01:30 PM GMT, United States - Inflation Data for January:

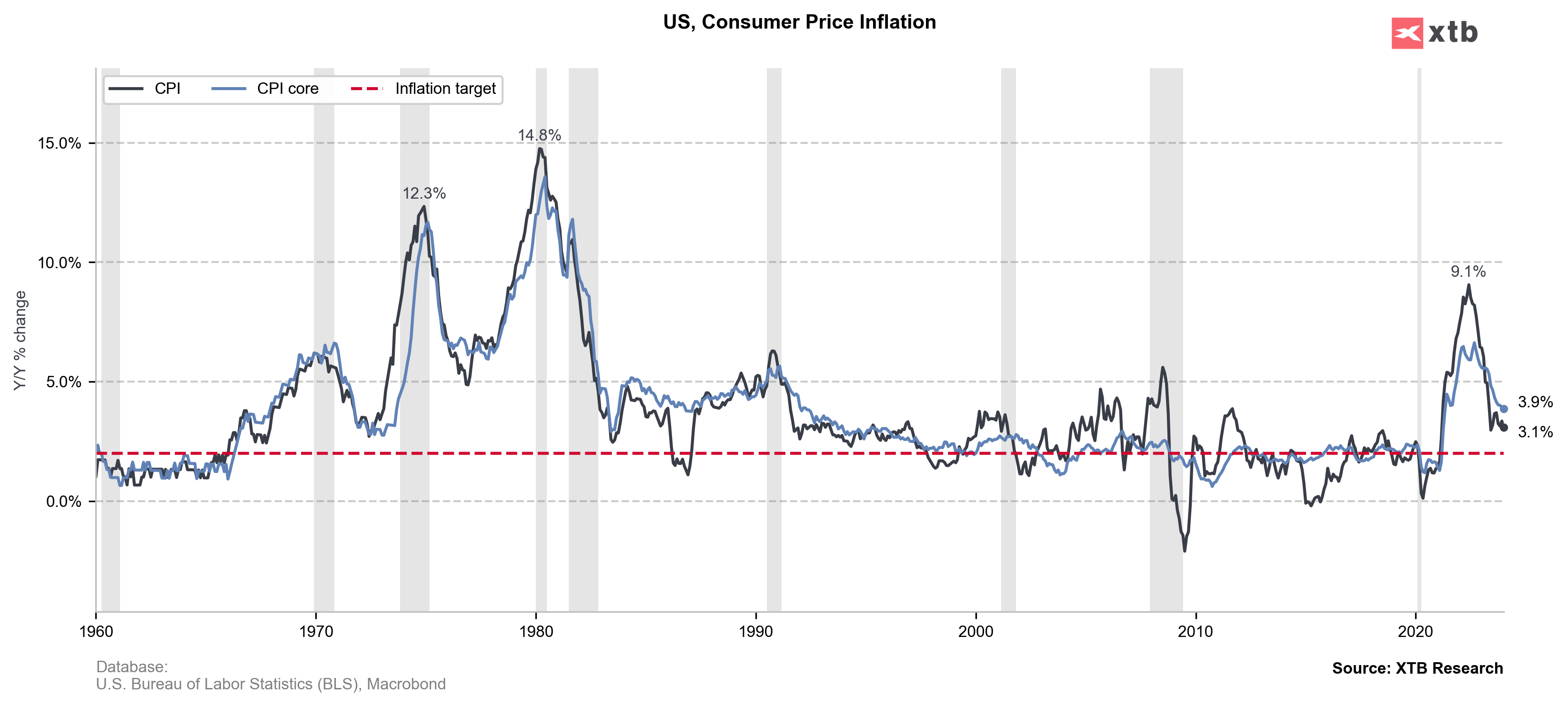

- Core CPI: actual 3.9% YoY; forecast 3.7% YoY; previous 3.9% YoY;

- CPI: actual 3.1% YoY; forecast 2.9% YoY; previous 3.4% YoY;

- CPI: actual 0.3% MoM; forecast 0.2% MoM; previous 0.2% MoM;

In January, the Consumer Price Index for All Urban Consumers (CPI) in the United States increased by 0.3% on a seasonally adjusted basis, following a 0.2% rise in December, leading to a 3.1% year-on-year increase before seasonal adjustment. The rise was mainly driven by a 0.6% increase in the shelter index, contributing significantly to the overall monthly increase. Additionally, the food index grew by 0.4%, balanced by a 0.9% decrease in the energy index due to falling gasoline prices.

In January, the Consumer Price Index for All Urban Consumers (CPI) in the United States increased by 0.3% on a seasonally adjusted basis, following a 0.2% rise in December, leading to a 3.1% year-on-year increase before seasonal adjustment. The rise was mainly driven by a 0.6% increase in the shelter index, contributing significantly to the overall monthly increase. Additionally, the food index grew by 0.4%, balanced by a 0.9% decrease in the energy index due to falling gasoline prices.

Core inflation, excluding food and energy, rose by 0.4% with notable increases in shelter, motor vehicle insurance, and medical care, while used cars, trucks, and apparel indexes saw declines. Over the past 12 months, the all items index rose by 3.1%, a smaller increase compared to the previous year, with the energy index decreasing by 4.6%, and the food index rising by 2.6%.

EURUSD loses sharply and is unable to recover losses within minutes after the reading. The sharply higher CPI and CPI core data will extend the potential path of interest rate cuts this year. Now, Fed swaps shift full pricing of rate cut to July from June.

Source: xStation 5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report