US biopharmaceutical company, Biogen (BIIB.US), will report its results tomorrow; before Wall Street opens. Value-oriented fund Patient Capital Management on "Opportunity Equity Strategy" shared its observations with investors. In Q1, the commenting company said, the fund provided its investors with an 11.8% return net of fees, compared to a 10.6% gain from the S&P 500 index. The firm indicated that one of its biggest investment choices in Q1 was the stock of US pharmaceutical company Biogen (BIIB.US). Biogen discovers, develops, manufactures and delivers therapies for the treatment of neurological and neurodegenerative diseases. The company's shares have been underselling pressure for many months and have lost more than 30% since April 2023. The stock is trading flat today.

Alzhaimer's drug - an opportunity for Biogen?

- Biogen focuses on treating multiple sclerosis, spinal muscular atrophy and Alzheimer's disease. The company has been under pressure since the FDA's approval of Aduhelm, a drug to inhibit Alzheimer's (June 2021).

- The approval process has been criticized due to the limited effectiveness of the drug's therapy. Patient Capital believes that the company now has a new, highly regarded CEO, Christopher Viehbacher, a rationalized cost structure and more disciplined investment management;

- Patient Capital assessed that the company already has another Alzheimer's drug, Leqembi, which is more effective than Aduhelm and fully approved. The fund assessed that while progress in the use of Leqembi has been slow so far, it still creates great long-term potential for a higher patient population. Analysts pointed out that this potential may be 'dramatically underestimated' at present.

- As a result, the fund maintained that Biogen now offers an opportunity to buy forward-looking, high-performing healthcare assets with a strong track record of delivering great products. The fund summarized Legembi's outlook and stressed that "it's not often that you see such a risk/reward ratio in the market, and we opportunistically took advantage of that."

- Analysts at Oppenheimer 2 days ago lowered their target price, for Biogen shares from $290 to $270 which would still imply approx. 40% upside potential from current valuation levels. Wedbush, on the other hand, lowered its recommendation significantly, from $245 to $213 per share.

- The value (Equity) generated by Biogen as of 2021 has increased by $4 billion, to $14 billion, against an unchanged long-term debt level of about $6 billion. In February, the company said it expected $15 to $16 in earnings per share for the full year 2024 (about 5% y/y growth). A possible upward revision of these forecasts could help the company's stock. Wall Street still seems skeptical looking ahead to tomorrow's report; looking at recent analyst revisions.

...But the world is still skeptical

- Today's Reuters report suggests that Biogen's partner Japanese Eisai (as well as the company itself) launch faces a fundamental problem, because physicians still see Alzheimer's disease as untreatable. Alzheimer's drug adoption in US slowed by doctors' skepticism 9 months after the drug debut.

- Eisai has recently outlined a range of ways to kick-start Leqembi’s lackluster launch, from increasing the number of neurology account specialists to adding a subcutaneous option. Spherix report found few of the 75 surveyed U.S. neurologists “Consider Leqembi to be a significant medical advance over other historical AD treatments.” Less than half of the neurologists were actively recommending the drug to patients.

Biogen shares (BIIB.US)

Biogen shares have been outperforming companies like Eli Lilly (LLY.US) for years. The current, D1-based RSI indicates levels near oversold levels, near 30 points. Levels of $190 appear key to hold in the medium term, as they reflect the 'local lows' of 2013 and 2022. On February 13, the company reported results that disappointed Wall Street expectations.

Source: xStation5

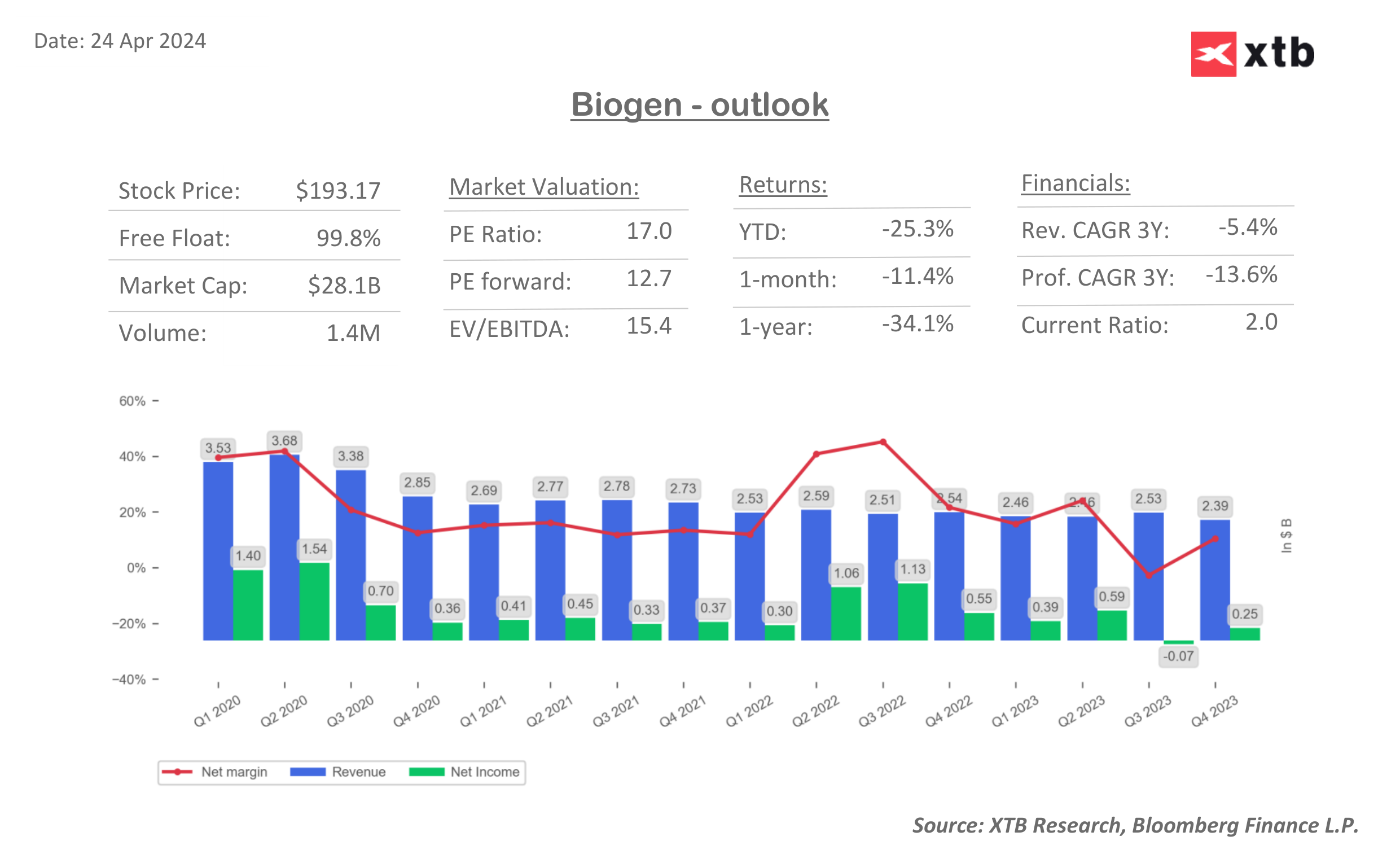

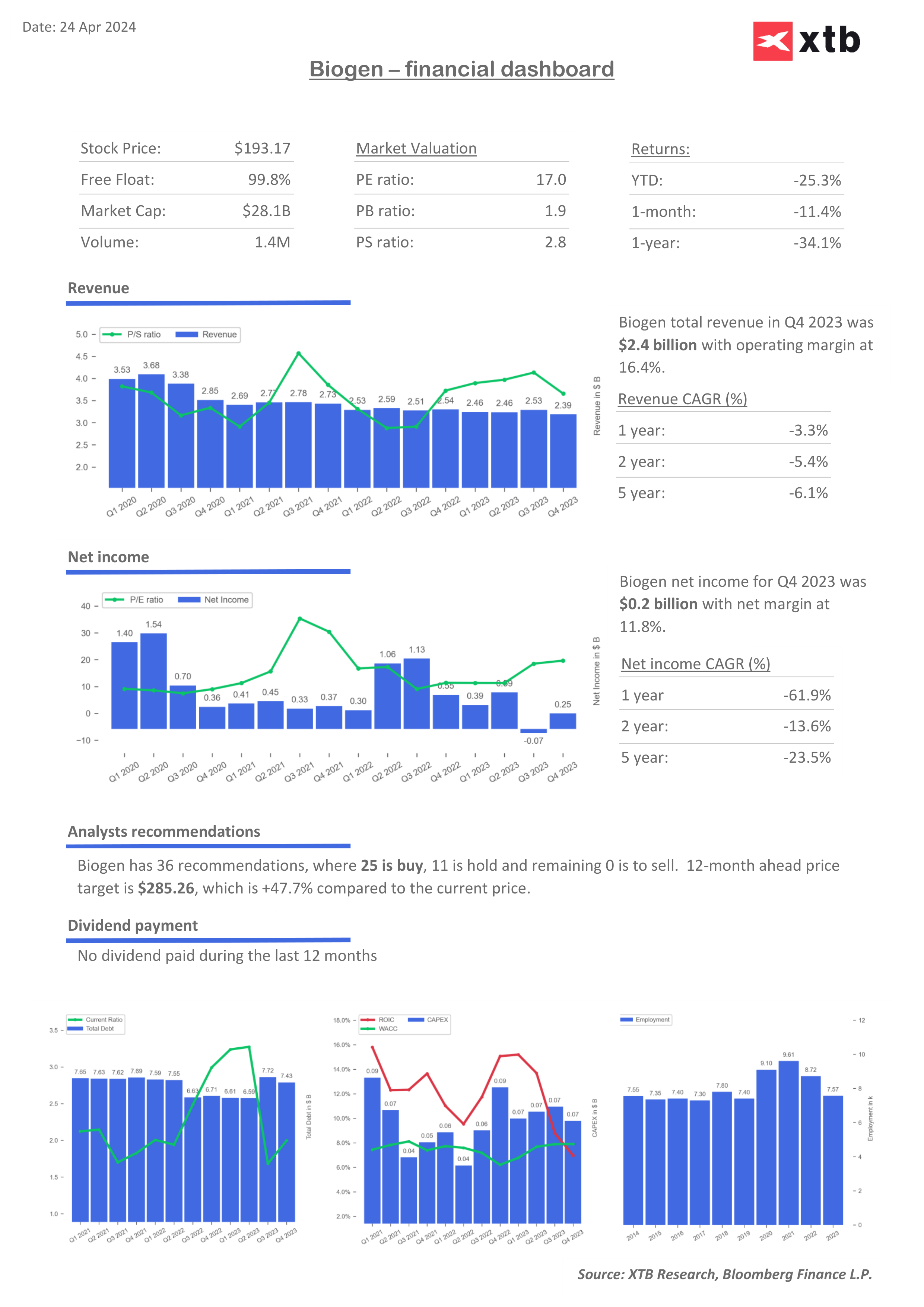

Source: Bloomberg Financial LP, XTB Research

Source: Bloomberg Financial LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster