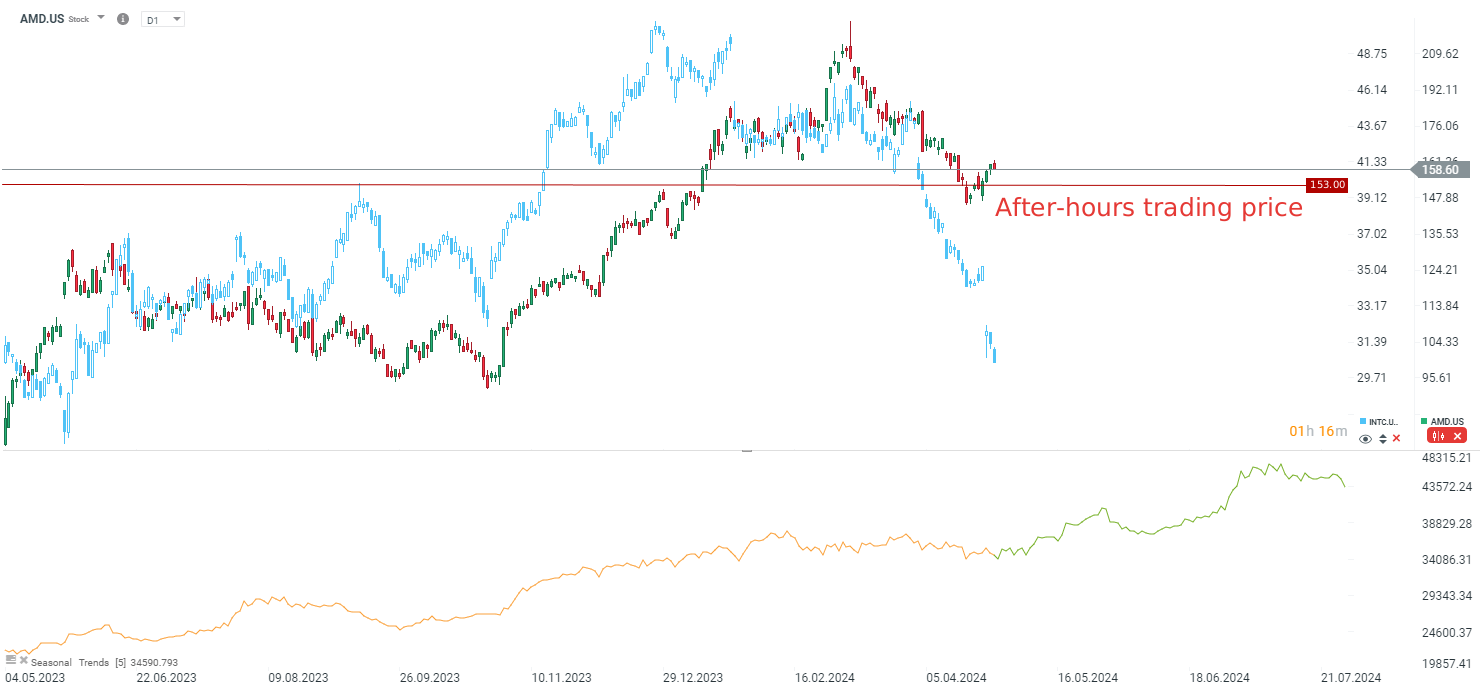

AMD announced results for the first quarter of 2024, which were mostly in line with analyst expectations. The company's revenue was $5.47 billion, up 36% from last year. Earnings per share (EPS) were $0.62, beating expectations of $0.61. On the other hand, the company presents rather mixed guidance. Results in line with expectations and rather weak guidance show that the company is not able to grow like Nvidia at the moment, which may suggest that despite a strong correction, the company's stock declines may not be over yet. AMD loses approximately 3.6% in after-market quotations. Moreover, SMC shows weaker results (mainly in terms of revenues and guidelines), which also worsens the mood in the chip sector.

Key Points:

- AMD reported Q1 2024 revenue of $5.47 billion, up 36% YoY, meeting analyst expectations.

- EPS of $0.62 beat expectations of $0.61.

- Data Center segment revenue grew 80% YoY to $2.3 billion, driven by strong demand for MI300 AI accelerators and Ryzen and EPYC processors.

- Client segment revenue grew 85% YoY to $1.4 billion but declined 6% sequentially.

- Gaming and Embedded segment revenues declined 48% and 46% YoY, respectively.

- Q2 revenue guidance of $5.4-$6.0 billion below analyst expectations.

- AMD continues to invest heavily in R&D, spending $1.53 billion in Q1.

- The company expects data center demand to remain strong as AI adoption grows.

- AMD faces stiff competition from Intel and Nvidia in data centers, PCs, gaming, and embedded systems.

- The stock is down about 3.6% in after-hours trading, following Intel's downward trend.

Quantum Computing after Earnings: Quantum Breakthough?

Alibaba sell-off extends amid White House national security concerns📌

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈