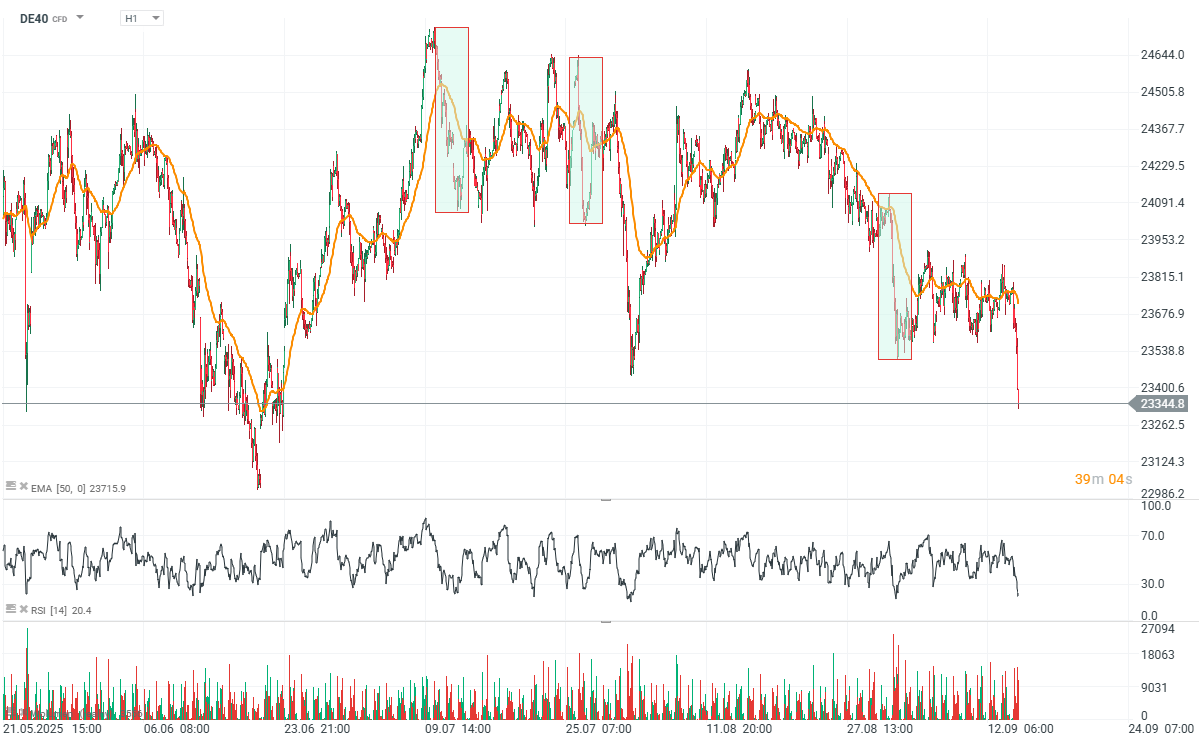

Futures on German stock index DAX (DE40) loses more than 1.8% today falling to the levels last seen in the second half of June 2025. The RSI signals capitulation, falling below 20 level. The sell-off is driven by German insurers and banks. Even Rheinmetall (RHM.DE) dropped almost 1% today, despite BofA 'Buy' recommendation, citing naval acquisition with price target at 2225 EUR per share.

As we can see below, sentiments around German stock market are pressured by the sell-off on quite large volume. From the price action analysis the 1:1 correction may be expected from the 23250 level. As for now we can see that also other futures on European indices are falling with EU50, FRA40 and SUI20 down almost 1.2%. Sentiments across the US equities are much more positive, with US100 down only -0.05%.

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉