- US stocks open slightly higher

- Verizon (VZ.US) stock rose premarket despite mixed quarterly results

- Bitcoin hits new all-time high

US launched today's session higher as solid earnings numbers overshadowed concerns over rising inflation due to soaring energy prices and supply chain disruptions. Earnings from both Verizon and Biogen beat analysts’ estimates and the companies raised their full-year outlook. Meanwhile, shares of Netflix were down more than 2% after forecasting current quarter earnings below estimates. Tesla and IBM will report their quarterly results after the closing bell. Bitcoin reached a new all-time high today as investors cheered the successful launch of the first US bitcoin futures exchange-traded fund.

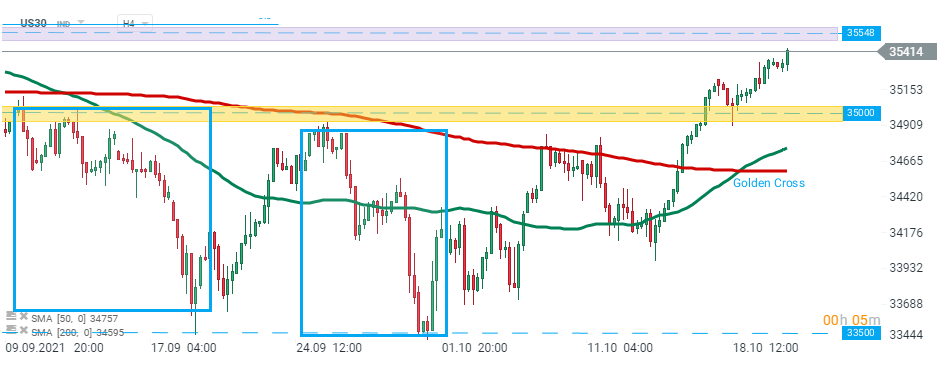

US30 launched today’s session sharply higher and is approaching its all-time high at 35548 pts. Also recently medium-term 50-day SMA (green line) crossed above the long-term 200-day SMA (red line). This has formed a bullish ‘golden cross’ which supports a bullish scenario. On the other hand, if sellers manage to halt declines, then another downward move towards aforementioned support may be launched. Source: xStation5

US30 launched today’s session sharply higher and is approaching its all-time high at 35548 pts. Also recently medium-term 50-day SMA (green line) crossed above the long-term 200-day SMA (red line). This has formed a bullish ‘golden cross’ which supports a bullish scenario. On the other hand, if sellers manage to halt declines, then another downward move towards aforementioned support may be launched. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Verizon (VZ.US) stock rose more than 1% in premarket despite mixed quarterly results. Company earned $1.41 per share, beating analysts' estimates of $1.36 per share, while revenue was slightly disappointing. Telecommunications company raised its full-year outlook, as growing 5G adoption has a positive impact on sales.

Verizon (VZ.US) stock launched today’s session with a bullish price gap and is currently trading above the earlier broken lower limit of the descending channel. If current sentiment prevails, upward move may accelerate towards the resistance zone around $54.75. Source: xStation5

Verizon (VZ.US) stock launched today’s session with a bullish price gap and is currently trading above the earlier broken lower limit of the descending channel. If current sentiment prevails, upward move may accelerate towards the resistance zone around $54.75. Source: xStation5

Novavax (NVAX.US) stock plunged over 26.0% in the premarket after Politico reported that the drug maker was unable to meet some of the Food and Drug Administration quality standards for its Covid-19 vaccine.

Anthem (ANTM.US) shares gained nearly 2% in premarket after the health insurer reported quarterly earnings of $6.79 per share, while analysts expected earnings of $6.37 per share. Revenue also beat market projections. Company increased its full-year guidance amid higher premiums for its Medicare and Medicaid businesses.

Biogen (BIIB.US) stock rose more than 2.0% before the opening bell after the company posted better than expected quarterly results. Biogen earned an adjusted $4.77 per share for the quarter, well above analysts’ estimates of $4.11 per share. The company is still optimistic about prospects for its Alzheimer’s drug Aduhelm, despite slower than expected adoption.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.