Summary:

-

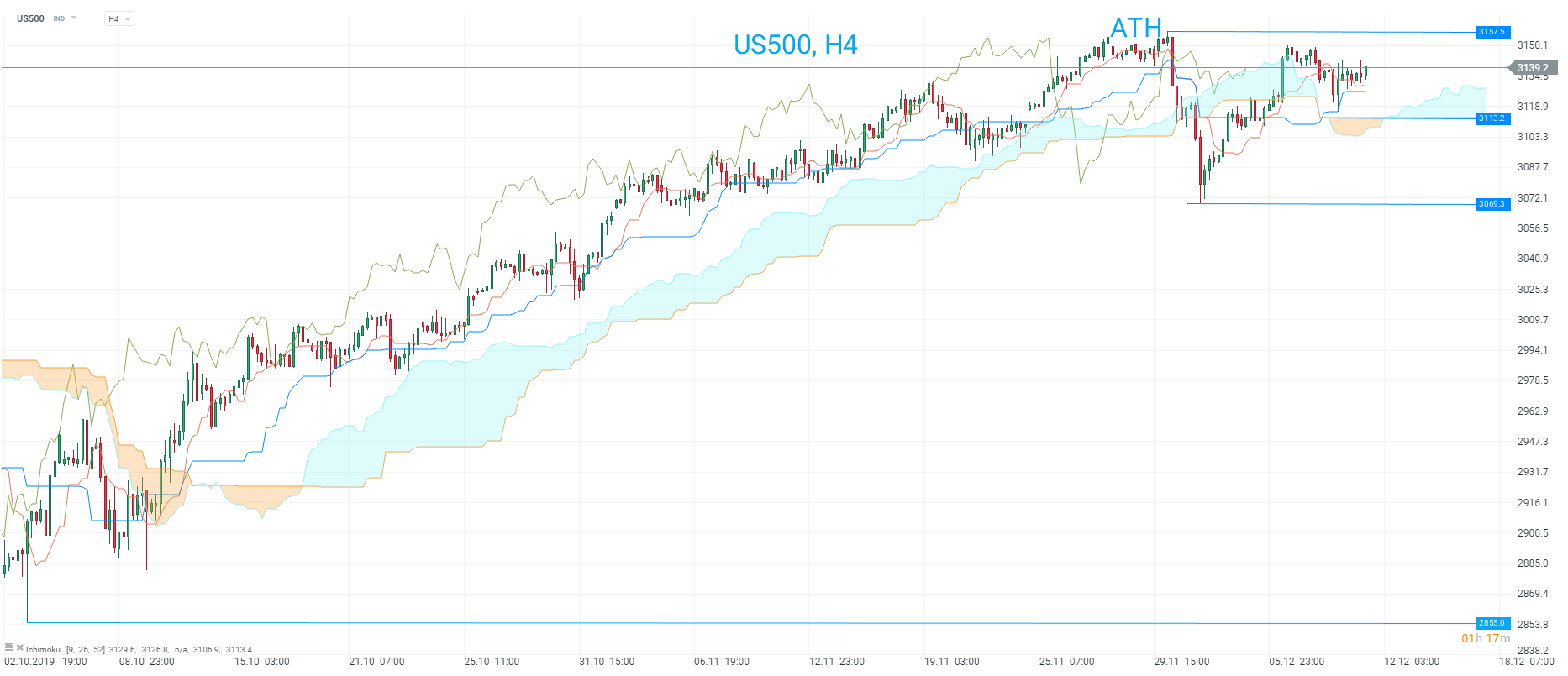

US indices remain not far from record highs

-

CPI data shows slight increase

-

FOMC meeting at 7PM (GMT) a major event risk

The cash session for US indices was a fairly subdued affair yesterday, with most the action coming before the opening bell. A sizable drop in the morning raised some hopes for the bears before a market-friendly trade article from the WSJ caused some swift buying pressure to send the futures back into the green before the cash benchmarks opened. After that there wasn’t much to report and while trade news continues to cross the news wires the US500 is trading pretty much where it was 24 hour ago.

The US500 continues to be well supported and trading just over 0.5% from its record peak of 3158. After dipping below the H4 cloud last week the market is now back above there and according to this as long as price is above 3113 then the uptrend remains in place. Source: xStation

The main scheduled event of the day by a distance for US markets is this evening FOMC rate decision (7PM GMT) but before there that has been some noteworthy data on inflation from November released:

-

CPI Y/Y: +2.1% vs +2.0% exp. +1.8% prior

-

CPI ex food and energy Y/Y: +2.3% vs +2.3% exp. +2.3% prior

The headline reading here has moved up more than expected and back above the 2% level once more. Given the year on year nature of this data, there could be further gains to come with the next couple of months seeing additional low readings from December 2018 and January 2019 roll out of the current year and into the base.

The CPI Y/Y has picked up sharply in the past month and could be set for further gains going forward due to base level effects. However, the Fed’s preferred inflation gauge, the PCE, remains below the bank’s 2% threshold. Source: XTB Macrobond

The CPI Y/Y has picked up sharply in the past month and could be set for further gains going forward due to base level effects. However, the Fed’s preferred inflation gauge, the PCE, remains below the bank’s 2% threshold. Source: XTB Macrobond

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.