Consulting firm Accenture (ACN.US) reported preliminary results for the current quarter and forecasts for the rest of the year that fell short of expectations from Wall Street. The company fears that growing economic uncertainty will keep IT budgets under pressure and prevent many companies from signing new and extending existing contracts. Undoubtedly, the main threat to the company is the prospect of a recession, with shares trading nearly 5% lower before Wall Street opened.

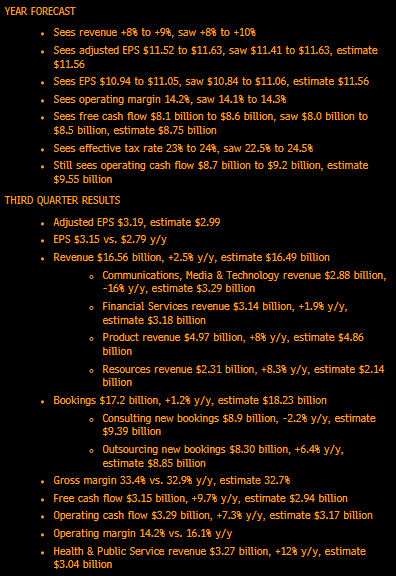

- Revenues turned out to be about $120 million higher at $16.6 billion vs. $16.49 billion forecasts

- Earnings per share (EPS) in the current quarter were $3.15, $0.18 higher than forecasts of $2.99 and $2.79 in Q2 2023

The company in 2023 expects earnings per share in the range of $10.94 to $11.05 versus analysts' $11.56 forecasts, and estimated lower full-year revenue in the range of $15.75 to $16.3 billion versus the market's average expectation of $16.3 billion. It also lowered its forecast for full-year operating cash flow, which is expected to fall between $300 million and $805 million. Accenture reported higher-than-expected free cash flow in the current quarter but the market ignored this, focusing on the weaker forecast. It is worth noting that even in the current fairly strong quarter, operating margins showed a y/y decline (14.2% vs. 16.1% in Q2 2023). Orders from the public and healthcare sectors surprised positively (more than 12% y/y growth).

Accenture results and forecasts in numbers. Significantly lower bookings - Wall Street expected almost 7% higher results, weakness in consulting bookings where we see almost -2.2% y/y decline. Source: Bloomberg

- Accenture's statement shows that demand for IT services in the United States is quite weak and could deteriorate further, even more so if the interest rate hike cycle continues.

- Over the past 90 days, three times as many analysts have lowered than raised forecasts for Accenture's full-year earnings per share so the news is not a huge surprise to Wall Street as a whole;

- Accenture in March indicated that it intends to lay off 19,000 employees. In 2021 and 2022, the company would dynamically increase its headcount by 16 and 23% y/y, respectively. In doing so, the company would save $1.5 billion by fiscal 2024.

- The company reported increased investment in AI, which it has been developing for nearly 10 years. Accenture's AI platforms (SynOps, myWizard or myNav) help the businesses of the company's partners. According to CEO, Julie Sweet, the company currently has 26 clients with total bookings of $100 million, and this year Accenture will generate positive cash flow with still high margins.

Accenture shares (ACN.US), W1 interval. In the event of a deep correction scenario, a test of $240 per share, where we see the 61.8 Fibonacci retracement and key previous price reactions that could trigger support, seems to be not out of the question. Today's opening indicates a drop to the area of $297 by which bears may want to test the nearest lower support from the Fibonacci abolition. A strong level is also 71.6 Fibo at 217 USD, where we see pre-pandemic highs from 2019 and local lows from the fall of 2020. The key level to overcome after the opening may be $300 - a close above this zone may indicate still considerable bullish activity. Source: xStation5

Accenture shares (ACN.US), W1 interval. In the event of a deep correction scenario, a test of $240 per share, where we see the 61.8 Fibonacci retracement and key previous price reactions that could trigger support, seems to be not out of the question. Today's opening indicates a drop to the area of $297 by which bears may want to test the nearest lower support from the Fibonacci abolition. A strong level is also 71.6 Fibo at 217 USD, where we see pre-pandemic highs from 2019 and local lows from the fall of 2020. The key level to overcome after the opening may be $300 - a close above this zone may indicate still considerable bullish activity. Source: xStation5

New front in the trade war: Greenland❄️Will Gold rise further❓

Micron and the Unprecedented Memory Shortage. What It Means for the Market? 🚨

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?