Boeing shares are down nearly 9% ahead of the cash session on Wall Street, after the FAA (U.S. Federal Aviation Administration) grounded some MAX 9s following the fuselage failure of an Alaska Airlines plane on Friday. As media outlets have determined, the torn-out section of the Alaska Airlines plane's fuselage was a plug - covering the spot where some airlines place an additional emergency exit.

Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

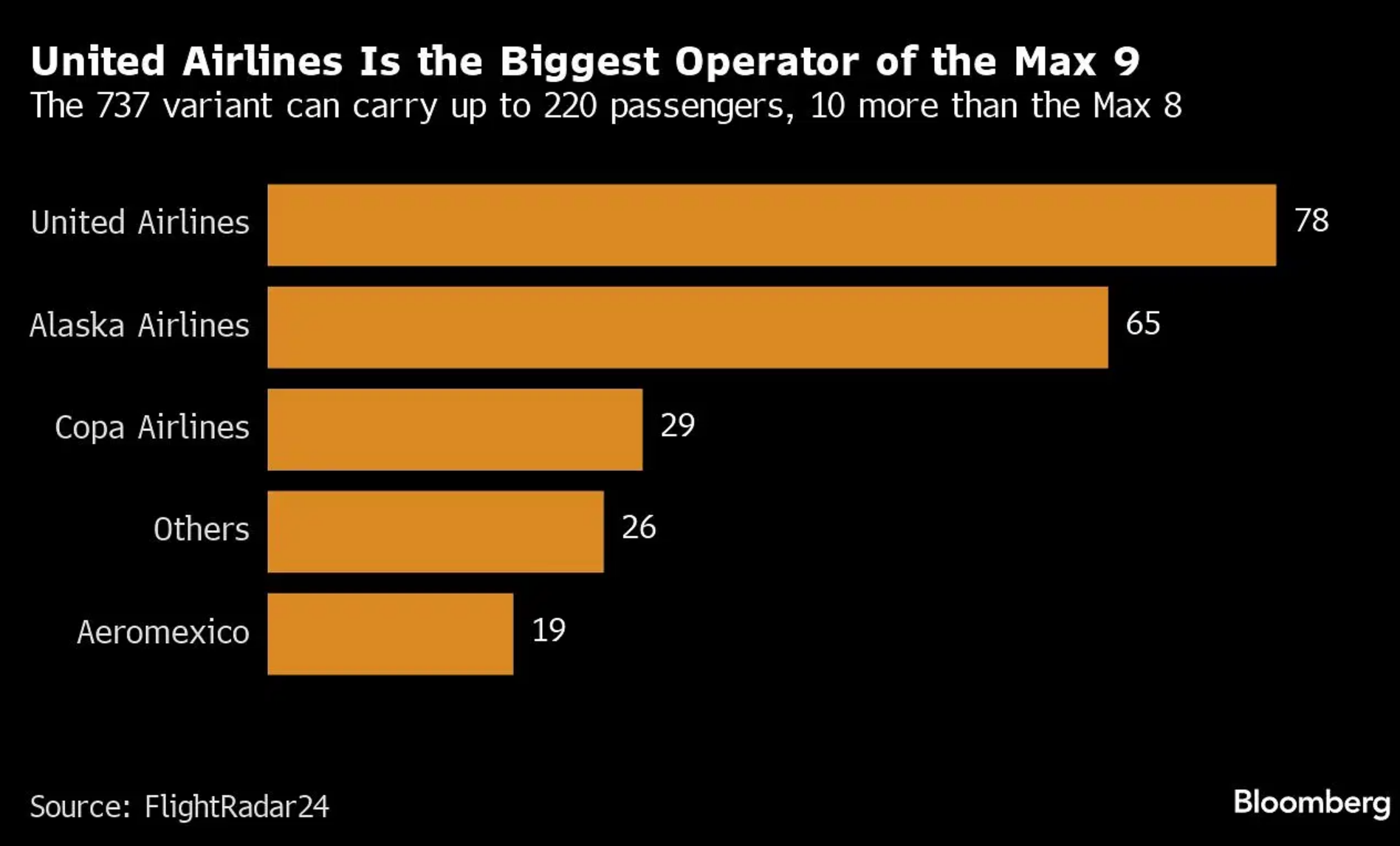

The U.S. aviation regulator said 171 Boeing 737 Max 9s must be grounded for inspection. Alaska said the flight disruptions will last until next week. United Airlines grounded 79 planes.

Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

The disruption is likely to primarily affect flights in the U.S., EASA, or the European Union's aviation safety agency, has communicated that flight disruptions on the Old Continent will be minimal due to the fact that, in its view, no European airlines operate these aircraft models. The required inspections will take about four to eight hours per aircraft, the FAA reported.

Source: xStation

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈