- US stocks opened higher

- US bond yields continue to move higher

- Bank of America (BAC.US) and Morgan Stanley (MS.US) posted solid quarterly earnings

US indices launched today’s session higher, attempting to erase recent losses supported by upbeat earnings from Morgan Stanley, UnitedHealth, Procter & Gamble and Bank of America. Today's upward move came despite the fact that government bond yields continue to move higher, with the 2-year note rising to 1.06% and the benchmark 10-year Treasury near 1.89%. On the data front, both housing starts and building permits beat forecasts, pointing to a tight housing market.

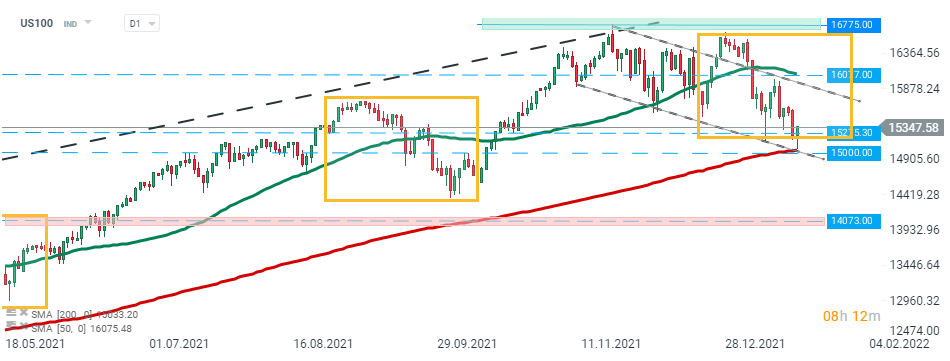

US100 fell sharply during yesterday's session, however downward move was halted around psychological support around 15000 pts which coincides with 200 SMA (red line) and lower limit of the descending channel. As long as the index stays above this level, further upward impulse may be launched. However if sellers manage to regain control, then support at 14073 may be at risk. Source: xStation5

US100 fell sharply during yesterday's session, however downward move was halted around psychological support around 15000 pts which coincides with 200 SMA (red line) and lower limit of the descending channel. As long as the index stays above this level, further upward impulse may be launched. However if sellers manage to regain control, then support at 14073 may be at risk. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Bank of America (BAC.US) stock jumped over 3.0% in the premarket after the company posted quarterly earnings of 82 cents per share, while analysts expected earnings of 76 cents. Revenue disappointed slightly, but the bank’s overall performance was helped by strength in investment banking.

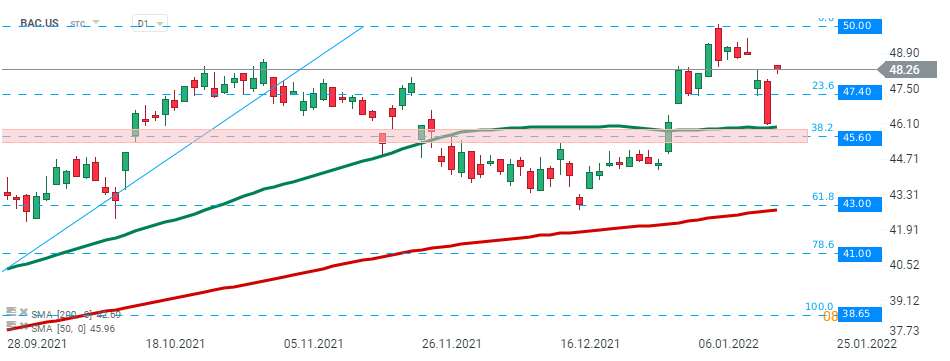

Bank of America (BAC.US) stock plunged yesterday, however sellers failed to break below support at $45.60 which coincides with 38.2% Fibonacci retracement of the last upward wave launched in September 2021 and 50 SMA ( green line). Stock launched today’s session with a bullish price gap and if current sentiment prevails then another upward move towards recent high at $50.00 could be launched. On the other hand, should break below the aforementioned support occur, the next target for sellers is located at $43.00 which coincides with 61.8% retracement. Source: xStation5

Bank of America (BAC.US) stock plunged yesterday, however sellers failed to break below support at $45.60 which coincides with 38.2% Fibonacci retracement of the last upward wave launched in September 2021 and 50 SMA ( green line). Stock launched today’s session with a bullish price gap and if current sentiment prevails then another upward move towards recent high at $50.00 could be launched. On the other hand, should break below the aforementioned support occur, the next target for sellers is located at $43.00 which coincides with 61.8% retracement. Source: xStation5

Morgan Stanley (MS.US) stock rose more than 3.0% before the opening bell, after the bank recorded quarterly profit of $2.01 per share, beating market consensus of $1.91. Revenue came in line with analysts' estimates as the bank capitalized on a boom in mergers and acquisitions and generated robust fees from advising on deals.

Procter & Gamble (PG.US) stock rose 1% in the premarket after the consumer giant posted solid quarterly figures and raised its organic growth outlook. P&G earned $1.66 per share, slightly above market expectations as consumers shrugged off price hikes for the company’s household staples.

UnitedHealth Group (UNH.US) reported quarterly earnings of $4.48 per share in Q4, beating market expectations by 17 cents. Health insurer’s revenue also topped forecasts partially thanks to good results of its Optum unit’s drug management business.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.