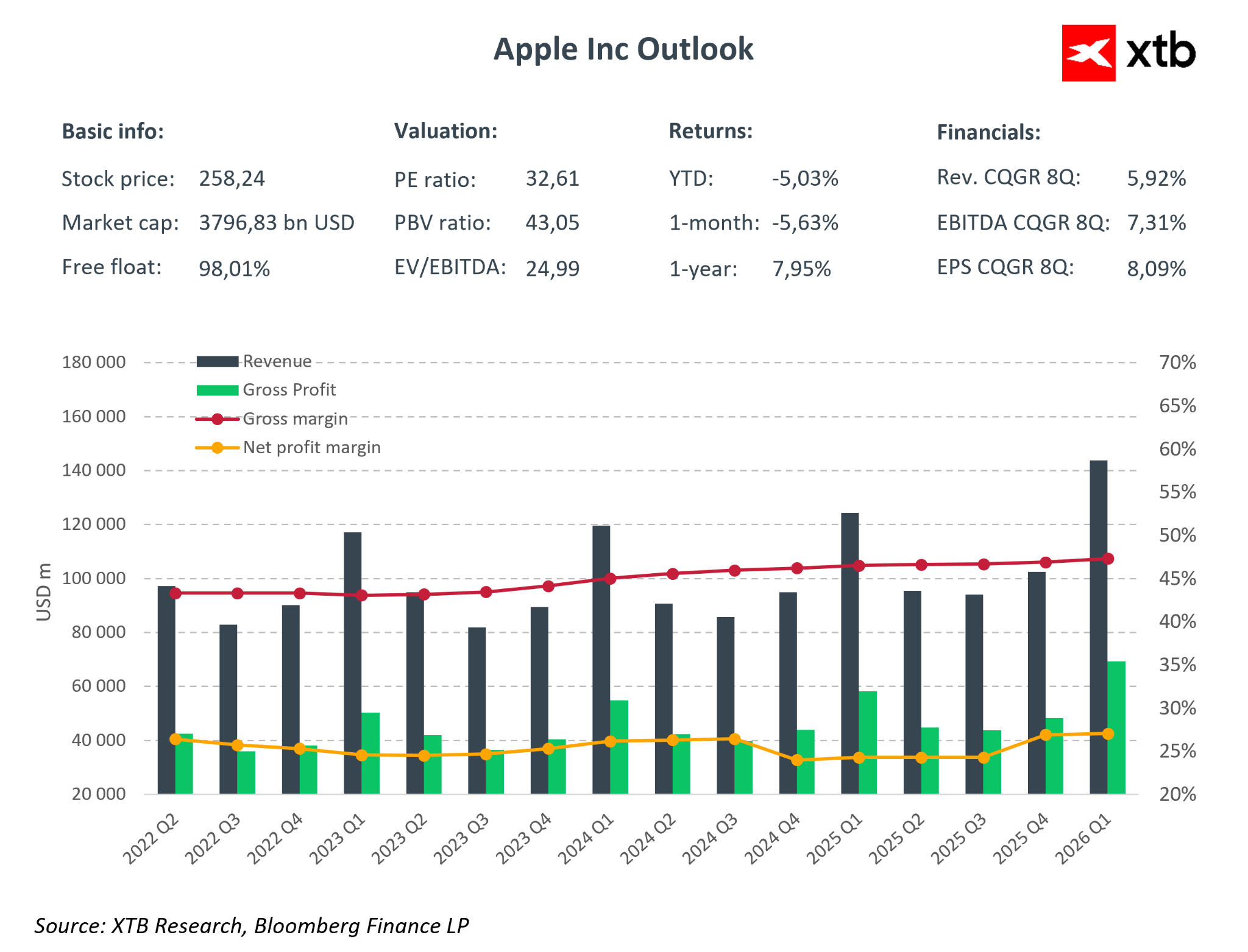

Apple has inaugurated fiscal year 2026 with the strongest quarterly performance in its history. The Cupertino giant is not merely breaking sales records; it is redefining its growth strategy by leveraging the synergy between high-performance hardware, high-margin services, and an evolutionary approach to Artificial Intelligence. While critics have spent the past eighteen months lambasting the company for missing the initial AI rally, Apple’s decision to bypass the first phase of the arms race may yield significant dividends in the form of substantially lower costs compared to the aggressive capital expenditures of Alphabet, Meta, and Microsoft.

📊 Apple Q1 2026 – Key Financial Metrics

-

Total Revenue: $143.8bn (+16% y/y) – A historical record.

-

iPhone: $85.3bn (+23.3% y/y) – A spectacular return of the supercycle.

-

Services: $30.0bn (+14% y/y) – A new all-time high with a gross margin of 76.5%.

-

Net Income: $42.1bn (EPS: $2.84, +19% y/y).

-

Gross Margin (Total): 48.2% – Exceeding the upper bound of previous guidance.

-

Installed Base: Over 2.5bn active devices.

-

Capital Return: $32bn returned to shareholders in a single quarter.

-

Q2 Guidance: Anticipated revenue growth of 13–16% y/y with margins maintained at 48–49%.

The company has faced headwinds due to its perceived tardiness in the AI race, with the stock gaining a mere 8% over the past year. Conversely, Apple continues to generate formidable revenues and profits while maintaining disciplined costs. Is this the definitive blueprint for a return to market leadership? Source: Bloomberg Finance LP, XTB

The company has faced headwinds due to its perceived tardiness in the AI race, with the stock gaining a mere 8% over the past year. Conversely, Apple continues to generate formidable revenues and profits while maintaining disciplined costs. Is this the definitive blueprint for a return to market leadership? Source: Bloomberg Finance LP, XTB

1. iPhone and Services: The Twin Engines of Growth

Apple has decisively quelled fears of iPhone stagnation. Sales momentum accelerated from a 6% increase in Q4 2025 to a staggering 23% in the current period. Emerging markets proved pivotal, with Greater China surging 38% y/y alongside robust growth in India.

Simultaneously, the Services segment has evolved from a secondary hardware attachment into a primary pillar of the business. Generating $30bn per quarter, Apple Services now rivals Fortune 50 companies in scale. This serves as a "quiet engine" for valuation: these revenues are recurring, resilient to hardware cycles, and—given the immense margins—are a primary driver of bottom-line expansion.

2. AI Strategy: ‘Invisible’ Intelligence over Spectacle

Apple has adopted a unique "Invisible AI" strategy. Rather than promoting standalone flagship models in the vein of Microsoft or Google, the company is embedding AI deeply into the system’s user experience (UX).

-

Hybrid Architecture: Tasks are distributed between on-device processing and Private Cloud Compute.

-

The Gemini Partnership: By licensing Google’s Gemini, Apple has effectively conceded that it requires external support in the foundation model race. This partnership allows for a rapid upgrade of Siri without the multi-billion dollar CAPEX burden of proprietary data centers that currently weighs on competitors’ balance sheets.

-

Indirect Monetization: AI is not envisioned as a standalone product but as a catalyst for hardware upgrades (e.g., the iPhone Pro) and increased adoption of iCloud subscription tiers.

While many AI peers grapple with the "monetization gap"—where high CAPEX has yet to yield proportional revenue increases—Apple is leveraging the competitive landscape to refine its ecosystem, a tactic it has historically deployed with great success.

3. Apple vs. The World: The Battle for Capitalization

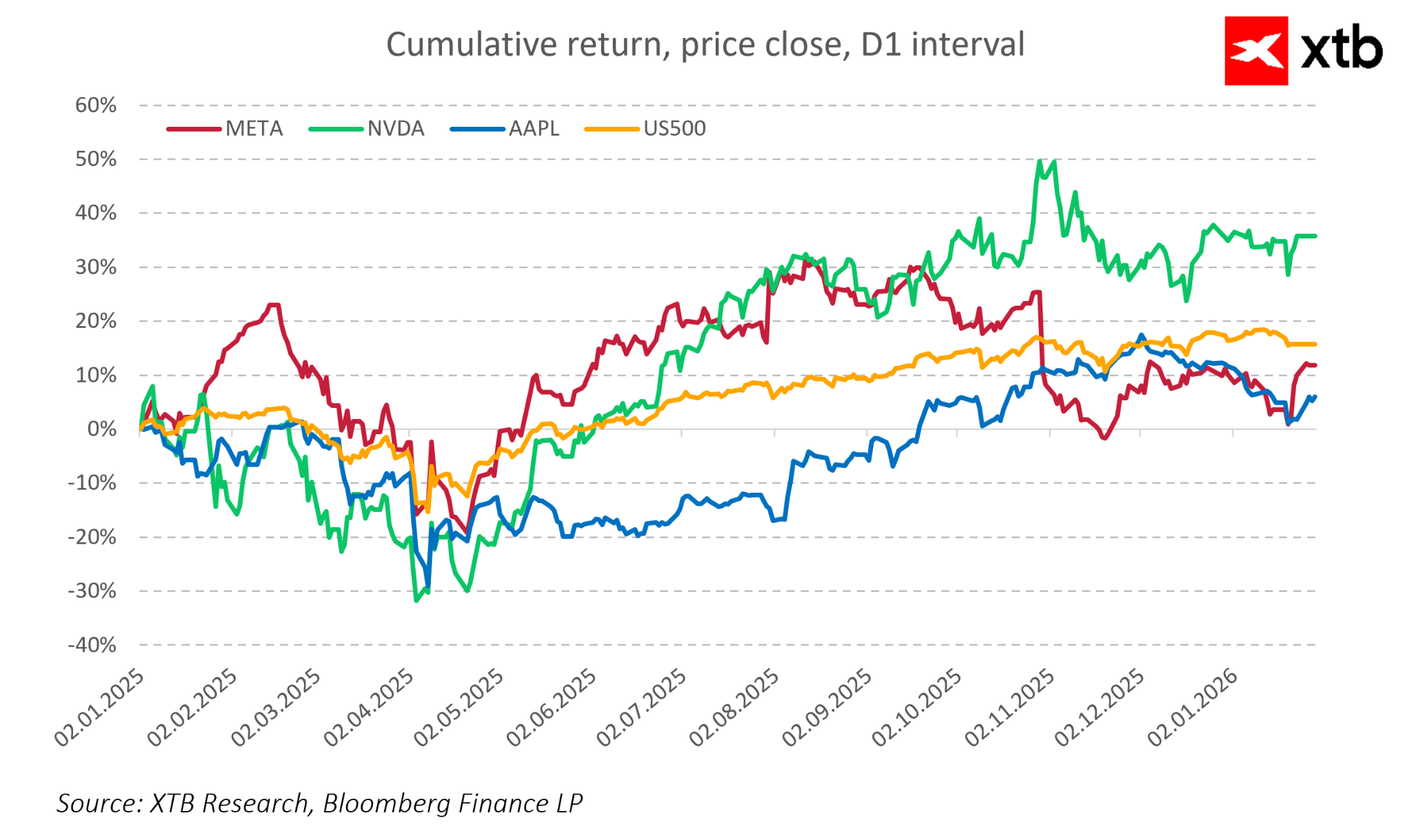

With a market capitalization of approximately $3.8tn, Apple currently sits in third place, trailing Nvidia and Alphabet. The market continues to value Apple more conservatively, yet to grant it the "AI premium" enjoyed by infrastructure providers.

What is required for Apple to reclaim the #1 spot?

-

Sustaining the iPhone Supercycle: Providing empirical evidence that Apple Intelligence significantly shortens device replacement cycles.

-

Margin Scaling: Maintaining profitability despite the rising costs of memory and AI-specific components.

-

The Success of the New Siri: Convincing the technical community that the Google partnership and proprietary "Baltra" chips deliver a UX superior to Microsoft’s Copilot.

Apple shares have seen mixed performance over a one-year horizon and have retreated since the start of 2026. A powerful fiscal first quarter (calendar Q4 2025) should restore confidence in Apple’s position as one of Wall Street's most resilient blue chips. Source: Bloomberg Finance LP, XTB

Apple shares have seen mixed performance over a one-year horizon and have retreated since the start of 2026. A powerful fiscal first quarter (calendar Q4 2025) should restore confidence in Apple’s position as one of Wall Street's most resilient blue chips. Source: Bloomberg Finance LP, XTB

4. Conclusion

Apple may have arrived late to the "AI marketing" theatre, but it has not necessarily lagged in value creation. Capital discipline and a refusal to join the frantic data center race have preserved record margins and enabled aggressive share buybacks.

For the investor, Apple remains a unique hybrid: a cash-generating safe haven with an embedded AI growth option. Though "invisible," this AI strategy may prove to be the most effectively monetized in the industry, thanks to a closed ecosystem of 2.5 billion users. If the market begins to re-rate Apple as a premier AI platform, its return to the throne of the world’s most valuable company appears to be only a matter of time.

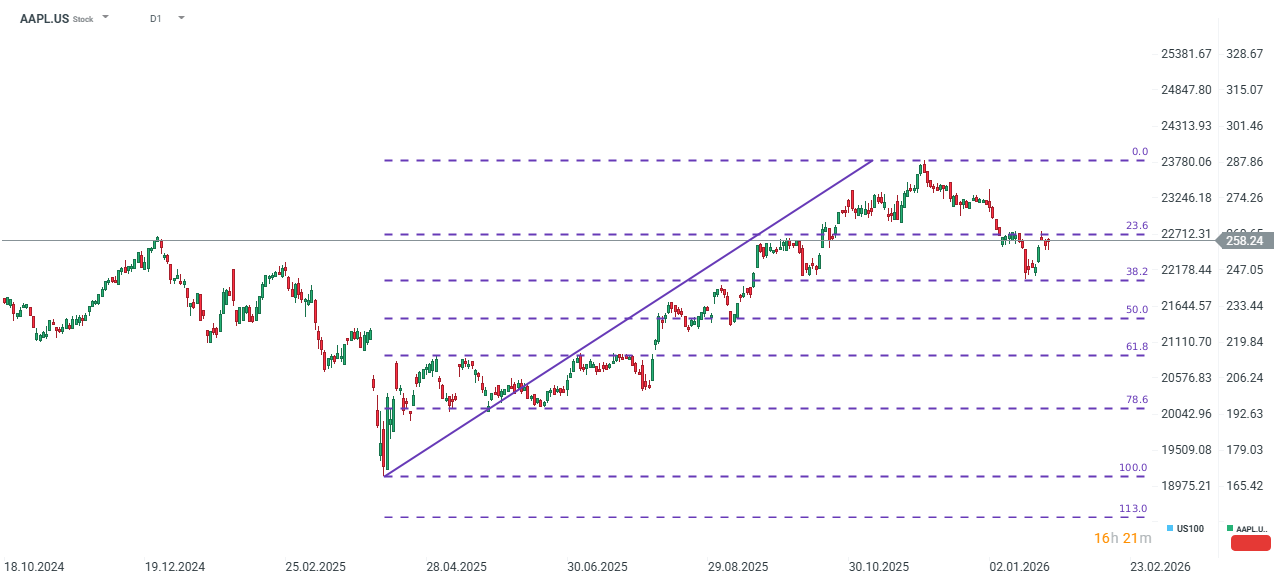

Shares rose 2% in initial post-market trading following the report's release. However, these gains have since been fully retraced. Both the US100 and US500 are showing marked weakness, which may weigh on sentiment as Wall Street opens for the final session of the week and month. Source: xStation5

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?