BP (BP.US) ADR rose more than 3% today after the oil giant announced Tuesday that will most likely reach its $35 billion debt-reduction target in Q1, thanks to assets sales, which included a stake in a major gas field in Oman and in Palantir (PLTR.US), and higher oil prices. This announcement came approximately a year earlier than analysts expected and means that BP could restart its share buyback program while returning at least 60% of surplus cash flow to shareholders. "This is a result of earlier than anticipated delivery of disposal proceeds combined with very strong business performance during the first quarter," announced CEO Bernard Looney. Company did not provide any news regarding dividends, which were lowered last year. BP will provide its first quarter figures and more details regarding its buyback program on April 27th.

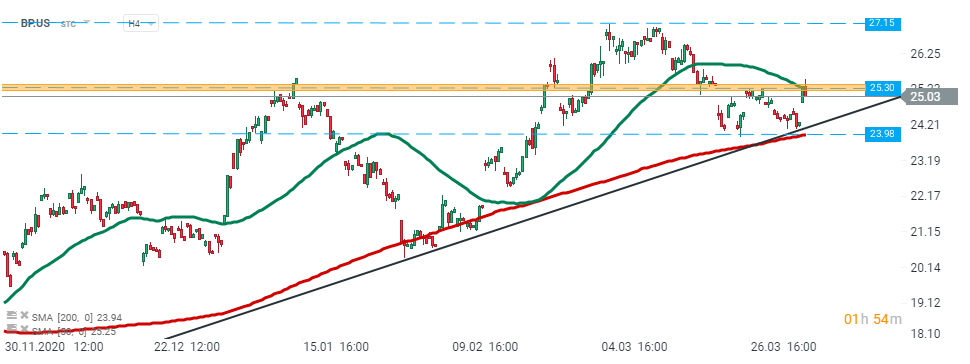

BP (BP.US) stock launched today's session with a bullish price gap and is currently testing major resistance at $25.30 which is additionally strengthened by 50 SMA (green line). Should break higher occur, then upward move may accelerate towards next resistance at $27.15. On the other hand, if sellers manage to regain control then nearest support lies at $23.98 and coincides with the 200 SMA ( red line) and long term upward trendline. Source: xStation5

BP (BP.US) stock launched today's session with a bullish price gap and is currently testing major resistance at $25.30 which is additionally strengthened by 50 SMA (green line). Should break higher occur, then upward move may accelerate towards next resistance at $27.15. On the other hand, if sellers manage to regain control then nearest support lies at $23.98 and coincides with the 200 SMA ( red line) and long term upward trendline. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street