include United Airlines, Alaska Airlines, and Delta Air Lines, among others.

source: xStation 5

Gilead Sciences' (GILD.US) stock fell by 10% after their drug Trodelvy, used in treating metastatic non-small cell lung cancer, did not meet its primary goal of improving overall survival in a late-stage trial. Although Trodelvy is already approved for certain types of metastatic breast and urothelial cancers, it has yet to receive approval for use in metastatic non-small cell lung cancer. This setback in the trial marks a significant disappointment for Gilead Sciences.

Source: xStation 5

Source: xStation 5

Coherus BioSciences (CHRS.US) soared by over 12% following the announcement that Sandoz will acquire its biosimilar ranibizumab, CIMERLI, in a deal worth $170 million upfront, plus additional payments for product inventory. The acquisition is expected to be finalized in the first half of 2024, subject to standard conditions and approvals. Additionally, Coherus BioSciences recently reported promising results from a Phase 2 trial of its IL-27-targeting antibody, casdozokitug, as part of a liver cancer combination therapy.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.