US NFP report for March was released today at 1:30 pm BST. The report is always closely watched but this time it drew even more attention as it came after a streak of rather downbeat data from the US jobs market, like jobless claims, JOLTS or ADP. Actual data came in more or less in-line with expectations. The only 'real' surprise came from the unemployment rate which dropped from 3.6 to 3.5% (exp. 3.6%). Earnings growth was slightly weaker.

US, NFP report for March

- Non-farm payrolls: 236k vs 240k expected (311k previously)

- Unemployment rate: 3.5% vs 3.6% expected (3.6% previously)

- Average earnings growth: 4.2% YoY vs 4.3% YoY expected (4.6% YoY previously)

- Average earnings growth: 0.3% MoM vs 0.3% MoM expected

Initial market reaction was interesting - neither hawkish, nor dovish as both USD and US equity futures gained. EURUSD dropped below the 1.09 mark in a knee-jerk move while S&P 500 futures (US500) jumped to around 4,135 pts. However, EURUSD recovered much of the drop while US index futures held onto gains.

Market attention now shifts to US CPI reading for March scheduled for Wednesday, 1:30 pm BST next week. Unless inflation drops more than expected, FOMC rate hike in May may be still in play.

EURUSD is making a break back below 1.0910 price zone following a decent NFP reading. Source: xStation5

EURUSD is making a break back below 1.0910 price zone following a decent NFP reading. Source: xStation5

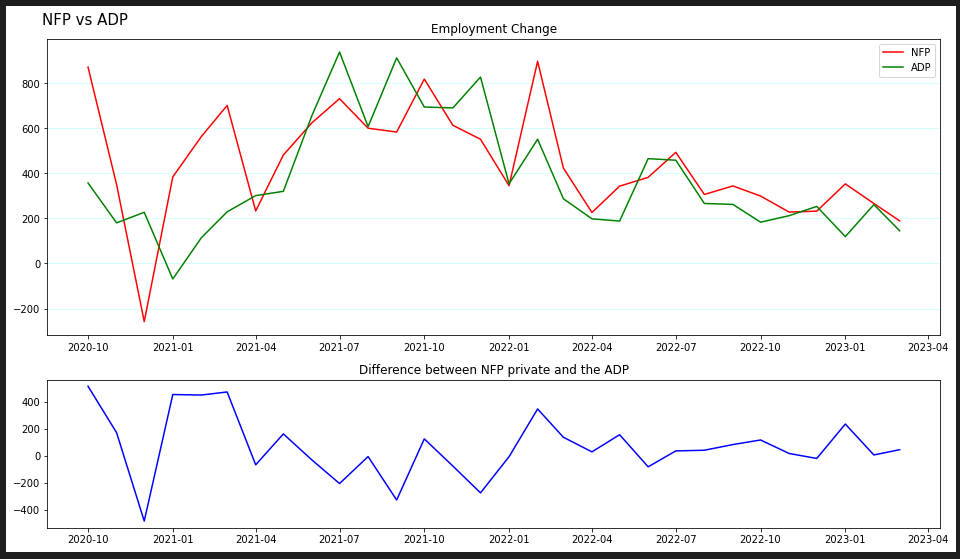

Both ADP and NFP private data showed lower jobs growth in March than in February. Source: Bloomberg, XTB

Both ADP and NFP private data showed lower jobs growth in March than in February. Source: Bloomberg, XTB

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀