AUDJPY is trading around 1% lower today, as AUD is the worst performing G10 currency and JPY is a leader among majors.

AUD is weakening following release of Australian CPI data for Q4 2023, which showed inflation slowing from 5.4% YoY to 4.1% YoY (exp. 4.3% YoY). This, in turn, boosted market pricing for RBA rate cut, with June cut probability now priced at 70%, up from around 50% yesterday.

When it comes to JPY, currency's strength comes from Bank of Japan Summary of Opinions from the January 22-23, 2024 monetary policy meeting. The document has been rather vague overall, but it showed that one of BoJ members said that the Bank may be forced to sharply tighten policy if the decision to exit negative rates comes too late. While this is not a concrete statement in any way, it was enough to reignite market hopes for an imminent hawkish pivot from the Bank of Japan.

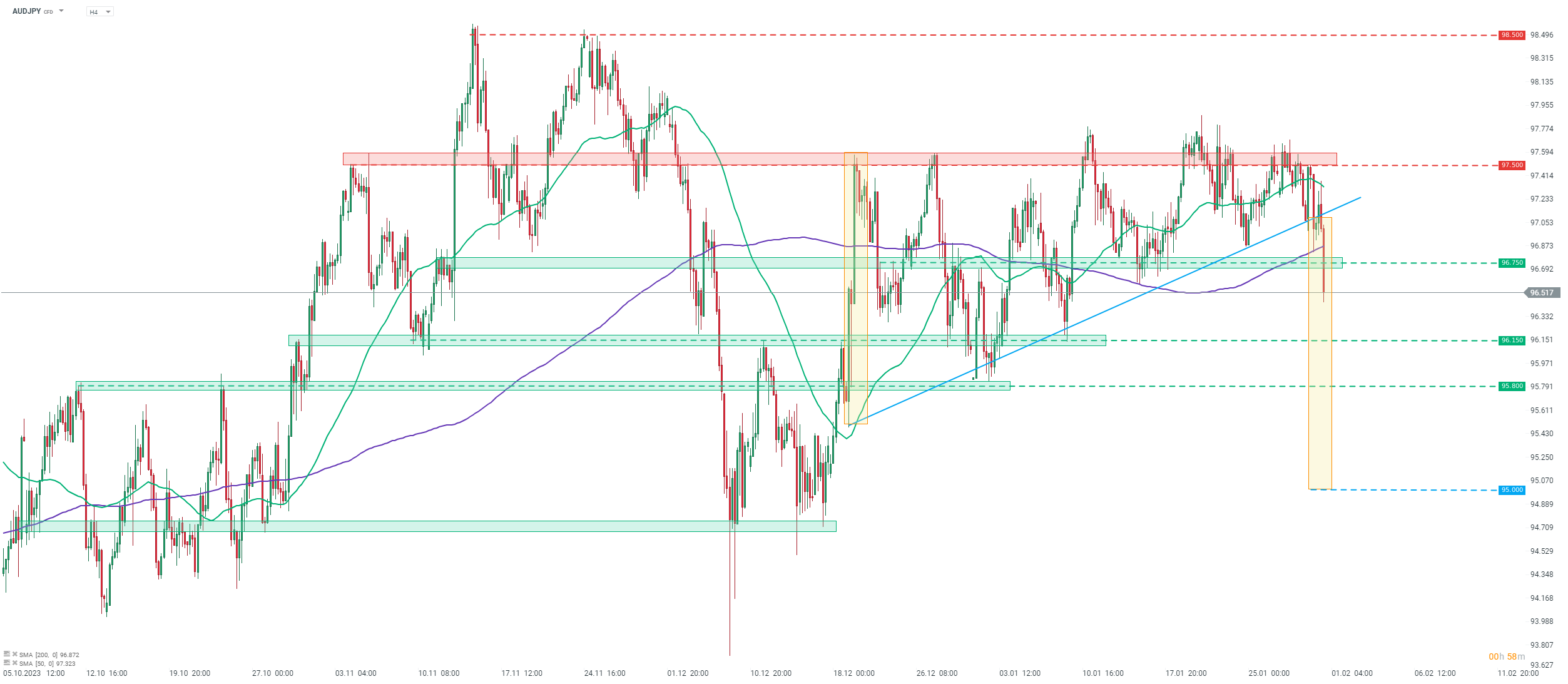

Taking a look at AUDJPY chart at H4 interval, we can see that the pair slumped below the upward trendline that marked the lower limit of an ascending triangle pattern. Textbook range of the downside breakout from the pattern suggests a possibility of a move to as low as 95.00 area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️