Shares of the largest U.S. technology companies are supporting gains in Nasdaq 100 (US100) futures ahead of tomorrow’s key risk events: the Fed decision (6 PM GMT, with Powell’s press conference at 6:30 PM GMT) and after-hours earnings from Meta Platforms (META.US) and Microsoft (MSFT.US). Both companies will report Q4 2025 results after the U.S. close and will likely shape expectations into what is effectively the “peak” of the current U.S. earnings season. Broader U.S. equity sentiment is also being helped by a sharply weaker dollar today.

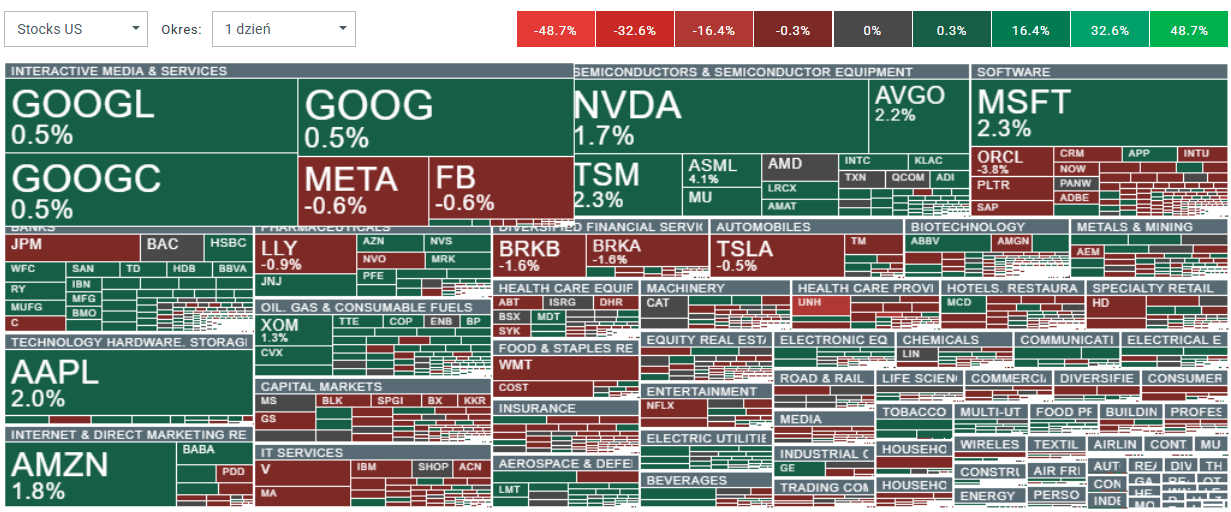

- Big Tech is clearly outperforming the wider market. Nvidia, Apple, Amazon, and Microsoft are up close to 2%, while additional momentum is coming from semiconductors. Shares of Taiwan Semiconductor and ASML are rising even more than the flagship U.S. tech names, giving the index a meaningful tailwind.

- Strength in mega-cap chip stocks is more than offsetting visible weakness in software, where Oracle is down nearly 4%. The outperformance of large-cap leaders may also reflect a degree of portfolio rebalancing, after the “Mag 7” names were among the weakest parts of major U.S. indices for months.

- Looking at the S&P 500 companies earnings season so far (FactSet data as of January 23, with 13% of S&P 500 reported), 75% have beaten net profit expectations and around 70% have topped revenue estimates. Current year-over-year EPS growth for the S&P 500 is running near 8%, but after Big Tech reports that figure will likely rise materially, potentially toward roughly 15% YoY.

- This quarter marks the 10th consecutive quarter of year-over-year EPS growth for the index. The S&P 500 is currently valued at around 22x earnings, roughly 10% above its 5-year average and close to 15% above its 10-year average near 19.

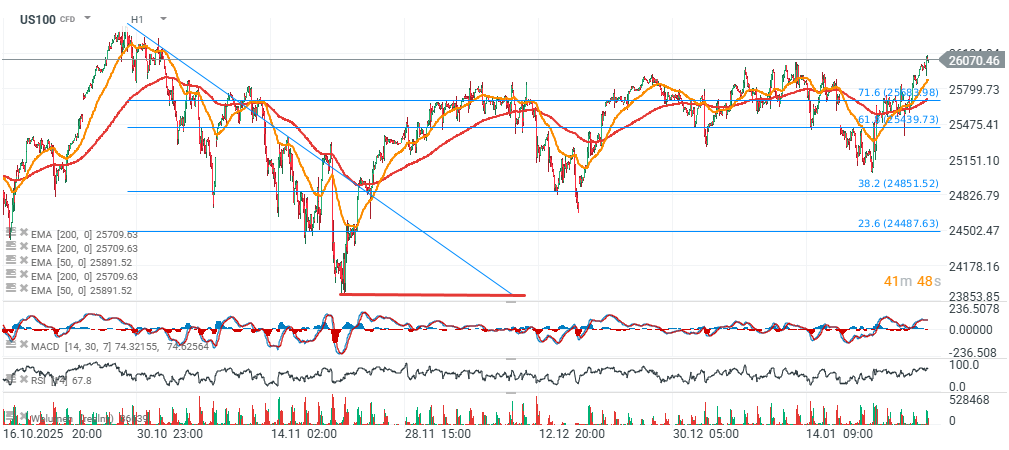

US100 (H1 timeframe)

Source: xStation5

Sentiment across the broader equity market is generally mixed today, but BigTech supports Nasdaq 100 momentum. Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

Middle East conflict ramps up a gear as energy price spike rips through markets

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.