A few moments ago investors were offered The Energy Information Administration’s (EIA) report. The weekly data showed that crude oil inventories declined even more than expected. Gasoline inventories fell more or less in line with forecasts while distillate inventory showed much larger decline. The exact results were as follows:

-

Crude Oil Inventories: -3818k (vs expected: -3400k)

-

Gasoline Inventories: -1626k (vs expected: -1400k)

-

Distillate Inventory: -7240k (vs expected: -1950k)

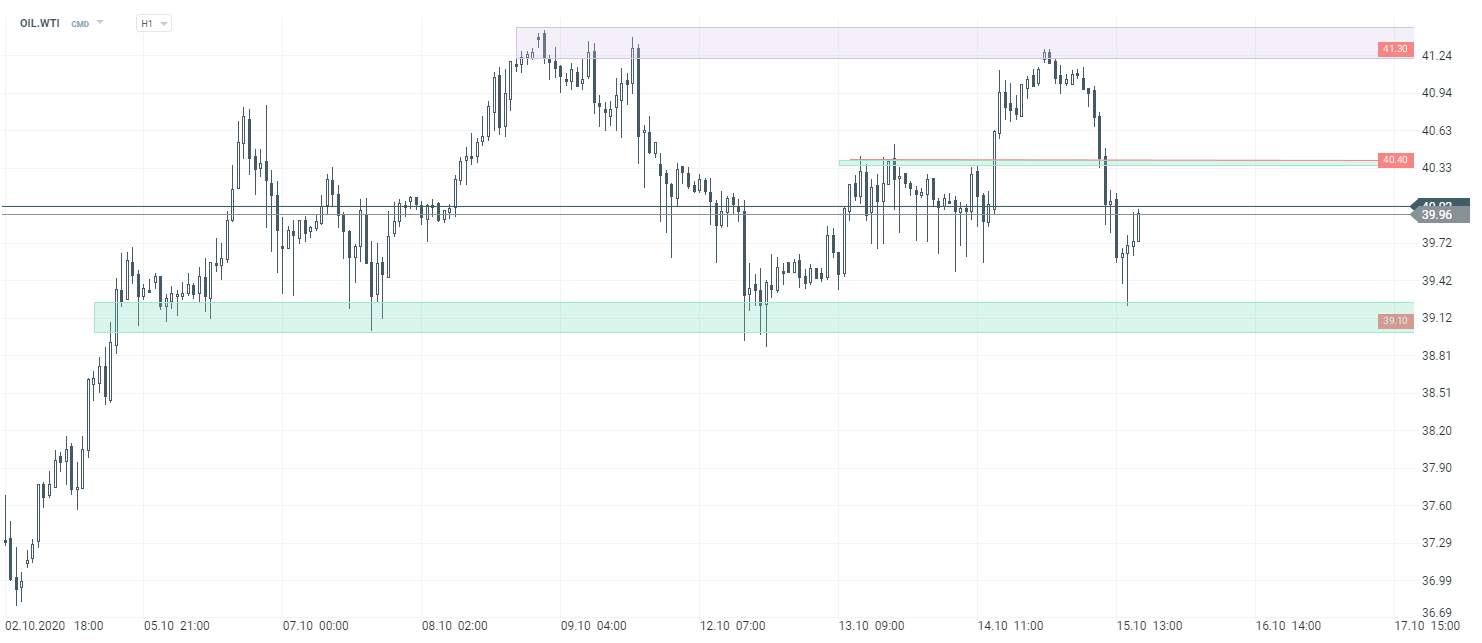

OIL.WTI prices went slightly up shortly after the announcement. Looking at H1 time frame, WTI has remained in local consolidation recently. The area at $39.1 is key support level while the $42.30 level might be regarded as a resistance area. Source: xStation5

OIL.WTI prices went slightly up shortly after the announcement. Looking at H1 time frame, WTI has remained in local consolidation recently. The area at $39.1 is key support level while the $42.30 level might be regarded as a resistance area. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉