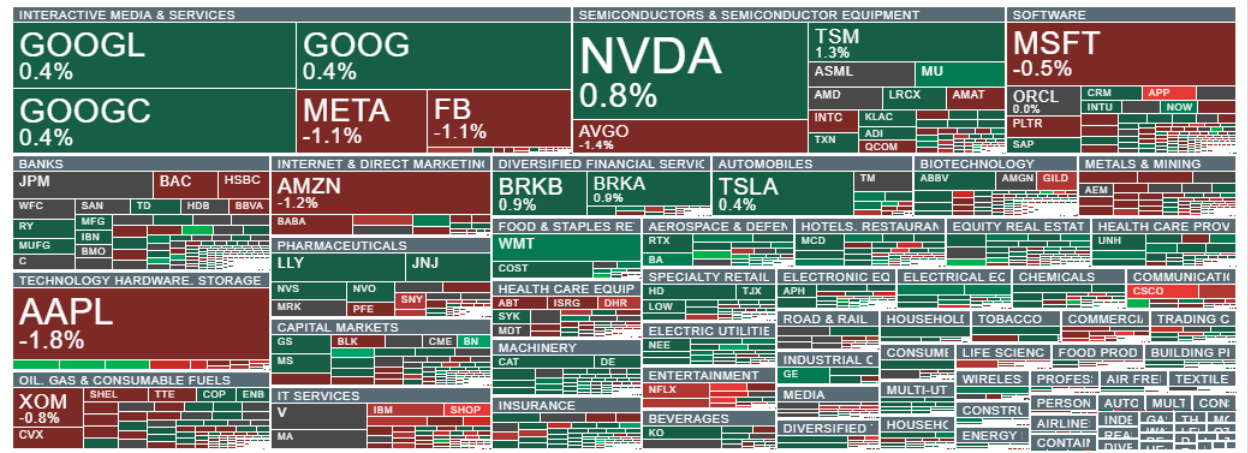

US indices are seeing a mixed start to Thursday’s session: US100 is lower, while US30 and US500 are slightly higher. Among the top gainers are Howmet Aerospace (an industrial heavyweight in the aerospace supply chain), along with Eli Lilly, Walmart, Micron, and Exelon.

The software sector remains under selling pressure, and today’s hardware sell-off is led by Cisco Systems, which is down 10% after earnings as investors were disappointed by the company’s guidance. Initial jobless claims edged up to 227k versus 223k expected, while US home sales surprised to the downside, falling -8.4% m/m versus -4.6% expected (after a +5.1% increase previously).

US100 (D1 interval)

Source: xStation5

US equities are sliding today in IT services, entertainment, software, and communication services. Shopify and Cisco Systems are among the notable laggards. The defense and real estate sectors are higher.

Source: xStation5

Cisco after earnings (fiscal Q2 FY2026): growth accelerates, but guidance disappoints

Cisco delivered a very strong second quarter of fiscal 2026 (period ended January 24, 2026). Revenue and earnings grew at double-digit rates and came in above the high end of the company’s prior guidance, while Cisco also reported a clear acceleration in AI infrastructure orders from hyperscalers. Despite the strong headline numbers, the stock fell in after-hours trading—suggesting some investors are trading the broader macro and sentiment backdrop rather than the quality of the quarter alone.

Key takeaways from the report

-

Record revenue: $15.3bn (+10% y/y) and Non-GAAP EPS: $1.04 (+11% y/y), above consensus ($1.02).

-

Margins beat expectations: Non-GAAP gross margin 67.5% and Non-GAAP operating margin 34.6%, both above the top end of guidance.

-

Demand is clearly accelerating: product orders +18% y/y, with networking orders growth accelerating to above 20% y/y.

Networking is back to being the engine - not just a stabilizer

After a softer period in prior quarters, the networking segment has returned as the key growth driver, with networking revenue up 21% y/y. Management highlighted that a multi-year campus networking refresh cycle is underway, which improves demand visibility in enterprise and reduces the “one-quarter spike” risk.

AI Infrastructure: the headline number that matters

The most market-moving data point was $2.1bn of AI Infrastructure orders from hyperscalers in the quarter. Cisco expects this stream to exceed $5bn in FY2026. The significance here is straightforward: AI at Cisco is no longer just a narrative - it’s starting to translate into meaningful volumes and could support growth over the next few quarters.

Guidance: steady trajectory, but tariff risk remains

-

Q3 FY2026: revenue $15.4–$15.6bn; Non-GAAP EPS $1.02–$1.04.

-

FY2026: revenue $61.2–$61.7bn; Non-GAAP EPS $4.13–$4.17.

Notably, EPS guidance includes the estimated impact of tariffs, based on current trade policy.

Why the market isn’t “rewarding” the beat immediately

A post-earnings decline despite a beat isn’t unusual for mature mega-cap tech. Investors may be reacting to the broader environment (slowdown concerns, financing costs, capex caution) and to the fact that services revenue fell 1% y/y, while growth is being driven primarily by products. In short: the quarter was strong, but the market is still filtering it through cyclicality and the question of how durable hyperscaler demand will be.

Going forward, the key will be sustaining double-digit order growth and whether AI Infrastructure remains a repeatable demand stream rather than a single purchasing wave. Investors will also watch Cisco’s ability to protect margins amid intensifying competition in the “AI fabric” arena and potential trade-policy friction.

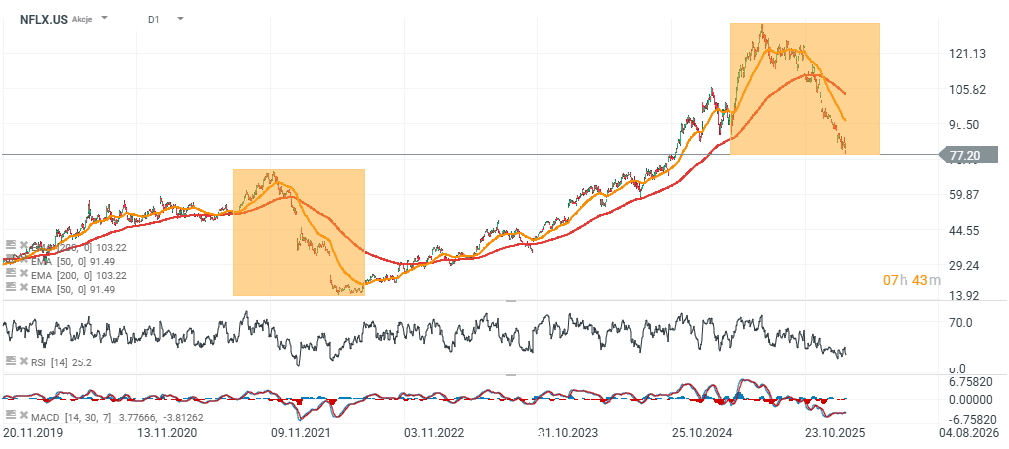

Cisco Systems and Netflix charts (D1)

![]()

Source: xStation5

Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks