Cryptocurrencies have been moving in a sideways trend for the past 2 weeks, but demand has not been able to carry Bitcoin's quotations higher, ultimately resulting in a sell-off. Macroeconomic circumstances continue to keep pressure on risky assets, with still no events on the horizon that could potentially reverse the trend:

- Ethereum is back to levels near $1,500, Bitcoin is holding near $18,800, dangerously close to the June lows. Bulls could find themselves in more trouble again, as sentiment and faith in the growth of digital assets has been shaken again;

- Bellatrix's update on the Ethereum blockchain caused problems, with a significant increase in the unclaimed block ratio. It amounted to 9% against 0.5% of the norm. Only 74% of validator nodes completed the update. According to Ethernodes, more than 25% of nodes still have not implemented the upgrade required to move to Proof of Stake, which was likely the reason for Bellatrix's disappointing final result;

- Developers pointed out the problems and challenges of 'educating' validators and network participants and did not hide their disappointment with the result. Merge was not postponed, however; according to Vitalik Buterin, the final consensus change to PoS will take place between September 14 and 15. After that, developers will work on scalability and improving the network, which is currently capable of processing a maximum of 15 to 20 transactions per second against Visa's nearly 50,000;

- According to KPMG, investment in cryptocurrency businesses has fallen to levels in the vicinity of $14 billion in the first half of the year versus more than $32 billion in the first half of 2021;

- Nearly $450 million from venture capital went to ConsenSys, which helps build the Ethereum blockchain. Despite a decline of more than 50% y/y, investment in digital assets is still at levels well above previous years;

- Freshly elected, new UK Prime Minister Liz Truss has spoken positively about cryptocurrencies in the past. While still Trade Minister, Truss hinted at 'unleashing the potential of blockchain technology,' and in 2018 she hinted at regulations that would not limit potential and entrepreneurship in the new market. Therefore, we can expect a debate in the UK in the future on the regulation of the industry;

- Poolin - one of Bitcoin's largest miners (mining pool) in terms of so-called 'hash rate' (10.8% share of mining) has suspended withdrawals in Bitcoin and ETH amid liquidity problems, which has caused another wave of cryptocurrency market concerns. Poolin indicates that the pause could last up to 2 weeks, however, assures investors that balances are intact.

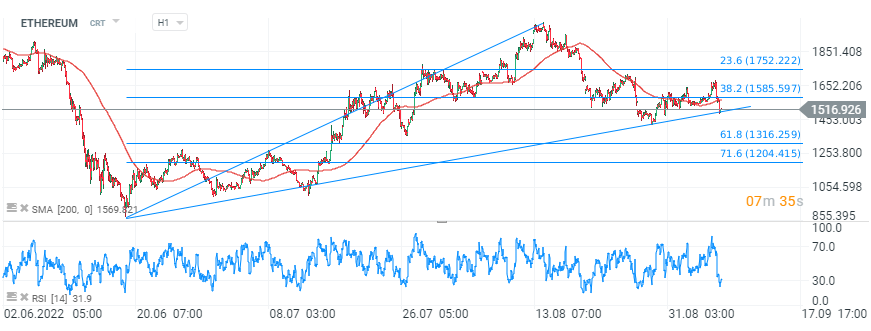

Ethereum chart, H1 interval. Looking at the bigger picture, the Ether price has continued to move in an upward trend since June. A drop below $1500 would mean a break of the trendline. The head-and-shoulders-like formation is also worrying, a fall below the potential 'neckline' could coincide with a fall below the trendline and suggest another cascading sell-off. The next support according to Fibonacci is only at the $1300 levels, at 61.8 retracement. However, contrary to yesterday's RSI result above 70, which, as we pointed out in the analysis, historically turned out to be a resistance level today's 'post-sale' result near 30 was the level from which Ethereum started its climb. However, a drop below the 200-session moving average is worrisome, and could herald longer-term weakness. Source: xStation5

Ethereum chart, H1 interval. Looking at the bigger picture, the Ether price has continued to move in an upward trend since June. A drop below $1500 would mean a break of the trendline. The head-and-shoulders-like formation is also worrying, a fall below the potential 'neckline' could coincide with a fall below the trendline and suggest another cascading sell-off. The next support according to Fibonacci is only at the $1300 levels, at 61.8 retracement. However, contrary to yesterday's RSI result above 70, which, as we pointed out in the analysis, historically turned out to be a resistance level today's 'post-sale' result near 30 was the level from which Ethereum started its climb. However, a drop below the 200-session moving average is worrisome, and could herald longer-term weakness. Source: xStation5

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks