American Express (AXP.US) stock jumped 8% during today's session after the credit card service company posted upbeat quarterly results and record card spending. American earned $2.18 per share, well above analysts’ projections of $1.87 on revenue of $12.15 billion, up from $9.35 billion last year. In the U.S., average basic card member spending rose by 27% to $6,351 from $4,983 last year. Customers spent $368.1 billion on their cards in the quarter, compared with $285.9 billion spent on cards in 2020.The company is seeing particular traction with younger spenders. Looking at the U.S., the company saw fourth-quarter millennial and Gen-Z spending levels climb 50% above where they were in the fourth quarter of 2019, Chief Financial Officer Jeff Campbell told MarketWatch.

Similar to its competitors, American Express recorded higher expenses this quarter. Total expenses increased 29%, as the company paid out additional rewards to its customers but also because of higher compensation expenses for its employees. Company’s management team expects that the pandemic will subside and the return to travel will have a positive effect on revenues in a range of 18% to 20%. The company also expects full-year earnings this year between $9.25 and $9.65 a share.

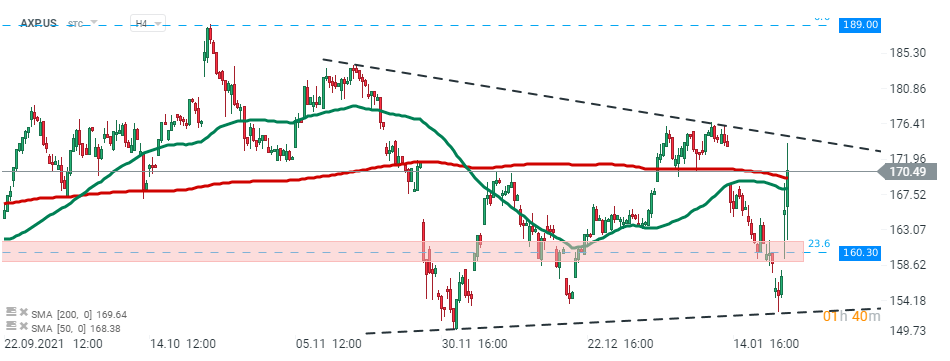

American Express (AXP.US) stock rose sharply during today's session, however it struggled to break above the upper limit of the wedge formation. In case buyers manage to push the price higher, then the next target lies at $189.00 where the all-time high is located. However if sellers manage to regain control, then nearest support is located at $160.30 and coincides with 23.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

American Express (AXP.US) stock rose sharply during today's session, however it struggled to break above the upper limit of the wedge formation. In case buyers manage to push the price higher, then the next target lies at $189.00 where the all-time high is located. However if sellers manage to regain control, then nearest support is located at $160.30 and coincides with 23.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street