September's central bank marathon is almost over - traders have already heard from the Federal Reserve, Bank of England, Norges Bank, Riksbank, CBRT and SNB this week. However, there is one more major central bank left to announce its policy decision this week - Bank of Japan. BoJ will announce its rate decision during the upcoming Asian session. Timing of the announcement is tentative but usually it comes around 3:00 am BST.

What does the market expect?

No change in the level of interest rates in Japan was taken as given for years. There were good reasons for it - inflation in the Japanese economy has constantly undershoot BoJ's target and periods of deflation were not uncommon. However, post-pandemic and war-related acceleration in price growth pushed inflation above target and BoJ has already made some hawkish moves, like widening tolerance band around 10-year target yield. On top of that, new BoJ governor Ueda said earlier this month that there is a non-zero chance that the wage-inflation cycle will be confirmed by the end of this year, what would pave the way for rate increases.

Nevertheless, rate hikes are not expected until the turn of the year. None of the economists polled by Bloomberg expects a decision other than a hold tomorrow. Market sees less than a 10% chance of a rate hike tomorrow and a less than 20% chance of a hike at the October meeting. However, market pricing for a December rate hike is approaching 80%!

Money market pricing does not point to a rate hike at the coming or the next meeting but a 10 basis point hike is fully priced in for the turn of 2023 and 2024. Source: Bloomberg Finance LP

Japan CPI has climbed above the BoJ target amid post-pandemic surge but more persistent wage growth acceleration is yet to materialize. Source: Macrobond, XTB Research

Japan CPI has climbed above the BoJ target amid post-pandemic surge but more persistent wage growth acceleration is yet to materialize. Source: Macrobond, XTB Research

What's next for USDJPY?

Change to the level of interest rates looks highly unlikely and so does any change to the yield curve control mechanism, given that it was altered at the latest BoJ meeting in July. However, the message accompanying the decision will be crucial. If Ueda doubles down on his remarks about the possibility of a wage-inflation cycle materializing soon, could see JPY gain and hawkish BoJ bets in money markets increase further. On the other hand, failure to build upon those remarks may hint that they were made with a sole purpose of supporting yen and it could lead to JPY weakening.

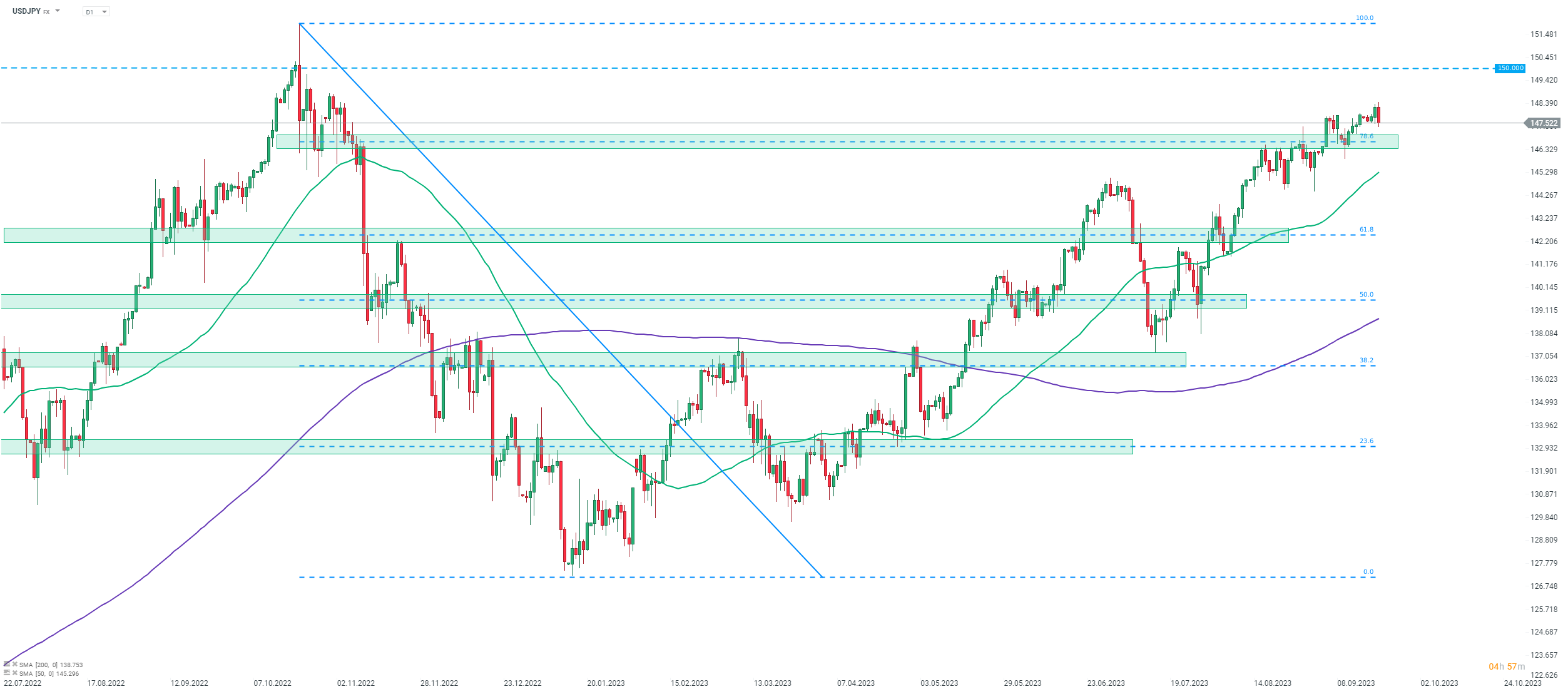

Taking a look at USDJPY chart at D1 interval, we can see that the pair has recovered more than 80% of the downward move launched in October 2022. It should be noted that back then a reversal on USDJPY market was triggered by Japanese intervention and given that the pair is once again approaching 150.00 area, a direct action rather than just verbal intervention becomes more and more likely. JPY weakness is a headache for BoJ and Japanese authorities therefore it cannot be ruled out that Ueda will strike a hawkish note tomorrow to provide some support for JPY.

Source: xStation5

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.