- Apple is making significant inroads in generative AI, having built its own language model (Ajax) and an internal chatbot ⚛

- The tech giant is taking a cautious approach to AI, balancing its potential against the need for careful implementation 💡

- Despite a lack of clear strategy for consumer release, Apple's AI advancements indicate a strong commitment to remain competitive in the AI space ⚡

Apple shares are gaining over 1% after the company informed about its new generative AI project - Ajax. Company has made significant strides in generative artificial intelligence, building its own large language model known as Ajax and an internal chatbot for its employees. These advancements mark Apple's commitment to AI, providing a competitive edge against other tech giants. The Ajax framework, serving as the foundation for these developments, was designed to unify machine learning development within the company. While Apple's approach to AI has been cautious, with CEO Tim Cook emphasizing the need for thoughtful implementation, the tech giant recognizes the potential of generative AI products and services and is keen to leverage this technology.

Apple's AI initiatives have resulted in internal tools that assist with product prototyping, text summarization, and data-informed responses. While the internal chatbot is not intended for public use, it signifies Apple's significant investment in AI. Despite an unclear strategy for releasing the technology to consumers, Apple is reportedly working on several AI-related initiatives involving its AI and software engineering groups and the cloud services engineering team. With these advancements, Apple aims to transform how consumers interact with technology, striving to stay abreast of AI developments to maintain its strong market presence.

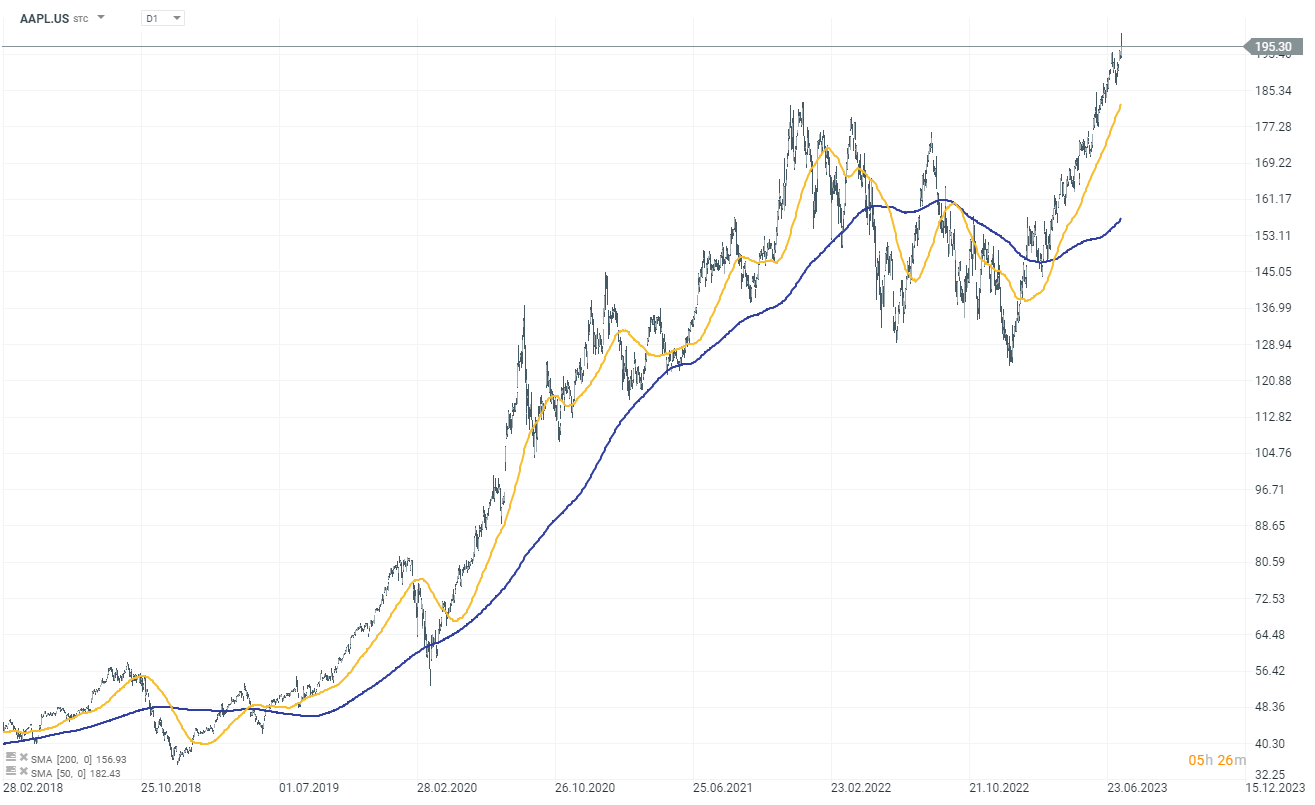

Apple (AAPL.US) shares continue to be in a strong upward trend and are significantly above the previous all-time high (ATH). The stock is in an upward channel, reaching a price of 196 dollars per share today, source xStation 5.

Apple (AAPL.US) shares continue to be in a strong upward trend and are significantly above the previous all-time high (ATH). The stock is in an upward channel, reaching a price of 196 dollars per share today, source xStation 5.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street