Investors have reacted with palpable relief to a pivot in rhetoric from Donald Trump, who signalled a move away from military posturing regarding the acquisition of Greenland. Speaking at the World Economic Forum in Davos, the President adopted a uncharacteristically measured tone, notably omitting any mention of retaliatory tariffs against nations that recently deployed armed forces to the territory.

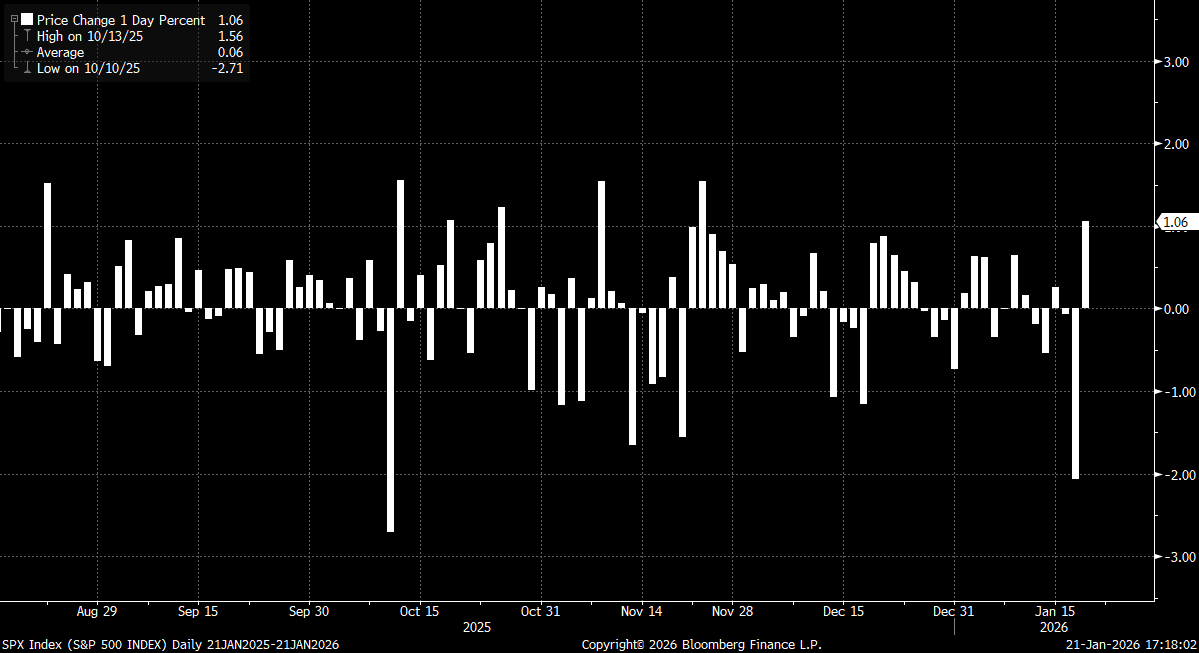

The US500 contract, tracking the S&P 500, gained approximately 1% in early trading. While the move initially mirrored the rally seen on December 19, the momentum quickly accelerated, marking the index's strongest daily performance since November. Market observers have noted that the current price action bears a striking resemblance to the October "V-shaped" recovery; following a sharp 2% pullback, the index established a local bottom before embarking on a sustained march toward fresh record highs.

S&P 500 daily changes. Source: Bloomberg Finance LP

Wall Street commentators suggest that the decision to de-escalate the Greenland standoff—coupled with the President’s silence on proposed credit card interest rate caps—points toward a "quiet retreat" from some of his more contentious policy proposals.

On a technical basis, the US500 is currently testing the 6,900 handle. A decisive break above the 23.6% Fibonacci retracement of the most recent major impulsive wave would bolster the case for a resumption of the primary bullish trend, keeping the current decline within the bounds of a standard correction.

However, the spectre of protectionism remains. The tariff saga is far from resolved, particularly as markets await a definitive ruling from the Supreme Court on the President’s use of executive powers to bypass Congress on trade levies. While the Court issued three unrelated rulings on Tuesday, its continued silence on the tariff mandate maintains a floor of underlying uncertainty for global investors.

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

Middle East conflict ramps up a gear as energy price spike rips through markets

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.