- Bitcoin soars past $29,000

- The digital asset seems poised for a run to $30,000

Bitcoin on Thursday jumped to a record $29,180 after the digital currency almost quadrupled in value this year amid heightened interest from institutional investors. In addition to the well-known market giants Grayscale, MicroStrategy or PayPal, more and more companies decide to invest on the Bitcoin market. For example, NexTech AR announced that it will invest $2 million in Bitcoin as a first step to hedge against the FED’s inflationary monetary policy. Bitcoin is emerging as a digital alternative to gold, so more retail and institutional investments may follow next year. Also a second package of stimulus checks worth $600 could affect the price of bitcoin. Few months ago, many Americans decided to use the first stimulus checks worth $1,200 to invest in cryptocurrencies. At that time, the US-based cryptocurrency exchange Coinbase reported a spike of first-time deposits worth $1,200.

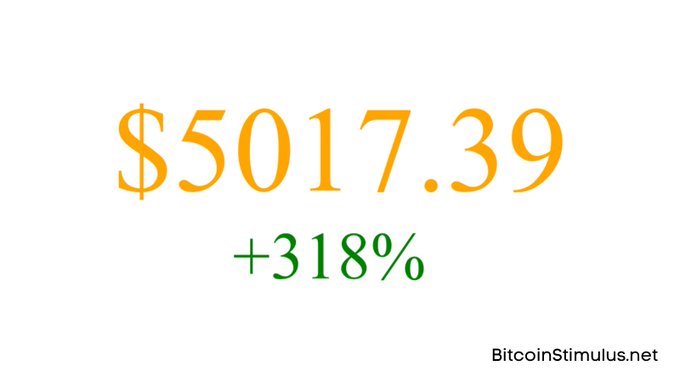

According to a Twitter account tracking the value of the first stimulus check, now it is worth over $5,000, over 300% higher from what it was worth in April. Source: Twitter

The growing functionality and social awareness of the cryptocurrency market also support the upward trend. The mayor of the city of Miami caused a stir when he expressed openness to the idea of putting 1% of the city’s financial reserves into Bitcoin. Meanwhile NFL professional player Russell Okung confirmed that starting from 2021 will receive half of his salary in Bitcoin.

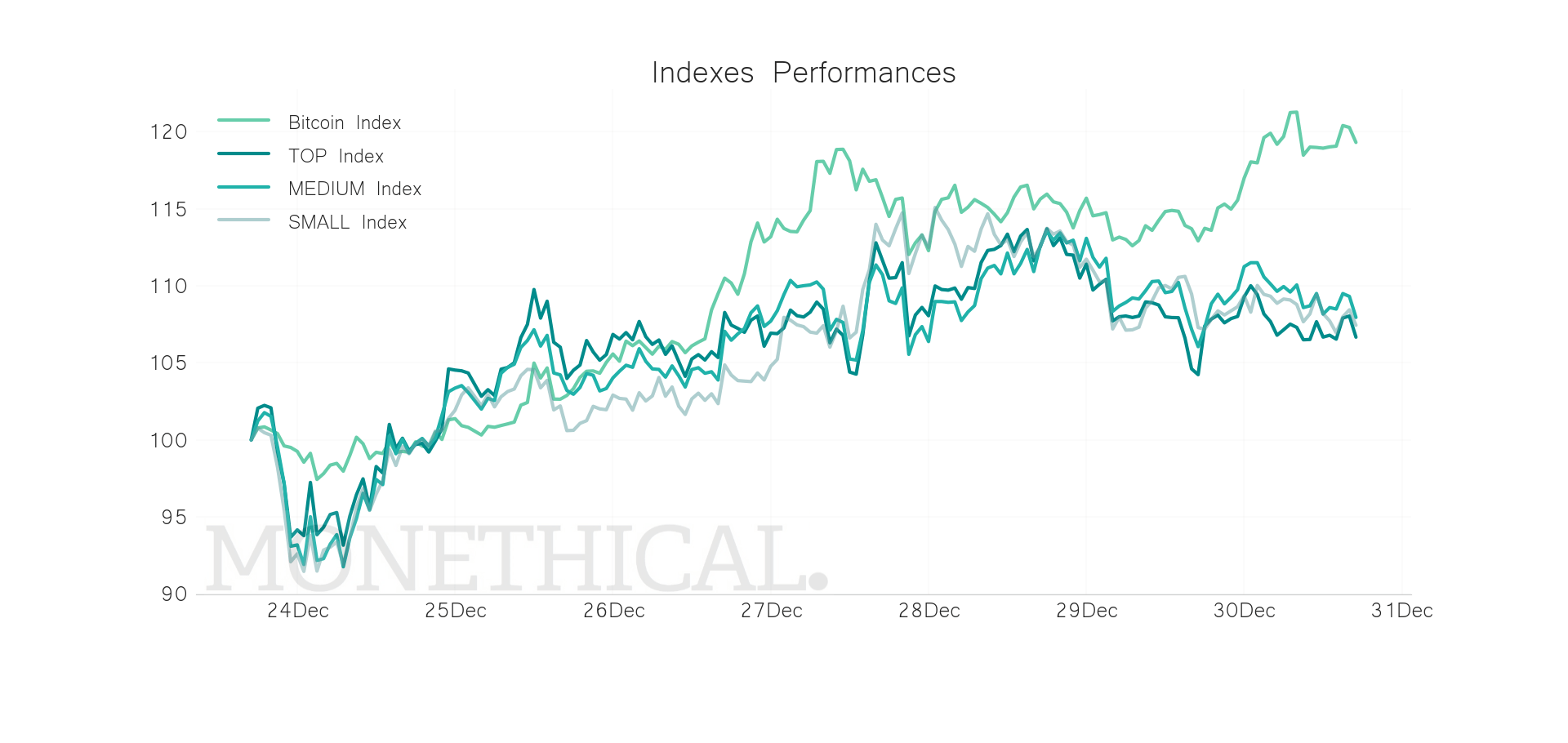

Last few days were very positive for Bitcoin, which is approaching a psychological level of $30,000. Altcoins are also performing well, however are not able to keep the pace of BTC. Bitcoin's market dominance increased to 70.6% market dominance. The total market capitalization of Bitcoin now exceeds $541 billion as the entire cryptocurrency market touches $767 and is slowly approaching the all-time high of $827 billion. Source: Monethical

Bitcoin pulled back slightly after reaching new all-time high. If the current sentiment prevails, then another upward impulse towards psychological level at $30,000 could be launched. On the other hand, a deeper correction could follow in the next few days as the price moves into the overbought zone according to the RSI. Also Bitcoin showed strong price fluctuations of up to $2,500 in recent days, so this scenario does not seem unlikely. The nearest key support to watch lies at $27,000. Source: xStation5

Bitcoin pulled back slightly after reaching new all-time high. If the current sentiment prevails, then another upward impulse towards psychological level at $30,000 could be launched. On the other hand, a deeper correction could follow in the next few days as the price moves into the overbought zone according to the RSI. Also Bitcoin showed strong price fluctuations of up to $2,500 in recent days, so this scenario does not seem unlikely. The nearest key support to watch lies at $27,000. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?