Yesterday, Strategy (MSTR.US) decided to purchase 13.6k BTC, lifting its bitcoin holdings to nearly 687k BTC; the stock rose by more than 3% during yesterday’s U.S. session and is up by over 1% today ahead of the market open. It was the company’s largest purchase since summer 2025. Strategy’s shares are currently trading broadly in line with the value of the bitcoin it holds, suggesting a gradual stabilization compared with previous weeks, when the stock traded slightly below the value of its BTC reserves.

Strategy’s average BTC acquisition price is now roughly USD 75,000, which gives the company a fairly “solid cushion” in a downside scenario and is almost 1:1 consistent with the April 2025 correction low (panic triggered by Trump’s tariffs). Despite a stronger U.S. dollar, Bitcoin has stabilized around USD 90,000 and, after the latest dip, managed to rebound relatively quickly back toward USD 92,000. So far in 2026, demand for “hard assets” (mainly precious metals) has persisted despite the stronger dollar, which could ultimately also benefit Bitcoin.

Source: xStation5

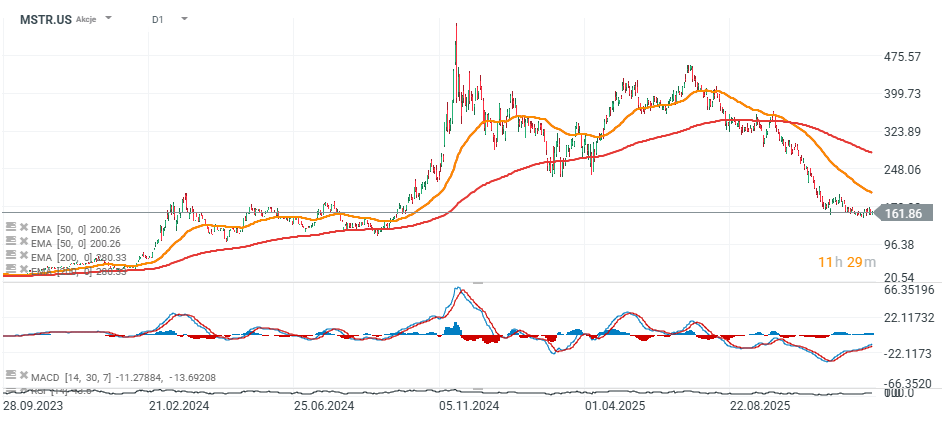

MSTR (D1 timeframe)

MSTR shares are down nearly 70% from their highs, something that in recent years has typically occurred only during deep Bitcoin bear markets. On the one hand, the stock faces “competition” from spot Bitcoin ETFs, which reduce traditional-market demand for the company’s shares as a kind of “proxy” for direct BTC exposure. On the other hand, any return of a BTC bull market should clearly revive the stock from deeply oversold levels. The RSI and MACD indicators are turning upward, and if Bitcoin manages to break above USD 95,000, the rally in the stock price could accelerate meaningfully.

Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈