Futures linked to major Wall Street indices bounced off daily lows , while dollar erased some of the early gains following publication of FED's Chair Powel prepared remarks for Sweden's Riksbank symposium on central bank independence, organized by Riksbank.

Remarks showed that Powell will not discuss the state of the US economy or the prognosis for monetary policy, therefore markets attention will turns on Thursday's CPI inflation reading.

Below are key takeaways from Powell remarks:

-

Without congressional laws, it is inappropriate for us to use our monetary or supervisory tools to promote a greener economy.

-

The Fed must resist temptation to broaden its scope to address other important social issues.

-

The Fed has narrow responsibilities regarding climate-related financial risks.

As for inflation, the market expects a reading of 6.5%, while in November it was 7.1%YoY. Can inflation surprise with a lower reading? Here attention may focus not only on energy prices (in December fuel prices were lower than in December 2021), but also on food, which maintains a significant contribution to inflation (approx. 1.5-1.6 percentage points in recent months) . If the contribution of food inflation drops significantly, then this will be a sign of potential deeper declines in the coming months.

The latest contribution of energy prices is 1.0 pp, while food prices are 1.5 pp. Source: Bloomberg

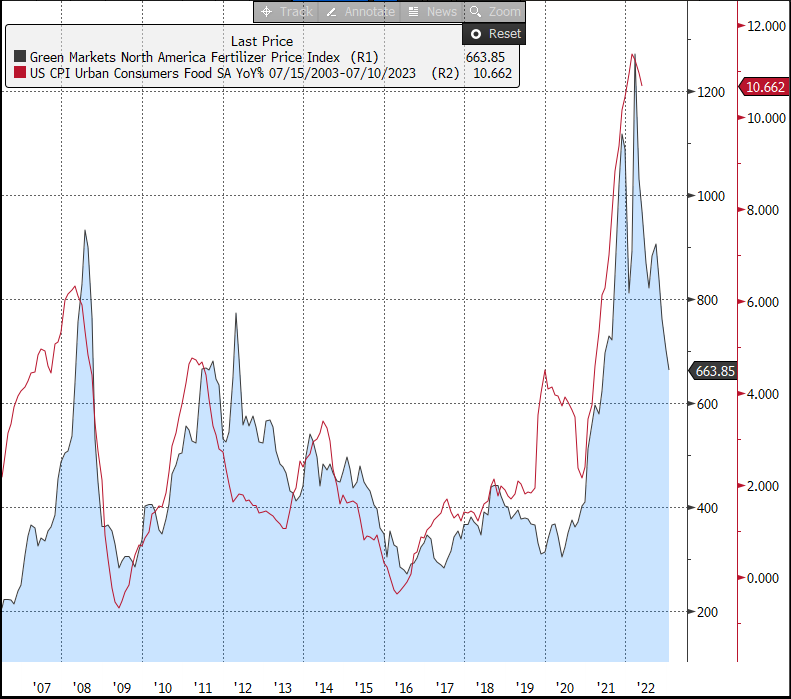

Food inflation is still over 10% y/y! However, the prices of fertilizers, which affect the prices of agricultural commodities and, of course, food, suggest that food inflation is coming to a halt. Source: Bloomberg

Food inflation is still over 10% y/y! However, the prices of fertilizers, which affect the prices of agricultural commodities and, of course, food, suggest that food inflation is coming to a halt. Source: Bloomberg US500 again approaches major resistance at 3900 pts. Source: xStation5

US500 again approaches major resistance at 3900 pts. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.